U.S. regulators seek to curb Wall St trades with Volcker rule

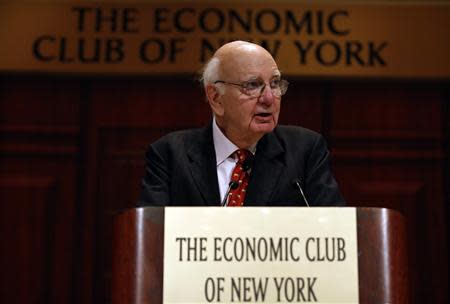

By Emily Stephenson and Douwe Miedema WASHINGTON (Reuters) - U.S. banks will no longer be able to make big trading bets with their own money after regulators on Tuesday finalized the Volcker rule and shut down what was a hugely profitable business for Wall Street before the credit crisis. After struggling for more than two years to craft the complex rule, five regulatory agencies signed off on the nearly 900-page reform that included new tough sections narrowing carve-outs for legitimate trades. The rule is expected to eat into revenues at large investment banks such as Goldman Sachs and Morgan Stanley , even if many have already wound down some of their trading desks in anticipation of the rule's release, and may spark legal challenges. Reform advocates cheered the changes in a sign they were tougher than the original proposal in November 2011, but much of the impact will be down to how regulators police banks to make sure they do not try to pass off speculative bets as permissible trades. "At some point someone is going to have to write up a manual for examiners on what to look for and ... how to enforce that stuff. That's going to be a really important document," said Bradley Sabel, a lawyer at Shearman and Sterling in New York. Better Markets, a pressure group critical of large banks, reacted positively to the final rule, calling it a "major defeat for Wall Street." Bank of America CEO Brian Moynihan said at a conference on Tuesday that it cost his bank up to $500 million of revenue per quarter when it exited the trading activity banned under the Volcker rule. But he said the final text should not force the bank to make any further significant adjustments. "I don't think it changes anything dramatically," Moynihan said. Championed by former Federal Reserve Chairman Paul Volcker, the rule bans proprietary trading, or speculative trading by banks for their own profit, and is a central part of the 2010 Dodd-Frank Wall Street reform act. In the final rule, regulators strictly defined carve-outs for trades executed to serve clients' interests or protect against market risks. Regulators are eager to prevent a repeat of trading debacles such as JPMorgan's $6 billion trading loss in 2012, dubbed the "London Whale" because of the huge positions the bank took in credit markets. LEGITIMATE TRADES Regulators have struggled for years to agree on a text that, while prohibiting risky activities, would still allow banks to take on risk on behalf of clients as market-makers, to hedge risk, or when underwriting securities. Banks have argued these functions are critical to markets. In the final wording, banks could still engage in market-making and take on positions to help clients trade but their inventories should not exceed "the reasonably expected near-term demands of customers," the regulators said. The regulators also seek to put an end to portfolio hedging, a practice in which banks entered all kinds of trades that were supposed to hedge risk elsewhere in the business but that could be used as veiled speculation. Another addition will make bank managers attest that their banks have appropriate programs in place to achieve compliance with the rule, though they would not themselves have to confirm their banks are in compliance. Further, traders could no longer be paid big bonuses for taking on undue risk and compensation should be "designed not to reward ... prohibited proprietary trading." Regulators also eased the rule in some areas, for instance including a wider exemption for the trading of government bonds, which will now be permitted for foreign sovereign fixed-income instruments and not just for U.S. bonds, after complaints from Europe. They also scaled back their definition of which hedge funds and private equity funds fall under a rule limiting banks' investment to a maximum of 3 percent of funds' total value and 3 percent of the banks' total core capital. The industry complained the previous proposed definition of so-called "covered funds" was too broad, and that it would capture securitized loans, investment vehicles often used by corporations like joint ventures, registered funds based overseas and commodity pools. The rule explicitly exempts many of those kinds of funds and also more narrowly defines commodity pools so that only those operating most like hedge funds are captured. Regulators also extended the deadline by which banks have to fully comply with the new regulations by one year to July 2015, a widely expected move after they repeatedly missed deadlines for the rule. Further delays were also possible, the regulators said in the text of the rule. DISSENTERS Even before the five regulators adopted the rule on Tuesday, lawyers were looking for weak spots, preparing for a potential fight in court to try to knock out the legislation - possibly helped by dissent within the agencies. Scott O'Malia, a Republican member of the Commodity Futures Trading Commission, said he had only three weeks to review the lengthy document, which he said flouted proper rulemaking. Dan Gallagher at the Securities and Exchange Commission likened the rule to President Barack Obama's flawed launch of the HealthCare.gov website, accusing regulators of pressing ahead with "massive, untested governmental intrusion." Such remarks, laid down in written dissenting statements, can be a powerful tool during later lawsuits and lay out a possible roadmap banks could use to challenge the rule. Legal experts are generally expecting a court challenge, for instance from Wall Street trade groups, though none of these have so far announced any plans to do so. Banks have already done away with many of the riskiest trading operations common before the crisis. Morgan Stanley in January 2011 said it would spin off its proprietary trading unit Process Driven Trading, which had 60 employees around the world. Goldman Sachs said it had shut down two proprietary trading desks, one known as GSPS and another that did global macro trading, by February 2011. And Citigroup has closed a loss-making unit that had traded stocks. These banks have such sprawling legal structures engaging in different financial activities that the rule needs to be adopted by a patchwork of U.S. agencies: three bank watchdogs and two market regulators. The Volcker rule applies only to banks that have access to the Federal Reserve's discount window or other government backstops. Financial firms that do not have access, such as Jefferies, can continue to own hedge funds or engage in proprietary trading. (Additional reporting by Sarah N. Lynch in Washington and David Henry, Peter Rudegeair and Dan Wilchins in New York, Editing by Karey Van Hall, Tim Dobbyn and Krista Hughes)

Yahoo News

Yahoo News