Adidas jogs on from television advertising

BI Intelligence

This story was delivered to BI Intelligence "Digital Media Briefing" subscribers. To learn more and subscribe, please click here.

Adidas is making a big bet that advertising on digital channels will be more effective at driving revenue growth than commercials on TV.

The CEO, Kasper Rorsted, told CNBC that Adidas is focusing on their marketing efforts on digital and social channels in order to target younger potential customers. In addition, Adidas is targeting €4 billion ($4.3 billion) in sales solely through online channels in 2020, nearly quadruple the €1 billion ($1.1 billion) in e-commerce sales in 2016. The shifting of Adidas’ ad budget to largely digital channels reflects their ambitions to attract younger users, who are watching less TV and are increasingly shifting attention to mobile devices. Here are a few implications:

Digital helps Adidas develop all along the value chain. The company incorporates data from digital engagement to help them develop products, from design, manufacturing, and sales. The company believes by consolidating ad spend in digital efforts will eventually help the company expand margins. Clearly, Adidas is having major success with digital and social channels, and believes that dedicating a majority of marketing resources to the channel will ultimately pay off in strides.

Athletes have large and engaged social media followings. Real Madrid’s Cristiano Ronaldo has the world’s largest Facebook following, about 120 million, and reaches over 260 million users via social media. This prompted Nike to sign a $1 billion lifetime pact with the soccer player, which some believe was a bargain for Nike. Adidas, meanwhile, has a lifetime deal with Barcelona's Lionel Messi, which is reportedly worth $10 million a year.

Not all brands are as gung ho for digital as Adidas though. Recently, Marc Pritchard, CMO at P&G, the top advertiser by ad spend, criticized the 'dark side' on digital advertising, calling for greater media transparency and consistent viewability standards across all platforms. These qualms were no doubt driven by the various measurement gaffs and misreported metrics at companies like Facebook and Twitter. Facebook has since agreed to an independent audit by the Media Rating Council (MRC), as announced in a February blog post.

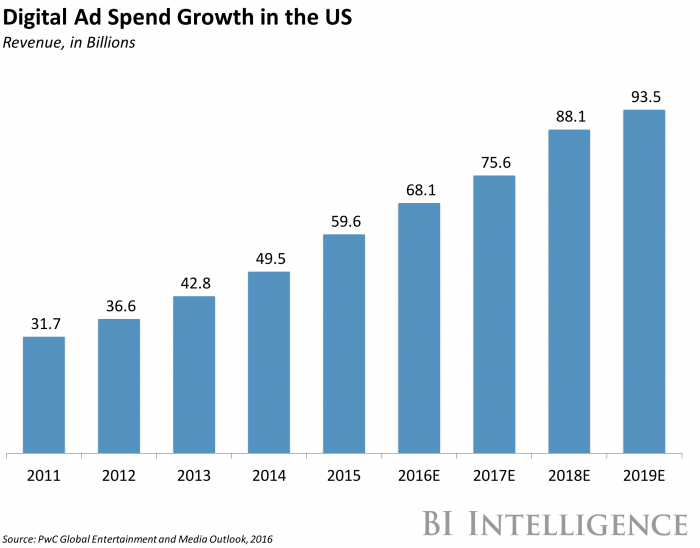

Consumers continue to increase their time spent consuming digital media, while advertisers continue to increase their ad budgets into digital channels.

The influx is not expected to let up in the near future. The US digital advertising industry will continue to experience remarkable growth through 2021 to reach nearly $100 billion in annual revenue, driven primarily by the sustained migration of ad dollars from traditional TV to digital video and the continued increase of social spending.

Overall, the strong growth of the US digital ad market can largely be attributed to increased time spent by consumers on digital media and brands' increased comfort with allocating budgets to digital formats, particularly on digital video. In a recent 2016 survey of almost 400 US ad agencies and marketers, the IAB found that two-thirds of respondents plan on increasing spending on digital video in the next year.

Moreover, mobile will become the top destination for digital ad spending as advertisers continue to attempt to resolve the disconnect between the rapid growth in time spent on phones and tablets and the relatively small share of ad budgets that are allocated to such platforms — known as the mobile opportunity gap. In fact, mobile is set to eclipse desktop ad spend by 2018.

Dylan Mortensen, senior research analyst for BI Intelligence, Business Insider's premium research service, has compiled a detailed report on U.S. digital media ad revenue that forecasts revenue trends over the next five years and outlines the key growth drivers for overall digital ad revenue in the U.S.

Here are some key points from the report:

US digital ad revenue is expected to reach nearly $100 billion by 2021, according to BI Intelligence estimates. This represents compound annual growth of 8% from the $68.9 billion expected in 2016.

Mobile is positioned to become the top destination for digital ad spending as advertisers continue to attempt to close the "mobile opportunity gap."

Digital video advertising will grow faster than any other segment over the next five years, as consumers shift time spent online to phones and tablets. Revenue in this category is forecast to rise from $8.5 billion in 2016 to $23 billion in 2021.

Social advertising in all formats is gaining traction and will be among the key drivers of digital ad growth in the next five years. Social ad revenue is poised to climb to $30.8 billion by 2021, up from $15.5 billion this year.

Artificial intelligence, augmented and virtual reality, and sponsored content will help propel further digital ad growth in the next decade.

In full, the report:

Forecasts US digital ad revenue through 2021.

Highlights the rising popularity of digital media with consumers and brands.

Explores why digital video advertising growth will exceed all other formats over the next five years.

Outlines emerging technologies that will help propel ad growth in the next decade.

To get your copy of this invaluable guide, choose one of the following two options:

Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. » START A MEMBERSHIP

Purchase & download the full report from our research store. » BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of digital media ad revenue.

See Also:

Yahoo News

Yahoo News