Amazon steps up battle with Netflix and Sky by adding new UK channels

Amazon is to add more than 40 TV channels to its UK streaming service, including ITV and live sport for the first time, upping the stakes against rival Netflix and pay-TV operators such as Sky.

Amazon will offer the channels at an extra cost to Amazon Prime members, who pay £79 a year or £7.99 a month for on-demand video including exclusive shows such as American Gods, The Grand Tour and Man in the High Castle.

The individual pricing for the new channels ranges from £1.49 to £9.49 a month, with subscribers choosing and paying for individual services, rather than for a bundle as with the traditional pay-TV model used by Sky. Netflix’s standard video on-demand service costs £7.49 a month while Sky’s cheapest package of channels is £22.

ITV will offer its live TV and ad-free catch-up service for £3.99. Conspicuous by their absence are the UK’s other main free-to-air broadcasters – the BBC, Channel 4 and Channel 5.

“We don’t focus on our competitors,” said Alex Green, the managing director of Amazon’s TV channel rollout across Europe. “We focus on how we can improve our service for customers.”

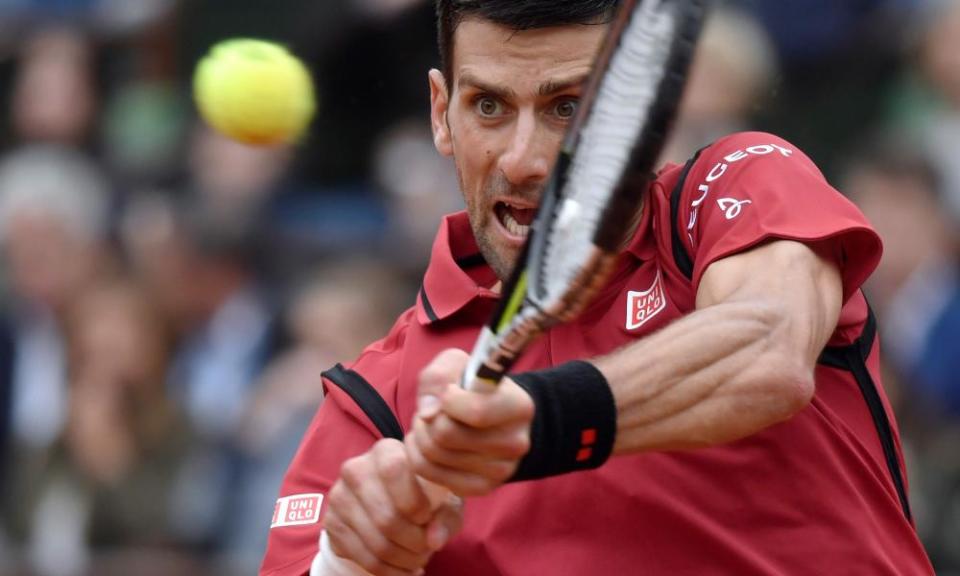

At launch, Amazon is offering channels including Gold Rush broadcaster Discovery and its Eurosport subsidiary, which will lead to Amazon offering live sport for the first time globally, starting with the imminent French Open and Olympic coverage from next year.

Other channels include NBC Universal’s reality TV service Hayu, which has shows such as Keeping Up With the Kardashians, Made in Chelsea and The Real Housewives franchise, and Amazon’s own Bollywood channel Heera.

There will also be films from providers including the BFI and studio MGM, which has movies such as The Hobbit.

“This move represents a massive broadening of content,” said Richard Broughton, an analyst at Ampere. “It makes Amazon increasingly competitive with both Netflix and Sky, although at an increasingly higher price point.”

There are also none of Sky’s channels, which is not a surprise given the broadcaster would see the launch as competition for its own subscribers.

Green, a former BT TV director who is also launching 25 channels on Amazon’s German service this week, said the focus at this stage was more on subscriber channels than free partners.

“It is day one and we think that this will grow and grow,” he said. “For the first time, Prime members in the UK and Germany will be able to choose to watch premium TV channels without having to sign up to a bundle or a contract, giving them the freedom to pay for only what they want to watch.”

Most of the mainstream channels on the service, such as Discovery, will be priced at about £4.99. However, there will be a broad pricing selection from £1.49 for Panna, a video cookery service, to £9.99 for Daily Burn, which offers live workouts.

For Discovery, which threatened to pull off the Sky platform after a dispute over its channel carriage deal earlier this year, it marks the first time its channels have been made available direct to the consumer.

For Amazon, offering the channels individually at an extra cost is an unusual tactic as it has mostly focused on sweetening its Prime subscription service – most recently adding the option of attending exclusive live gigs and giving free access to thousands of digital magazines such as Time and OK! without upping the cost of the service.

“The main challenge Amazon has is that it is offering all of the channels standalone, which is potentially extremely expensive,” said Broughton. “The a la carte model has been tried a few times in the pay-TV market before. Research suggests that people say they want to pick and choose but in practice they prefer buying a big bundle and get ‘all-they-can-eat’ TV. In time, Amazon may look at aggregating some of the channels it is offering into a pay-TV style package.”

Green said that so far the launch of Amazon channels in the US, which has grown to 107 partners since late 2015, had “exceeded expectations” in terms of subscriber numbers.

Yahoo News

Yahoo News