Amazon Prime subscriber spend is nearly double that of nonmembers (AMZN)

BI Intelligence

This story was delivered to BI Intelligence "E-Commerce Briefing" subscribers. To learn more and subscribe, please click here.

Prime subscribers spend an estimated $1,300 per year on Amazon, compared with $700 for nonmembers, according to a forecast by Consumer Intelligence Research Partners (CIRP) cited by Fortune.

The e-commerce titan now has 90 million US subscribers, up 38% from a year ago. Prime is a critical piece of Amazon's business, making its increasingly expansive reach key to the company's ongoing success.

Prime memberships are quite lucrative for Amazon — the company pulls in about $9 billion from its subscriber fees annually. Moreover, with these customers spending almost double what nonmembers do, Amazon can generate even more revenue from seller fees.

Its Prime subscriber base is also very loyal, presenting a strong, sustainable revenue stream for Amazon. For the past four quarters, at least 90% of Amazon Prime members surveyed said they would either “definitely” or “probably” renew.

With an eye toward the future of Prime, Amazon has begun making moves to appeal to Gen Z. It recently announced a new feature that allows teenagers to make accounts under their parents’, and created a new monthly plan of $5.49 for students, enabling them to bypass the usual year-long commitment. Encouraging younger generations to use Amazon Prime will likely build loyalty with this lucrative segment — Gen Z is expected to be the leading generation in US consumer spending by 2026 — shoring up a fresh user base for the program as these consumers mature.

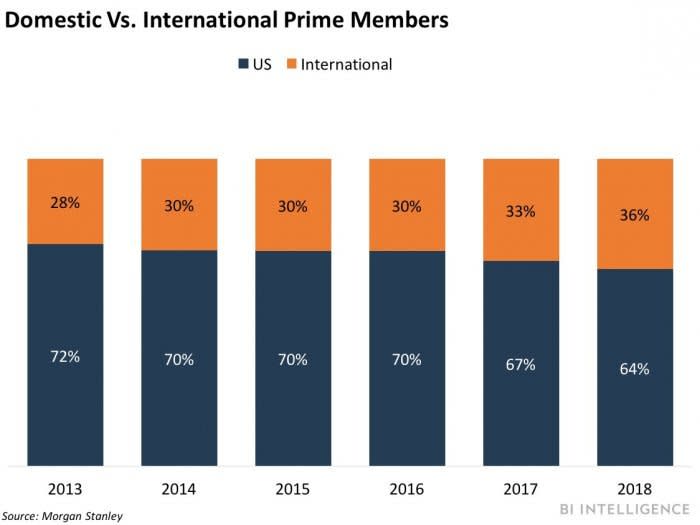

However, the company will need to expand Prime globally to sustain its success. As Prime memberships grow more ubiquitous in the US, uptake of the program in new markets will be critical to its continued growth. The company has recently been increasing its efforts to expand geographies like Southeast Asia, Latin America, and the Middle East, but international subscriptions still make up just about a third of Prime's total base. Moreover, while Amazon has seen success with Prime in certain markets, like India, it could have difficulty winning over customers in areas where rival Alibaba is already gaining traction, making international success harder to obtain than on its home turf.

To receive stories like this one directly to your inbox every morning, sign up for the E-Commerce Briefing newsletter. Click here to learn more about how you can gain risk-free access today.

See Also:

Yahoo News

Yahoo News