Booking Holdings (BKNG) Posts Narrower-Than-Expected Q2 Loss

Booking Holdings Inc. BKNG reported second-quarter 2020 non-GAAP loss of $10.81 per share, which narrowed from the Zacks Consensus Estimate of $11.81 per share. Notably, the company reported earnings per share of $23.59 and $3.77 in the year-ago quarter and prior quarter, respectively.

Revenues of $630 million surpassed the Zacks Consensus Estimate of $517.6 million. However, it declined 84% on reported basis and 83% on constant currency basis. The figure was also down 72.5% from the prior quarter.

The coronavirus pandemic remained the biggest headwind during the second quarter. COVID-19 induced economic shutdowns, social distancing and shelter-in-place restrictions impacted the company’s business operations negatively.

Worsening travel trend and increasing cancellation rate of bookings were primaryfactors that hindered the company’s gross bookings. Notably, the booked room nights number, which was28 million during the reported quarter, plunged86.7% from the prior-year quarter.

Further, Booking Holdings witnessed year-over-year decline of 69.7% and 90.4% in the airline tickets unit and rental car days, respectively,in the second quarter.

Additionally, the company witnessed sluggish agency, merchant and, advertising and other businesses revenues during the reported quarter.

Booking Holdings anticipates this pandemic situation to persist as a major headwind to the global travel industry in the near term.

Coming to price performance, Booking Holdings has lost 13.3% on a year-to-date basis against the industry’s rally of 57.5%.

Nevertheless, the company’s highly variable cost structure and strong liquidity position are expected to help it in navigating through the crisis scenario.

Moreover, the company has started witnessing improvement in its bookings since April in a few countries where stay-at-home restriction has been relaxed.

Top Line in Detail

Booking Holdings generates bulk of revenues from the international markets, wherein the agency model is more popular. This is reflected in the merchant/agency split of revenues, which was 38.9/56.7% in the second quarter (previous quarter’s split was 28.8/62.2%).

Merchant revenues were $245 million, down74.5% year over year.Further, Agency revenues were $357 million, reflecting a decline of86.3% on a year-over-year basis.

Advertising & Other revenues were $28 million (4.4% of total revenues), decreasing90.1% from the year-ago quarter. These are basically non-inter company revenues from Kayak and OpenTable.

Bookings

Booking Holdings’ overall gross bookings totalled $2.31 billion, down90.8% year over year on reported basis. Further, the figure was down 91% at constant currency from the year-ago quarter.

Additionally, gross bookings lagged the Zacks Consensus Estimate of $3.24 billion.

Merchant bookings were $771million, down 88% from the prior-year quarter. Further, agency bookings declined 91.8% year over year to $1.54 billion.

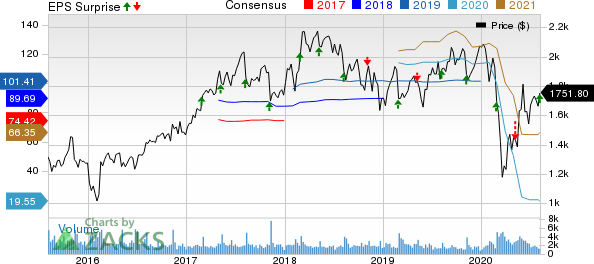

Booking Holdings Inc. Price, Consensus and EPS Surprise

Booking Holdings Inc. price-consensus-eps-surprise-chart | Booking Holdings Inc. Quote

Operating Results

Adjusted EBITDA in the second quarter was ($376 million) against $1.4 billion in the prior-year quarter.

Per management, operating expenses were $1.1 billion, down57.2% on a year-over-year basis.

Further, the company generated operating loss of $484 million againstoperating income of$1.25 billion in the prior-year quarter.

Balance Sheet & Cash Flow

As of Jun 30, 2020, cash and cash equivalents was $10.4 billion, up from $6.4 billion as of Mar 31, 2020.

At the end of the secondquarter, Booking Holdings had $10.6 billion of long-term debt, down from $7.5 billion at the end of first quarter.

During the reported quarter, the company utilized $122 million of cash in operations against $380 million of cash generated from operations in the prior quarter.

Further, free cash flow was $52 million in the second quarter.

Zacks Rank & Key Picks

Booking Holdings currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the retail-wholesale sector are JD.com, Inc. JD, Dollar General Corporation DG and The Kroger Co. KR. While JD.com sports a Zacks Rank #1 (Strong Buy), MercadoLibre and Kroger carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for JD.com, Dollar General and Kroger is currently pegged at 46.79%, 12.5% and 5.5%, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.3% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dollar General Corporation (DG) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News