These 4 Measures Indicate That Hainan Meilan International Airport (HKG:357) Is Using Debt Extensively

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Hainan Meilan International Airport Company Limited (HKG:357) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Hainan Meilan International Airport

What Is Hainan Meilan International Airport's Net Debt?

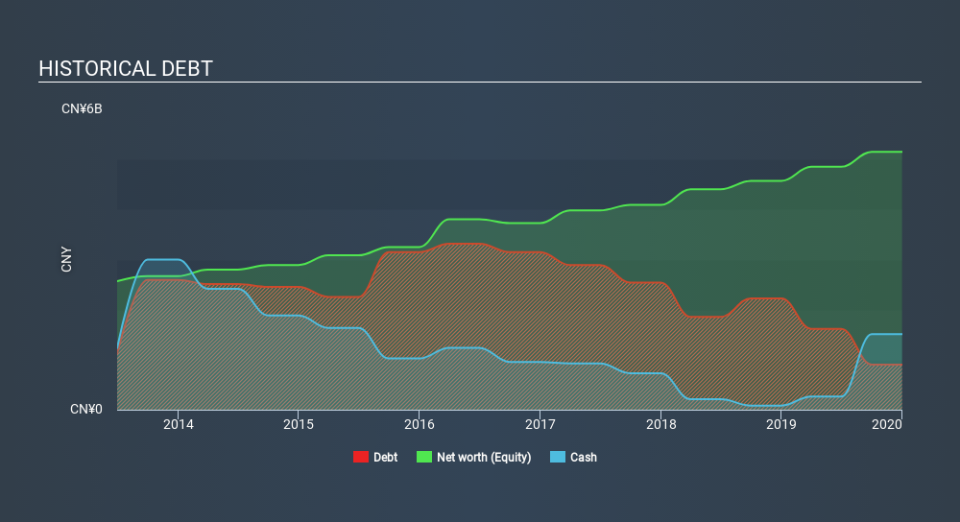

As you can see below, Hainan Meilan International Airport had CN¥838.7m of debt at December 2019, down from CN¥2.23b a year prior. But it also has CN¥1.51b in cash to offset that, meaning it has CN¥673.1m net cash.

How Healthy Is Hainan Meilan International Airport's Balance Sheet?

According to the last reported balance sheet, Hainan Meilan International Airport had liabilities of CN¥5.15b due within 12 months, and liabilities of CN¥1.16b due beyond 12 months. Offsetting this, it had CN¥1.51b in cash and CN¥504.4m in receivables that were due within 12 months. So it has liabilities totalling CN¥4.29b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the CN¥2.84b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Hainan Meilan International Airport would probably need a major re-capitalization if its creditors were to demand repayment. Given that Hainan Meilan International Airport has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

On the other hand, Hainan Meilan International Airport's EBIT dived 16%, over the last year. If that rate of decline in earnings continues, the company could find itself in a tight spot. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Hainan Meilan International Airport will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Hainan Meilan International Airport has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Looking at the most recent three years, Hainan Meilan International Airport recorded free cash flow of 24% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing up

Although Hainan Meilan International Airport's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of CN¥673.1m. Despite its cash we think that Hainan Meilan International Airport seems to struggle to handle its total liabilities, so we are wary of the stock. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Hainan Meilan International Airport's earnings per share history for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News