'The Bank of England will issue e-pounds within two years as cash dies out'

We will have “e-pounds” within two or three years and will be a virtually cashless society within a decade, the man who runs Britain’s cash machines has said.

A new digital sterling issued by the central bank will be widely used as a replacement for cash and take on the likes of digital currency Bitcoin, predicted John Howells, the boss of Link, the nation’s cash machine network.

There will be a period of 10 years when cash and e-pounds will still be interchangeable before cash use eventually dies out altogether, Mr Howells added.

Watch: What are the risks of investing in cryptocurrency?

“The shift will be accompanied by a massive Government education push similar to the move from shillings and pence during decimalisation in the 1970s, or the switch to digital television during the 2000s analogue switch-off.”

Existing digital currencies such as Bitcoin will never be an appropriate way of paying for goods, due to wild swings in its value, Mr Howells said. Rather, we will follow a highly regulated Swedish-style approach that keeps our spending habits private.

“We won’t be dispensing Bitcoin any more than we will be issuing gold bars out of a hole in the wall,” Mr Howells added.

It follows similar comments made by Andrew Bailey, the Governor of the Bank of England, who said earlier this year that Bitcoin was unlikely to ever become a mainstream form of payment.

The central bank is currently considering the practicalities of designing and introducing its own official digital currency such as an “e-pound”, similar to the “e-krona”, which is already being trialled in Sweden.

The idea is to allow simple transactions between parties without involving banks or other go-betweens, allowing people to pay in the same way they do in cash today without any physical money changing hands or anything being lost to third-party costs. As with cash, people would be able to use the digital currency without having a bank account, in theory.

But the new system would supposedly be more secure, with less risk of money going missing down the back of the sofa or being lost in other ways, such as theft.

“I am expecting this to happen pretty soon, within only a couple of years,” Mr Howells said.

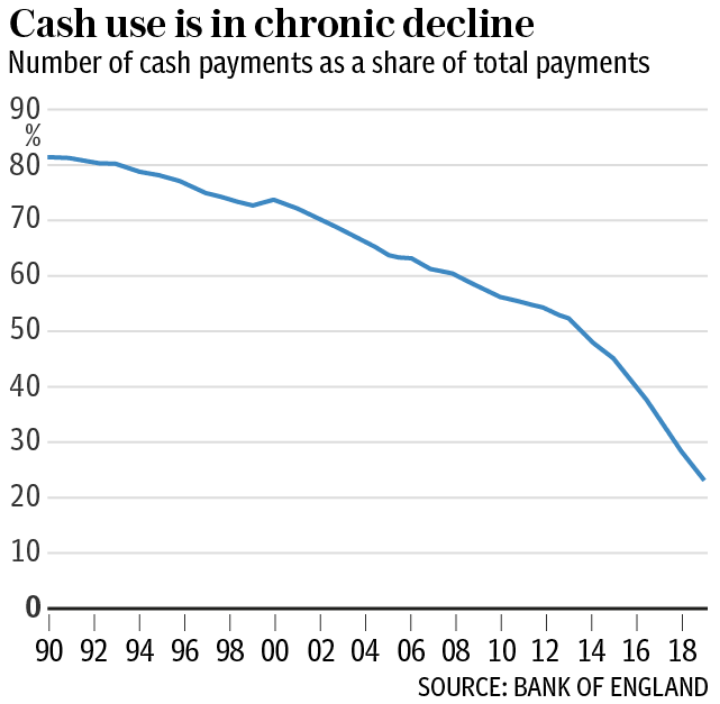

“Cash usage has almost halved and that is not going to come back as the pandemic eventually goes away. We are on the route to a very low-cash society. One in 10 payments are made in cash now. This is down from 60pc a few years ago. This could soon drop to one in 20.

“Once you get to that level, shops will stop accepting physical money altogether and cash machines and branches will get thinner on the ground. My job is to make sure there is still cash in machines that can live in harmony with the new system for those who will need help making the transition.”

Cash use is in chronic decline, as the above chart shows, and has fallen sharply since the pandemic began. Cash machine use on the main Link network was down by almost 40pc at the end of 2020 compared with the year before.

Cash machines on British high streets have closed down at a rate of 340 every month since the pandemic started, according to payments firm Dojo. One in three customers has been refused service in a shop when trying to use cash over contagion fears, consumer group Which? found.

Two million people still depend on cash every day, but at the same time interest in the most prominent digital currency Bitcoin has boomed.

Endorsement of the cryptocurrency from institutions such as payment firm PayPal, investment bank JP Morgan and investment house Ruffer, plus investors betting on future price rises, caused its value to soar to record highs of more than $50,000 (£35,000) this year, as you can see in the second chart.

But its value dropped by some $10,000 in a matter of hours this week, after America’s Treasury Secretary declared it “highly speculative” and “inefficient” for transaction.

Watch: What is bitcoin?

Yahoo News

Yahoo News