Bailout fund seeks £15bn to save thousands of companies by Christmas

Money managers and Treasury officials are racing to build a £15bn bailout fund by Christmas, as a leading figure in the effort warns that Rishi Sunak’s “short term fixes” will not be enough to save thousands of businesses.

Stephen Welton, chief executive of the Business Growth Fund, is in talks with investors to create a £15bn pot, potentially backed up with taxpayer cash, to take equity stakes in struggling businesses.

The so-called National Recovery Fund was first mooted in the immediate aftermath of the pandemic as a lifeline to firms laden with debts following the lockdown.

Mr Welton said he was now in “meaningful discussions” with a “significant range of institutions” such as pension funds and insurers over a private sector-led fund as a bleak winter looms for the economy.

“My strong sense remains that we need to be bringing all these conversations to a conclusion before Christmas, because whatever happens the economy is getting weaker and weaker and therefore the longer we wait, the more difficult it will be to recover. These businesses can run on empty for three to six months, but they can’t keep doing that.”

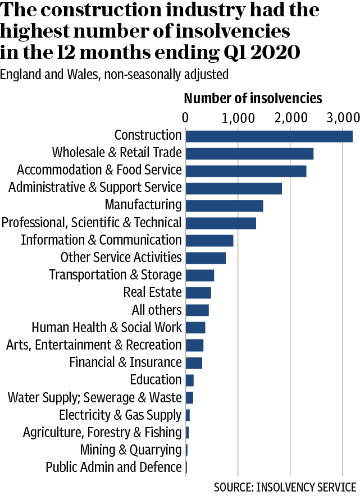

Corporate restructuring experts are bracing for an insolvency surge next year as state support delays a wave of company collapses until 2021.

Ric Traynor, chairman of insolvency firm Begbies Traynor, said the number of corporate failures could hit the 26,000 mark seen in 2009 in the wake of the financial crisis. “That sort of level does not seem unrealistic,” he said.

“Those that are hanging on and had the advantage of the furlough won’t have it any more, and the modest contribution of the Government won’t make much difference.”

Mr Welton’s £15bn fund would be targeted at the UK’s 20,000 mid-sized businesses where there is an “obvious and significant” funding gap, taking equity stakes of up to £10m.

Chancellor Rishi Sunak set out measures to ease cash flow pressure on company balance sheets in his Winter Economic Plan last week, including the extension of Covid loan repayments and tax referrals.

But lobby group TheCityUK has estimated that UK companies could be saddled with £35bn in unsustainable debt following the pandemic. Mr Welton said: “What we are currently seeing are short-term fixes, they are not proper fixes because they are just keeping companies alive.

“The only way we are going to get a recovery is to make sure firms are properly capitalised and they can plan for the next five years.”

Gareth Harris, a restructuring partner at accountant RSM, added: “If you look at what’s in my portfolio at the moment, it’s hotels, leisure businesses, events. It is not enough in relation to those industries.”

Yahoo News

Yahoo News