Can anyone stop the Zoom boom?

It's a question millions of people have been asking every day during lockdown: “Are you free to Zoom later?”

The video conferencing app has achieved every marketers dream, by rapidly entering common parlance just like “I'll Google it” or “let me get an Uber”.

Even the less technologically savvy have become big users of its intuitive service.

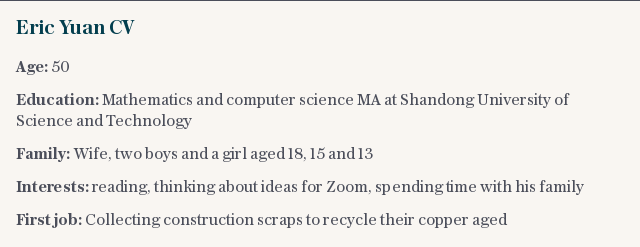

Founded by chief executive Eric Yuan, Zoom has done its name justice and soared in value in a remarkably short space of time. The videoconferencing app has been the big winner from lockdown. Its share price has trebled in value since the start of the year to $210 (£164) and its valuation now stands at $61bn - more than twice that of Twitter.

As Microsoft, Google, and Cisco slugged it out for control of the same market with more expensive and cumbersome products of their own - Zoom came from nowhere to covertly scale up its offering without alerting rivals.

“I think Zoom is on the track of becoming the Google of videoconferencing,” says, David Madden, an analyst at CMC Markets.

“The way technologies seem to go is there is one player that completely crushes it, as Google did with search engines. In my view it’s Zoom’s crown to lose.”

Zoom joined Netflix in making a mockery of analyst expectations, which were themselves intensely optimistic about their ability to grow market share during lockdown.

Revenue for the three months to the end of April climbed to $328.2m, a 169pc increase on the same period last year. Crucially, much of that revenue growth was driven by a surge in big paying customers.

Zoom now has 769 customers paying more than $100,000 in “trailing annual revenue”, which was up 90pc year on year. User numbers have surged from 10 million at the start of the year, with the app now hosting 300 million daily meeting participants.

Business customers with more than 10 employees surged 354pc to 265,400 during the quarter. Add to that the fact that the company is sitting on cash or “cash equivalents” of $1.1bn and it becomes clear that Zoom has moved fast to shore up its growth.

Yuan said he was “humbled” by the explosive growth of the service, which was founded a decade ago. But that growth has brought with it some teething problems - including security concerns and how to cope with an army of new customers.

The Zoom boss described dealing with the “incredible” increase in traffic was a “tremendous undertaking”.

“When the pandemic crisis started, our own data centers could not scale fast enough to handle the unprecedented traffic. Fortunately, some of the top public cloud providers were there to help,” Yuan told investors on Tuesday.

Zoom relied heavily on Amazon Web Services to provide the infrastructure to host its platform. Yuan said AWS provided the majority of new servers needed “sometimes adding several thousands a day for several days in a row”.

Thanks to its shiny new servers Zoom is also tipping its growth to continue, predicting revenue of between $495m and $500m for the second quarter of the year. Over the course of its full financial year, Zoom expects revenue to reach $1.8bn.

Of course Zoom’s growth has been hit by repeated security fears. Some companies have urged employees against using the product and experts have questioned the strength of the app’s encryption.

The company was plagued by reports of “Zoombombing” whereby uninvited guests crashed meetings and in some cases broadcast hate-filled or pornographic content.

Yuan introduced a range of measures to address the problem, including the introduction of “waiting rooms”, where hosts would approve guests before they entered, and automatically placing passwords on meetings.

“Such an influx of users will always attract attention from security researchers and malicious actors who are discovering vulnerabilities on high-traffic platforms, albeit for starkly different purposes,” says Chris Hodson, chief information security officer at Tanium.

Hodson says the company’s move to dramatically beef up security was “critical” to protect Zoom’s future success.

Competitors will look to latch onto Zoom’s security troubles as they bid to reclaim the market.

Microsoft is arguably the best-placed to compete with its Teams offering, which comes bundled in if a company already uses Office365.

The app can host chats with up to 250 people or present live to up to 10,000 people. It also allows for users to share invites and meeting recordings through Outlook. Seamless interaction in the Microsoft “ecosystem” will form a big part of the lure from Zoom.

Teams has enjoyed a boom during lockdown with daily active users climbing by 31 million in a month to 75 million.

Microsoft’s consumer-focused Skype was perfectly positioned to enjoy the surge nabbed by Zoom. Commentators suggested that Skype’s comparatively fiddly service forced less tech-savvy users to look elsewhere.

Zoom has excelled because it is seen as a "frictionless" product - easy for consumers to understand and use without technical expertise.

Not dissimilar to how Facebook launched its own version of Snapchat’s "Stories", the tech giant launched its own Zoom-like product in April called Rooms. The service will allow people to hold meetings with up to 50 people with no time limit.

Houseparty, meanwhile, offers a more socially-focused app than Zoom, with around 20 million users for the challenger and a strong reputation especially among younger users.

While Zoom’s free version allows up to 100 people at once, it does stipulate a 40 minute time limit.

The biggest names in tech are unlikely to leave Zoom alone to build on its 300 million “daily meeting participants”. With huge cash-piles, tech giants all want their own slice of the video conferencing boom.

That said “to Zoom” has turned into a verb among ordinary consumers as millions log in during lockdown. Getting Zoom out of the public vernacular may prove too tricky for the incumbents.

Yahoo News

Yahoo News