Bombardier secures US$669M New Jersey rail contract

After a rough end to 2018 that saw its stock tumble to lows not seen since 2016, Bombardier Inc. began the new year securing a US$669 million contract for a rail project with New Jersey Transit.

The Montreal-based plane and train maker announced Wednesday that it has signed a contract to supply 113 of its Multilevel III commuter rail cars for New Jersey Transit, with an option for up to 886 additional cars. The rail contract, valued at US$669 million, is Bombardier’s third with New Jersey Transit since 2002.

“We are privileged to have been a partner with NJ TRANSIT since 1980 and are pleased to have this opportunity to continue to work together,” Bombardier Transportation’s Americas president Elliot G. (Lee) Sander said in a statement.

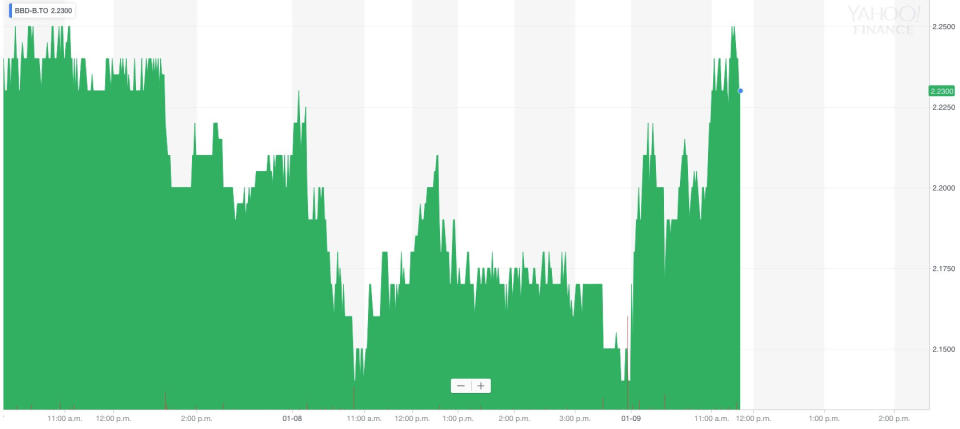

Bombardier’s stock was up nearly 5 per cent on the Toronto Stock Exchange to $2.24 as of 11:10 a.m. ET.

The new contract comes just a few weeks after Bombardier failed to secure a nearly $1-billion order to modernize Via Rail’s service between Quebec City and Windsor. Instead, Via Rail opted to go with German rival Siemens for the $989 million contract and a 15-year technical services agreement worth $23.7 million per year.

At the time, Bombardier Transportation said in a statement that it was “inconceivable” that a contract for a train that will pass “two national capitals” does not generate a maximum of local benefits. The company had claimed that Via Rail twice refused to consider a revised proposal.

Bombardier said the New Jersey contract will yield no additional work in Canada, with Buy American rules prompting Bombardier’s plant in Plattsburgh, N.Y., to build the multi-level cars, rather than its facility in Quebec.

In November, Bombardier’s stock plummeted to a 52-week low following news that the Autorite des Marches Financiers, Quebec’s financial markets regulator, would review transactions related to company’s executive compensation plan. Analysts had described the sell-off as “absurd”, “unjustified” and “irrational.”

With files from the Canadian Press

Download the Yahoo Finance app, available for Apple and Android.

Yahoo News

Yahoo News