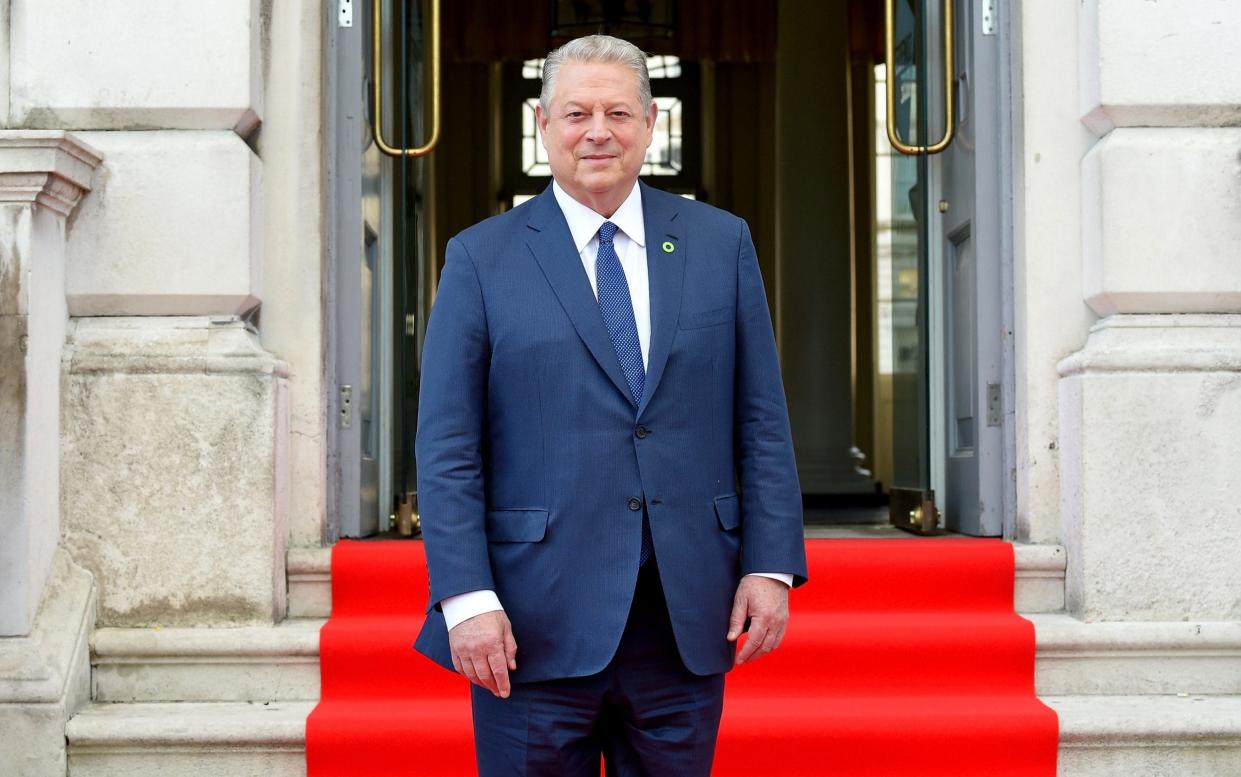

Al Gore’s investment fund Generation raises $1bn to back eco-friendly start-ups

Generation Investment Management, co-founded by former US Vice President Al Gore, has raised $1 billion (£786m) for its latest private equity fund to back sustainable start-ups.

Generation IM Sustainable Solutions Fund III will invest between $50 million and $150 million in companies helping the health of the planet or individuals, or those driving financial inclusion.

“We believe that we are at the early stages of a technology-led sustainability revolution, which has the scale of the industrial revolution, and the pace of the digital revolution," Gore said.

Generation Investment Management was co-founded by Mr Gore in 2004 alongside David Blood, the head of Goldman Sachs' asset management business.

It is headquartered in London and also has an office in San Francisco. It has previously backed businesses including Ocado, DocuSign and Asana.

The fund has already invested in Switzerland-headquartered health technology business Sophia Genetics, which uses artificial intelligence to analyse health data. Generation led a $77m investment round into the company.

The investment came in January days after Autonomy founder Dr Mike Lynch stepped down from the board of the company. Dr Lynch faces 17 fraud indictments from the US Department of Justice connected to the sale of Autonomy to HP. He denies the allegations.

Generation’s new fund has also led a $100m investment round into Andela, which allows companies to hire developers across Africa. The funding round included investment from Serena Ventures, the fund started by tennis player Serena Williams.

Demand to invest in a sustainable manner is growing, particularly in Europe, even if the definition of what this means can vary.

For Generation, target companies would provide "goods and services consistent with a low-carbon, prosperous, equitable, healthy and safe society".

Yahoo News

Yahoo News