Amazon has big plans to disrupt the payments industry (AMZN)

BI Intelligence

This story was delivered to BI Intelligence "Payments Briefing" subscribers. To learn more and subscribe, please click here.

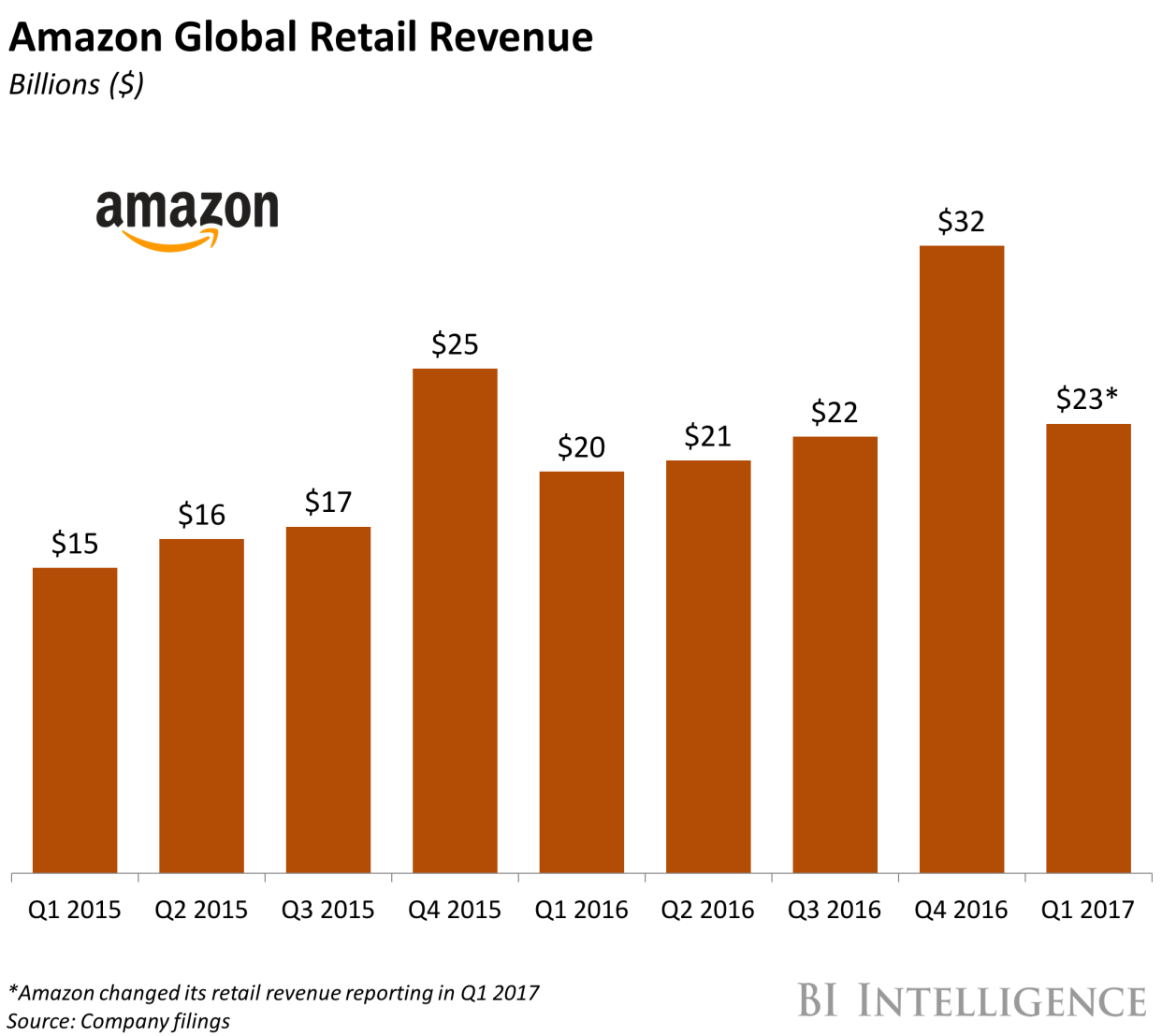

As Amazon prepares to report Q2 earnings today, all eyes will be on its growth in revenue and gross merchandise value (GMV) metrics.

But it's worth pointing out that the e-commerce powerhouse is significantly expanding its presence in digital payments. It's not a huge part of the business now, but it's poised for continued growth.

Here's how Amazon has been building out a payments ecosystem:

It introduced an easy and secure way for consumers to make online payments and merchants' to accept them with Amazon Pay. Users can now make frictionless and secure payments on participating merchants websites by using a one-click checkout, which leverages the payment information the user has saved on his Amazon account.

The e-commerce giant further built out this capability by allowing consumers to make convenient payments in-store via Amazon Pay Places. This new feature is allowing users to order ahead and pay for goods in-store via the Amazon app. TGI Fridays will be the first merchant to accept the payment option, but this will likely be rolled out extensively. Although this is very similar to other mobile wallet offerings, it is still another step by Amazon to begin squeezing out traditional payment players by building consumer habits around using the Amazon app for purchases.

Consumers then have the opportunity to add cash to their Amazon accounts and the ability to earn rewards, essentially giving these users a banking account. Amazon introduced a service that enables customers to add cash to their Amazon accounts at select brick-and-mortar stores, which is very similar to depositing cash at a bank. This was followed by a new rewards program in the US that gave Prime members 2% cash back when they load money into their Amazon Balance via a debit card or attached bank account. By giving these users incentive to easily add funds to their accounts, Amazon could find more consumers willing to spend online and in-store via Amazon's payment offerings. This would allow Amazon to earn on these transactions, similar to PayPal, which charges merchants fees as high as 2.9%.

Amazon also offers traditional banking services, such as loans, which are becoming increasingly popular. The firm paid out over $1 billion in small loans in the last year alone — for context, from 2011 to 2015 this service was used to lend $1.5 billion.

Here's why competitors should take notice.

Amazon has the reach. The company has a massive user base — the Amazon app is installed on three out of 4 smartphones in America, the company's subscription based loyalty program, Amazon Prime, had an estimated 80 million members in the US alone, and Amazon Pay has over 33 million users.

It has the capital. Amazon not only accounts for a massive amount of sales — in Q2 2017, it expects sales to grow 16-24% YoY to between $35 billion and $37 billion — but it has also shown a willingness to make big bets on future growth opportunities that aren't always obvious. Its recent acquisition of Whole Foods for $13.7 billion is a good example.

It has the infrastructure in place to build out a payments network quickly. Amazon Web Services (AWS), the company's cloud solution, has the capacity to handle the processing of payments if it were to push further into the space. As of Q1 2017, AWS controlled 33% of the global public cloud market, more than Microsoft, Google, IBM, Alibaba, and Oracle combined, according to the most recent figures from Synergy Research.

BI Intelligence, Business Insider's premium research service, has compiled a detailed report on retailer mobile wallets that:

Explains what hurdles universal mobile wallets have faced.

Details what features retailers have adopted into their mobile wallets that have been successful

Analyzes the use cases of retailers that have successfully leveraged their mobile wallet offerings to push growth.

Identifies how universal mobile wallets will eventually slow growth for retailer-based mobile wallets.

To get the full report, subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and more than 250 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >> Learn More Now

You can also purchase and download the full report from our research store.

See Also:

Yahoo News

Yahoo News