Alcanna's(TSE:CLIQ) Share Price Is Down 59% Over The Past Five Years.

While it may not be enough for some shareholders, we think it is good to see the Alcanna Inc. (TSE:CLIQ) share price up 23% in a single quarter. But don't envy holders -- looking back over 5 years the returns have been really bad. The share price has failed to impress anyone , down a sizable 59% during that time. So we're not so sure if the recent bounce should be celebrated. But it could be that the fall was overdone.

View our latest analysis for Alcanna

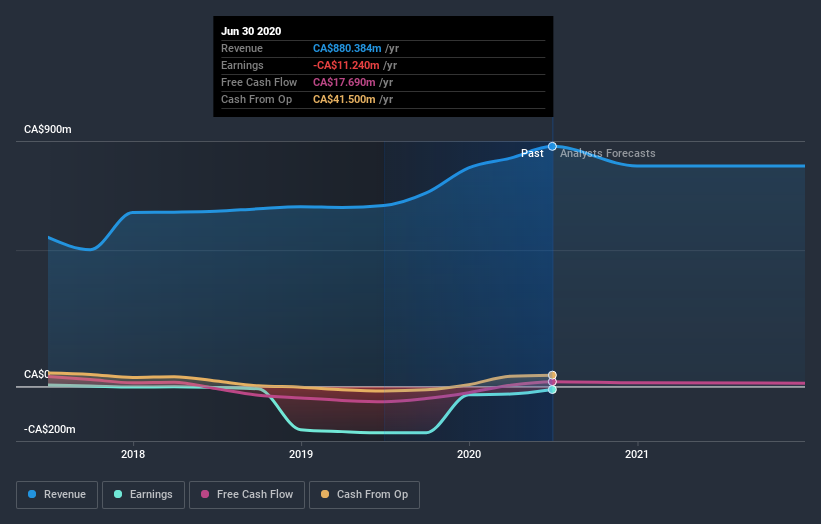

Because Alcanna made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, Alcanna saw its revenue increase by 1.3% per year. That's not a very high growth rate considering it doesn't make profits. This lacklustre growth has no doubt fueled the loss of 10% per year, in that time. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Alcanna. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. You can see what analysts are predicting for Alcanna in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Alcanna's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Alcanna's TSR of was a loss of 53% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

It's good to see that Alcanna has rewarded shareholders with a total shareholder return of 15% in the last twelve months. Notably the five-year annualised TSR loss of 9% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Alcanna has 3 warning signs (and 1 which is significant) we think you should know about.

Alcanna is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News