Budget 2017: The key points on NHS, Brexit and housing as Hammond scraps stamp duty for first-time buyers

Philip Hammond has announced a headline-grabbing move to scrap stamp duty for first-time buyers.

While a lot of measures in his third Budget were tinkering around edges against the backdrop of a tough economic picture, the move to cut stamp duty brought cheers from Tory MPs.

The chancellor said those who talked down the country were wrong – he saw a bright future.

He said the UK had “an economy that continues to grow, continues to create more jobs than ever before and confound those that talk it down”.

This Budget was about “much more than Brexit”, Hammond said.

The world is “on the brink of a technological revolution” and he plans to invest to keep Britain at the forefront of it.

“We choose a balanced approach, continuing to invest in our skills for the future – but also crucially helping families,” he said.

MORE: Stamp duty calculator: how much will you pay?

The key points revealed were:

Housing: Stamp duty abolished for first-time buyers of properties up to £300,000, from today – and also available on first £300,000 for homes valued up to half a million.

This move will benefit 95% of all first-time buyers.

Over next 5 years, £44bn in capital loans and funding guarantees to support market was announced, and to build 300,000 net additional homes a year on average by the mid-2020s.

NHS: Philip Hammond said he recognised the “NHS is under pressure right now”.

To help ease the burden, he said he was giving an extra £2.8bn to the health service in England. Of that, £350m will be for this winter, and then the rest in 2018 and 2019.

He said this comes on top of other funds already announced, meaning a £7.5bn increase in the NHS budget.

However, while he recognised the great work nurses do, he stopped short of announcing anything concrete on pay but did promise to honour any commitment on salaries recommended by an independent pay review.

MORE: Budget 2017: winners and losers

Brexit: Hammond revealed he had already spent £700m in preparations and is setting aside another £3bn for the two years. This government, he says, “expresses its resolve to look forwards not backwards”.

“We choose to run towards change, not from it. The prize will be enormous.”

Public finances: Jokingly referred to the bit with the “long economicky words in it”.

Regrettably, productivity continues to disappoint, he said. Growth is revised down by the Office of Budget Responsibility, so GDP for 2017 is down from 2% to 1.5%; down for 2018 1.6% to 1.4% and hitting just 1.3% in 2019-20.

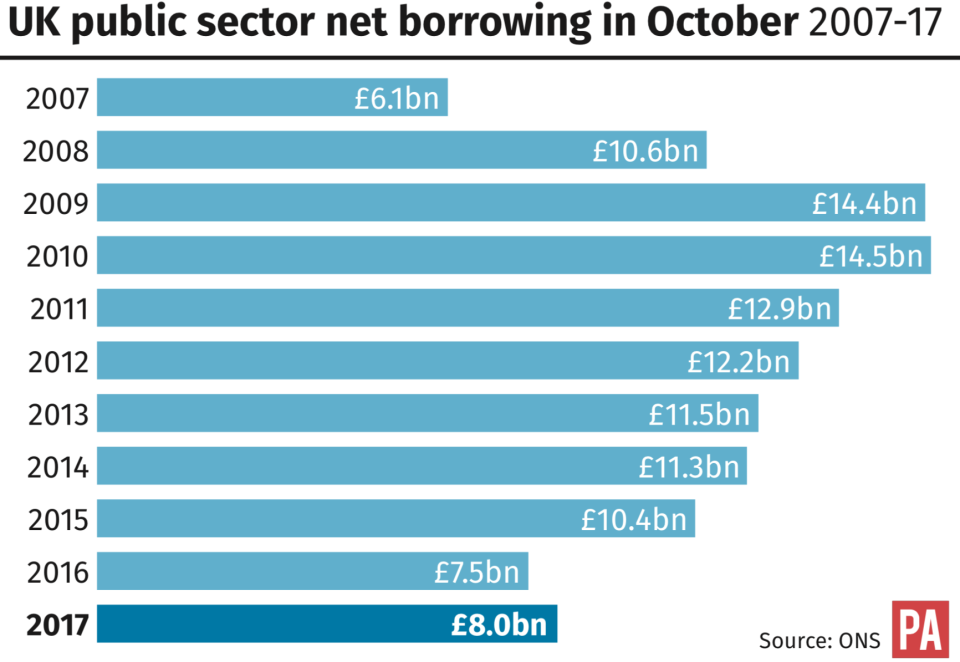

Borrowing forecast for 2017-18 is down from £58.3bn to £49.9bn and in 2018/19 revised down from £40.8bn to £39.5bn.

Hammond said borrowing was predicted to fall in every year of the forecast to reach its lowest level in 20 years by 2022/23.

Paul Johnson, director of the Institute of Fiscal Studies, said the OBR forecasts were “huge change”.

Business: The point at which small businesses pay VAT will be kept at £85,000, the chancellor said. There had been speculation Hammond might lower the threshold to bring it in line with other European countries.

But he told MPs: “I will consult on whether its design could better incentivise growth and in the meantime we will maintain it at its current level of £85,000 for the next two years.”

He also said business rates will be linked to the lower CPI inflation measure, not RPI, from April next year – saving businesses £2.3bn.

Hammond also said he was keen to tackle tax issues in the digital economy. HMRC will start to charge more tax on royalties relating to UK sales of digital companies from April 2019 when those royalties are paid to a low tax jurisdiction, raising about £200m a year.

He also announced a further package to raise £4.8bn by 22/23 through crackdown on tax avoidance and evasion.

Benefits: The chancellor defended the introduction of Universal Credit but said he recognised concerns raised by MPs.

As such, he was removing 7-day waiting time, and a full month’s payment would be given within 5 days of applying, and the repayment period will be upped to 12 months. Housing benefit will be extended by 2 weeks. In all, he said, it was s £1.5bn package to “address the concerns about the credit”.

Personal finance: From April, National Living Wage will rise 4.4%, from £7.50 an hour to £7.83.

From April, the personal tax allowance will rise to £11,850 and the higher rate threshold to £46,350

He confirmed a new railcard, for those aged 26-30, giving 4.5 million more young people a third off their rail fares.

New tech: The chancellor made a big play of putting the UK at the forefront of new tech. He wanted to unlock over £20bn of new investment in UK scale-up businesses, including through a new fund in the British Business Bank, “seeded with £2.5 billion of public money”.

He will also increase the main R&D tax credit to 12%.

This, he said, would take “the first strides towards the ambition of our industrial strategy to drive up R&D investment across the economy to 2.4% of GDP”.

On electric cars – charging at work will not be taxed as a benefit in kind. He announced a £400m electric car charging infrastructure fund, an extra £100m in Plug-In-Car Grant, and £40m for research into charging.

He also restated his desire to see self-driving cars on Britain’s roads – joking that while Grand Tour host Jeremy Clarkson may not like them, he does.

“It’s not the first time Jeremy Clarkson has been snubbed by Hammond and May,” he said, in reference to Clarkson’s co-hosts Richard Hammond and James May.

Diesel cars were hit – from April 2018, the first year Vehicle Excise Duty rate for diesel cars that don’t meet the latest emissions standards will go up by one band. Hammond emphasised it would be for cars only, “white van man and woman” will not be affected.

Plastic tax: He confirmed plans to introduce a tax on single use plastics – such as those used in fast-food outlets. “We cannot keep our promise for the future unless we ensure our planet has a future.”

Yahoo News

Yahoo News