Some Bingo Group Holdings (HKG:8220) Shareholders Have Copped A 97% Share Price Wipe Out

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. Imagine if you held Bingo Group Holdings Limited (HKG:8220) for half a decade as the share price tanked 97%. And we doubt long term believers are the only worried holders, since the stock price has declined 73% over the last twelve months. Furthermore, it's down 53% in about a quarter. That's not much fun for holders.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Bingo Group Holdings

Given that Bingo Group Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

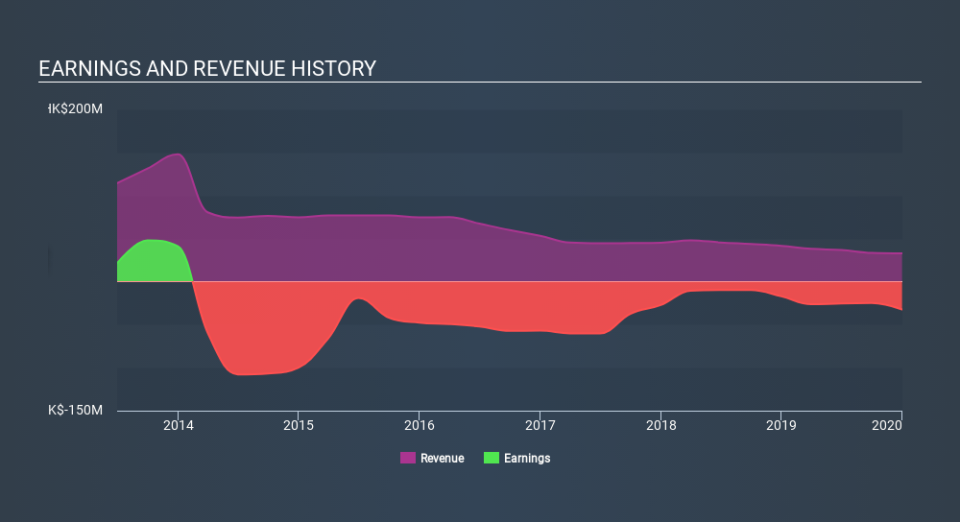

Over half a decade Bingo Group Holdings reduced its trailing twelve month revenue by 18% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 50% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Bingo Group Holdings's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 20% in the twelve months, Bingo Group Holdings shareholders did even worse, losing 73%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 50% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Bingo Group Holdings has 4 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

Of course Bingo Group Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News