Bitcoin (BTC) Falls Again as Bears Target $35,000

Key Insights:

Bitcoin (BTC) fell for a 5th session from 6 on Monday.

News of the Biden crypto executive order’s imminent release tested support for the crypto market.

Risk aversion stemming from Russia’s invasion of Ukraine remains crypto market negative.

On Monday, Bitcoin (BTC) fell for the 5th day in 6. Once more, Bitcoin failed to break through to $40,000. Bitcoin hit a day high of $39,536 before sliding to a day low of $37,192. Finding support at $37,000, Bitcoin wrapped up the day at $38,000 levels.

It was a mixed day for the broader crypto market.

BNB bucked the broader market trend, rising by 1.52%, while ADA (-3.52%) and SOL (-3.42%) struggled.

AVAX (-0.97%), ETH (-2.32%), LUNA (-1.70%), and XRP (-0.57%) also joined Bitcoin in the red.

Bitcoin Fear & Greed Index Hits Reverse

This morning, the Fear & Greed Index hit reverse. Bitcoin’s visit to sub-$38,000 weighed on the Index. Reversing an increase to 23/100, the Index fell back to 21/100 this morning. The pullback left the Index within the “Extreme Fear” zone.

For the Bitcoin bulls, the Index will need to move back through to 54/100 to bring $50,000 levels back into play for Bitcoin. A fall to sub-20/100 would deliver sub-$30,000 levels.

Heightened government and regulatory crypto scrutiny continued to pressure Bitcoin and the broader market. News of the White House planning to issue the heavily awaited crypto executive order tested crypto support on Monday.

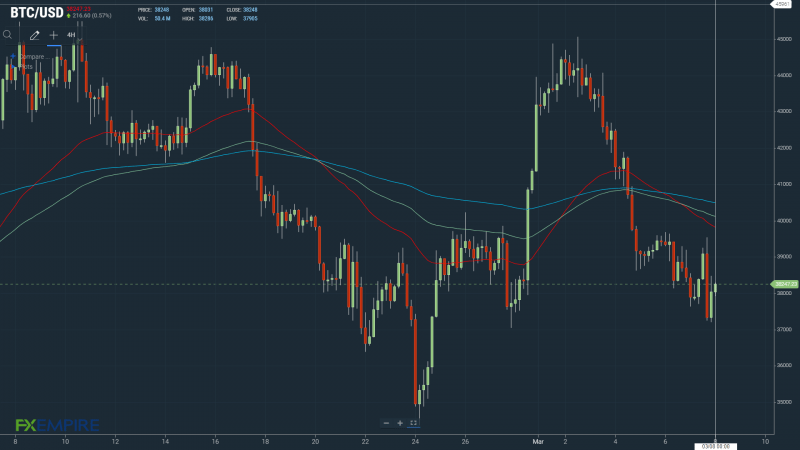

Bitcoin Price Action

At the time of writing, Bitcoin was up by 0.55% to $38,241.

Technical Indicators

Bitcoin will need to move through the day’s $38,253 pivot to make a run on the First Major Resistance Level at $39,317. Bitcoin would need broader market support to move back through to $39,000.

In the event of another extended rally, Bitcoin could test the Second Major Resistance Level at $40,591. The Third Major Resistance Level sits at $42,935.

Failure to move through the pivot would bring the First Major Support Level at $36,967 into play. In the event of an extended sell-off, the Second Major Support Level at $35,916 would likely come into play.

Looking at the EMAs and the 4-hourly candlestick chart (below), it is a bearish signal. Bitcoin continues to sit below the 50-day EMA. Following Sunday’s bearish crosses, we have seen the 50-day EMA pullback from the 100-day EMA delivering more downside pressure.

A move through the 50-day EMA, at $39,800, would provide support.

This article was originally posted on FX Empire

Yahoo News

Yahoo News