Big 3 Detroit Automakers in Focus: Which is the Ace of Spades?

After plunging the most in the second quarter since the Great Recession, the U.S. auto industry gathered momentum in the third quarter, with sales rebounding from coronavirus-led lows and buyers returning to showrooms. Sales growth for September marked the first monthly rise since February. Unless there is a spike in coronavirus cases, which will trigger another round of lockdown and send vehicle deliveries into a tailspin, auto sales in the United States are likely to gain traction going forward. Increasing consumer confidence, declining unemployment rate and Fed’s efforts to support the economy bode well for the auto industry, which is highly cyclical in nature.

Amid the improving landscape, let’s take a look at how the Big 3 automakers namely General Motors GM, Ford F and Fiat Chrysler FCAU are currently faring. General Motors, Ford and Fiat Chrysler are three of the oldest auto firms dated 1908, 1903 and 1925, respectively. While relatively new auto firms including Tesla TSLA are surely beefing up competition, especially in the electric vehicle space, these three legacy automakers have certainly stood the test of time and remain trusted picks for investors and consumers alike. While Fiat Chrysler currently sports a Zacks Rank #1 (Strong Buy), General Motors and Ford carry a Zacks Rank #2 (Buy) and 3 (Hold), respectively. You can see the complete list of today’s Zacks #1 Rank stocks here.

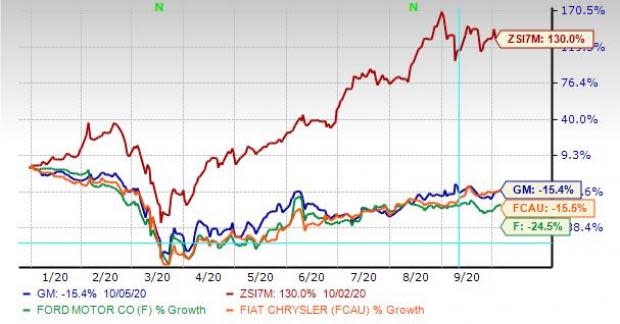

Before we delve deeper, let’s take a look at how these companies fared at the bourses so far this year. All the three stocks have declined and underperformed the industry’s rally of 130%. While General Motors and Fiat Chrysler have dropped around 15%, Ford lost nearly 24% of its value in the said period.

Let’s compare the stocks on certain parameters to give investors a better insight and find out which of the three stocks is positioned better in terms of fundamentals.

First-Half 2020 Performance & Projections

For the first half of 2020, General Motors, Ford and Fiat Chrysler raked in revenues of $49.5 billion, $53.7 billion and $37.9 billion, down 29.7%, 32.2% and 36.1%, respectively, on a year-over-year basis. Notably, General Motors generated an adjusted EBIT of $714 million for first-half 2020. Meanwhile, Ford and Fiat Chrysler posted pre-tax loss of $2.6 billion and €876 euros (more than $1 billion), respectively, during the same time frame.

General Motors expects EBIT to improve to $4-$5 billion for the second half of 2020. While the company’s guidance is encouraging, Ford expects an adjusted EBIT loss in 2020. For the third quarter of 2020, it anticipates adjusted EBIT of $0.5-$1.5 billion, indicating a decline from $1.8 billion in the corresponding period of 2019. Fiat Chrysler expects an improvement in profitability and cash flow during the second half of 2020. The company is on track to achieve expected cost savings of €2 billion for full-year 2020.

Third-Quarter Sales Report

General Motors delivered 665,192 vehicles in third-quarter 2020, down 10% from the year-ago level but up from deliveries of 492,489 vehicles in second-quarter 2020. Fiat Chrysler delivered 507,351 vehicles, which contracted 10% from the year-ago period but marked a 38.2% jump from the prior quarter. Ford sold 551,796 vehicles during the quarter under review, down 4.9% on a yearly basis but up 27.2% sequentially. Robust demand for pickups aided sales for the third quarter of 2020. Sales of Ford’s F-Series truck, Fiat Chrysler’s RAM pickup and General Motors’ Chevy Silverado totaled 221,647, 156,157 and 147,484 units, respectively, for the quarter. Importantly, for 43 straight years, the F-Series has been the best-selling pickup in the United States.

Valuation

When we look at valuation based on EV/EBITDA ratio, all the three firms are trading below the industry levels and seem to be a good pick for bargain-hunters. On the basis of trailing 12-month enterprise value to EBITDA (EV/EBITDA), General Motors, Ford and Fiat Chrysler are currently trading at 8.52X, 15.69X and 3.06X, respectively, compared with the industry’s 27.22X.

