Advanced Energy (AEIS) Q4 Earnings & Revenues Beat Estimates

Advanced Energy Industries, Inc. AEIS reported fourth-quarter 2019 non-GAAP earnings of 87 cents per share, beating the Zacks Consensus Estimate by 24.3%. Further, the figure was higher than management’s guided range of 56-80 cents.

Further, the bottom line improved 19.2% on a year-over-year basis and 61.2% sequentially.

Revenues of $338.3 million surpassed the Zacks Consensus Estimate by 8.3% and management’s guided range of $295-$325 million. Further, the figure soared 119.4% from the year-ago quarter and 93.2% from the prior quarter.

The top line was driven by strengthening demand in semiconductor equipment market, which led to acceleration in semiconductor revenues during the reported quarter. Further, the company witnessed solid momentum in data center computing market, which is a positive.

Additionally, positive contributions from Artesyn Embedded Power buyout contributed to the results.

However, the company bore the brunt of macro-economic headwinds especially in the industrial and telecom markets throughout the fourth quarter.

Coming to price performance, Advanced Energy has gained 37.7% over a year, underperforming the industry’s rally of 70.6%.

Nevertheless, strong cost optimization strategy, new product design wins and robust product pipelines are likely to help the stock recover in the near term.

Further, the company remains optimistic regarding its power density, deep engineering capabilities and strong application knowledge in the data center market. Moreover, the company’s position in the telecommunication market will aid it in capitalizing on 5G related prospects.

Top-Line in Detail

Product revenues increased 149.2% year over year to $311.6 million (92.1% of total revenues) in the fourth quarter. This can primarily be attributed to growing semiconductor product revenues and multiple product design wins.

Services revenues declined 8.5% from the prior-year quarter to $26.7 million (7.9% of revenues). This was primarily due to sluggish semiconductor service business. Further, divestiture of U.S. central inverter business affected the results.

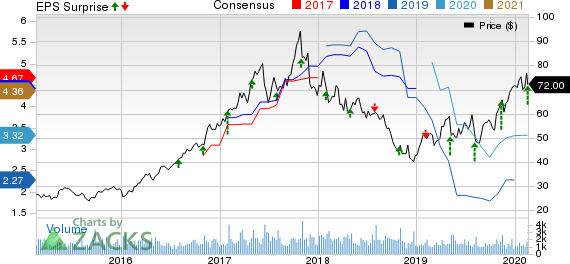

Advanced Energy Industries, Inc. Price, Consensus and EPS Surprise

Advanced Energy Industries, Inc. price-consensus-eps-surprise-chart | Advanced Energy Industries, Inc. Quote

Product Line in Detail

Semiconductor Equipment revenues improved 16.5% year over year to $125.1 million (37% of the total revenues). The company witnessed growing investments in foundry/logic, which remained a tailwind. Further, solid memory demand and positive contributions from prior design wins contributed to the product line’s revenues. Additionally, strong momentum across semiconductor power solutions was a tailwind.

However, softness in North America impacted the performance of semiconductor service business during the reported quarter.

Industrial & Medical revenues improved 106.8% year over year to $96.7 million (28.6% of revenues). This was driven by momentum of the company’s industrial embedded power products across 3D printing, robotics, food processing, motion control and horticulture applications. Moreover, growing presence in the medical equipment market and solid momentum across medical device customers acted as tailwinds. Additionally, accretive nature of the previous design wins benefited the top line of this product line.

However, weak demand across industrial production and auto industries especially in the Europe and China remained a headwind.

Telecom & Networking revenues were $38.5 million (11.4% of revenues), which increased from $10.02 million in the previous quarter. The company continued to gain from 5G infrastructure and deployment.

However, sluggish IT infrastructure investments led to weak demand from both telecom infrastructure and networking equipment OEM.

Data Center Computing revenues were $77.9 million (23% of revenues), up significantly from $13.5 million in the previous quarter. Strengthening momentum across hyperscale customers aided the company in securing multiple design wins during the reported quarter. Additionally, the company gained traction across key enterprise computing and storage customers. All these factors drove the top line of this product line in the reported quarter.

Operating Results

In fourth quarter, non-GAAP gross profit was 35.9%, which contracted significantly from 49.4% in the year-ago quarter due to acquisition related costs and facility expansion expenses.

Non-GAAP operating expenses came in $78 million, up 64.4% year over year.

Further, non-GAAP operating margin was 12.8%, contracting from 580 basis points (bps) from the prior-year quarter.

Balance Sheet & Cash Flow

As of Dec 31, 2019, cash, cash equivalents and Marketable securities were $349.1 million compared with $341.1 million Sep 30, 2019.

During the fourth quarter, cash flow from operations was $19 million compared with $10.5 million in the third quarter.

Capital expenditure during the reported quarter stood at $9.5 million, up from $8.9 million in the prior quarter.

Guidance

For first-quarter 2020, Advanced Energy expects non-GAAP earnings between 40 cents and $1 per share. The Zacks Consensus Estimate is pegged at 76 cents per share.

Revenues are anticipated in the range of $280-$340 million. The Zacks Consensus Estimate for revenues is pegged at $307.4 million.

The company expects demand in semiconductor equipment market to be up in the mid-teens in the current quarter on a sequential basis owing to strong bookings.

However, macro headwinds are likely to impact demand across industrial and medical verticals, which is expected to be down sequentially.

Zacks Rank & Other Key Picks

Advanced Energy currently has a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the broader technology sector are Itron, Inc. ITRI, NetEase, Inc. NTES and Five9, Inc. FIVN. All the three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Itron, NetEase and Five9 is currently pegged at 25%, 41.99% and 10%, respectively.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Itron, Inc. (ITRI) : Free Stock Analysis Report

Advanced Energy Industries, Inc. (AEIS) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Five9, Inc. (FIVN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News