American Water (AWK) Q2 Earnings & Revenues Beat Estimates

American Water Works Company AWK posted first-quarter 2020 earnings of 97 cents per share, which beat the Zacks Consensus Estimate by a penny.

The bottom line also improved 3.2% year over year on the back of strong contributions from Regulated and Market-based businesses. Second-quarter 2020 earnings figure reflects a 5 cents per share unfavorable impact due to the COVID-19 pandemic.

Total Revenues

Total revenues of $931 million beat the Zacks Consensus Estimate of $917 million by 1.5% and improved 5.7% from the year-ago figure of $882 million.

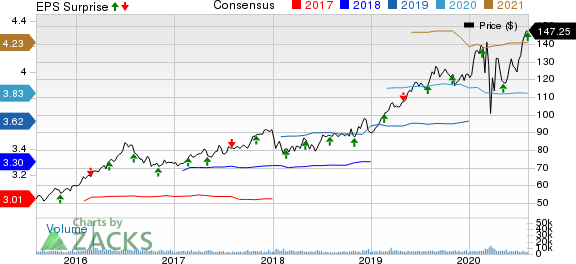

American Water Works Company, Inc. Price, Consensus and EPS Surprise

American Water Works Company, Inc. price-consensus-eps-surprise-chart | American Water Works Company, Inc. Quote

Highlights of the Release

Total operating expenses for the quarter were $618 million, up 6.6% from the year-ago period. The increase was due to higher operation and maintenance expenses.

Operating income was $313 million, 3.6% higher than the year-ago figure. New water rates effective January 2020 increased revenues by $80 million from a year ago.

Year to date, the company added 17,700 customers to the existing customer base through closed acquisitions and organic means. Its pending acquisitions, when completed, will add another 43,600 customers to the customer base.

For the 12 months period ended Jun 30, O&M efficiency improved to 34.3% from 35.2% in the year-ago period. The improvement was due to persistent focus on operating costs, and an increase in operating revenues for Regulated businesses.

Interest expenses for the reported quarter totaled $101 million, up 7.5% from $94 million in the prior-year period.

Segment Details

Regulated businesses’ net income was $177 million compared with $156 million in the year-ago quarter. Till Jul 31, 2020, this segment added 10,800 customers through 13 acquisitions in six states. Acquisitions, organic growth and additional authorized revenues to support infrastructure investments boosted income.

Market-Based businesses’ net income was $23 million compared with $21 million in the year-ago quarter.

Financial Highlights

Cash and cash equivalents amounted to $569 million as of Jun 30, 2020, up from $60 million on Dec 31, 2019.

Total long-term debt was $9,593 million as of Jun 30, 2020, higher than $8,644 million at 2019-end.

Cash flow from operating activities for first-half 2020 was $531 million compared with $480 million in the comparable year-ago period. For first-half 2020, capital expenditure of the company was $870 million compared with $712 million in the corresponding year-ago period.

Guidance

American Water reaffirmed its guidance for 2020 earnings in the range $3.79-$3.89, taking into consideration a 6-cent impact of depreciation not recorded as required by assets held for sale accounting and an estimated 5-8 cents per share unfavorable impact from the COVID-19 pandemic.

The company has plans to invest $20-$22 billion of capital over the next 10 years. Subject to the approval of the board of directors, dividend growth for the 2020-2024 period is expected to be at the high end of the 7-10% range.

Zacks Rank

American Water currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

Here are some other players from the water utility space that have reported second-quarter earnings:

While Essential Utilities WTRG and Middlesex Water Company’s MSEX earnings beat the Zacks Consensus Estimate by 20.8% and 7.8%, respectively, American States Water Company’s AWR bottom line was on par with the same.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Middlesex Water Company (MSEX) : Free Stock Analysis Report

American States Water Company (AWR) : Free Stock Analysis Report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

Essential Utilities Inc. (WTRG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo News

Yahoo News