No-deal Brexit recession 'could spark house price crash and decades of flat wages'

A no-deal Brexit will plunge the country into recession, with a “squeeze” on family budgets as the pound’s falling value pushes up prices, the UK government’s budget watchdog warned on Thursday.

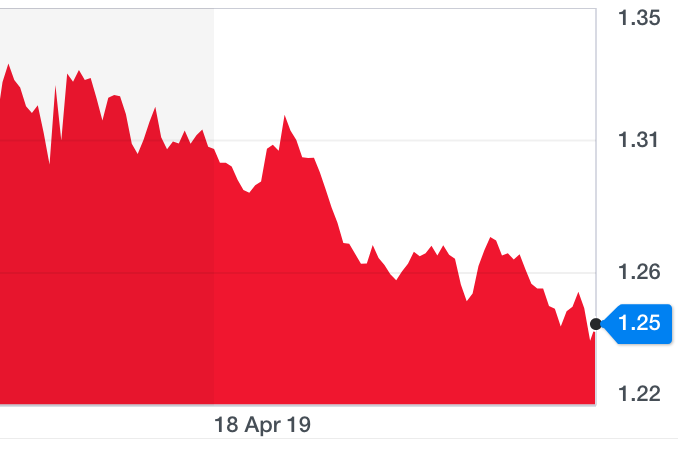

The value of the pound could fall “sharply” and house prices could nosedive 10%, with the cost of imported goods and government debt spiralling, foreign investment sliding and firms that sell to Europe battered by new trade barriers.

The Office for Budget Responsibility (OBR) said the British economy could contract by 2% in real terms by the end of 2020, taking the UK into recession for the first time since the financial crisis a decade ago.

The OBR’s Sir Charlie Bean said Britain could even see 30 years of barely rising real wages, with the next two decades continuing a trend of “stagnant” incomes struggling to rise above inflation since the financial crisis.

READ MORE: ‘Grim time’ for holidays as Brexit fears send pound sliding

The value of the pound has nosedived already in recent weeks as fears grow Boris Johnson, favourite to be the next UK prime minister, could take Britain out of the EU without a deal.

Johnson has repeatedly failed to rule out suspending parliament, which has voted several times against a no-deal Brexit.

The former London mayor and foreign secretary, who appears increasingly unwilling to compromise to secure a smoother Brexit deal and transition period, could be unveiled as his party’s leader and prime minister-in-waiting on Tuesday.

“Heightened uncertainty and declining confidence deter investment, while higher trade barriers with the EU weigh on exports,” Thursday’s OBR report warned.

“Together, these push the economy into recession, with asset prices and the pound falling sharply. Real GDP falls by 2% by the end of 2020 and is 4% below our March forecast by that point.”

Sterling’s fall — as well as new EU and UK tariffs as Britain leaves the single market — would both spark inflation and hit consumers’ pockets, according to the OBR.

But the budget watchdog said the Bank of England could temporarily allow inflation to rise. The BoE, according to the OBR, “is able” to cut the cost of borrowing to keep businesses and consumers spending and investing.

READ MORE: Boris Johnson’s Brexit plans could ‘gamble away’ UK reputation for business

The hit to the public finances would add around £30bn a year to government borrowing from 2020-21, and 12% of GDP to net debt by 2023-24, the OBR said.

The forecast is the latest in a long line of warnings from experts and businesses about the potentially devastating consequences of a no-deal Brexit. Thursday’s analysis is from one of the most authoritative voices yet on the issue.

But the forecaster said its prediction is “by no means” a worst-case scenario. The Bank of England’s forecasts included a larger downturn and loss of potential output from a disorderly Brexit.

The watchdog even calls its own forecast “relatively benign” compared to others, as it assumes border disruptions will be limited and only a short-term problem.

Britain has recently been through a period of weak growth, but has not faced a recession — defined as two quarters in a row of economic contraction — since the financial crisis a decade ago. The last recession before that to hit the UK was in the early 1990s.

The OBR was set up in May 2010 to guarantee independent fiscal forecasts free from real or suspected political interference. Thursday’s report includes the estimates in its “stress test” of the UK’s public finances, the Fiscal Risks Report 2019.

The reports are commissioned by parliament to analyse the medium- and long-term risks to the public finances.

“No MP with any insight into the dark misery a recession causes should allow no deal,” Neil Foster of the GMB trade union tweeted.

“It’s sudden unemployment, debt, house repossessions, mental & physical ill-health & risk of family breakdown. Back in 2016 people wanted things to get better not worse. MPs must rule out no deal.”

Britain’s chancellor Philip Hammond also warned recently a no-deal Brexit could cause a £90bn hit to the UK’s coffers, with the damage to the economy battering tax receipts.

The chancellor suggested on Thursday that “prominent Brexiteers” — taken as a reference to Boris Johnson — would pursue a harder Brexit that caused "much more disruption" and a worse recession than the one forecast by the OBR.

The OBR report also seemed to tick off the Treasury over the government’s spending plans on the NHS.

“The £27bn a year NHS settlement announced in June 2018 — unfunded, unaccompanied by detailed plans for reform and outside the normal timetable for spending decisions — has cast doubts over the Treasury’s usually firm grip on departmental spending,” the report said.

Yahoo News

Yahoo News