Race to EV Transition

Amid rising climate change concerns and favorable government policies, Detroit automakers are betting big on electrification efforts. While green vehicles are still years away to constitute a major chunk of overall sales, auto giants are fast changing their gears to electric.

In this regard, General Motors is leaving no stone unturned to demonstrate its EV prowess. It aims to spend more than $20 billion through 2025 to launch gen-next EVs powered by new low-cost batteries. The company is on track to roll out 20 new EVs by 2023. Key launches would include luxury Cadillac Lyric, Hummer pickup and SUV. General Motors’ collaboration with Honda HMC, Uber, EVgo and Nikola showcase its commitment toward an electrified future. When it comes to battery technology, General Motors has a clear edge over peers as of now with the Ultium Drive System, through which it seeks to build a vertically integrated electric car business.

Ford is committed to spend more than $11.5 billion in EVs through 2022. The company’s alliance with Volkswagen VWAGY and Electrify America is commendable. Ford’s upcoming launches including Mustang Mach E and electric F-150 pickups are likely to prove game changers. Meanwhile, Fiat Chrysler will be investing 9 billion euros (more than $10 billion) to introduce electrification across its brand portfolio through 2022. Key launches will include Fiat 500e, full-electric Maserati, hybrid versions of Jeep Compass and Jeep Renegade 4xe. Alliance with energy suppliers like Enel X and ENGIE bodes well.

Overall, General Motors’ EV goals seem to be more ambitious. Importantly, the company looks to develop and produce the electric components in-house, rather than Ford or Fiat Chrysler that have no such plans as of now and seek to outsource for EV parts. Mounting pressure on General Motors to spin off the EV unit as a separate business to unlock shareholder value only goes to show that the firm is truly ahead of peers in the EV game.

Balance Sheet Strength

Fiat Chrysler scores better in terms of leverage. As of Jun 30, the company had a long-term debt of 15.6 billion euros (more than $18 billion), with a long-term debt-to-capital ratio of 0.38. Meanwhile, General Motors and Ford had a long-term automotive debt of $32.2 billion and $37.4 billion, representing long-term debt-to-capital ratios of 0.53 and 0.55, respectively.

Given economic uncertainty, cash is the king for businesses. Companies are resorting to severe cost-containment initiatives to boost their liquidity profile. At second quarter-end, Ford, General Motors and Fiat Chrysler’s cash and cash equivalents were $30.9 billion, $28.2 billion and $16.4 billion, respectively. With a cash ratio of 0.62, Ford fares well in the liquidity parameter. Meanwhile, General Motors and Fiat Chrysler have a cash ratio of 0.48 and 0.42, respectively.

FCF Generation and Outlook

The coronavirus pandemic left the auto industry mired in crisis, especially at a time when companies intend to invest billions of dollars in electrifying the business model as the internal combustion era is drawing to a close. Amid coronavirus-induced sluggish demand for vehicles and high capex and R&D costs, cash flows of the firms have gone for a toss. Adjusted free cash flow for General Motors, Ford and Fiat Chrysler at the end of first-half 2020 came in at negative $10 billion, $12 billion and $7.5 billion, respectively.

Meanwhile, upbeat outlook for cash flow generation by General Motors and Fiat Chrysler boosted investors’ confidence. While General Motors expects $7-$9 billion of positive FCF during the second half of 2020, Fiat Chrysler hasn’t provided any guidance but stated that it expects positive FCF in the second half. Contrarily, Ford has not mentioned anything about its cash flow outlook for the year.

Last Words

In terms of valuation and leverage metrics, clearly Fiat Chrysler has an edge. Investors are also optimistic about the company’s mega merger with PSA Group, scheduled for closure during first-quarter 2021. In addition to financial and operational synergies, the deal will help the combined company to solidity its positions in different markets. Meanwhile, we remain encouraged by General Motors’ upbeat projections for FCF and EBIT. Also, the company is committed toward an all-electric future, which is evident from its strategic partnerships and vertical integration moves. Ford scores better when it comes to liquidity, which is extremely essential in the current economic environment. However, considering all the parameters, we believe that the scale is slightly titled toward General Motors as of now.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Fiat Chrysler Automobiles N.V. (FCAU) : Free Stock Analysis Report

Volkswagen AG (VWAGY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News