Business rates are a good tax – the Government should stick to its guns and revalue

Who will defend business rates? They’re one of the most unpopular taxes in the country, because they seem so high and don’t discriminate between small high street shops and out-of-town warehouse retailers like Amazon.

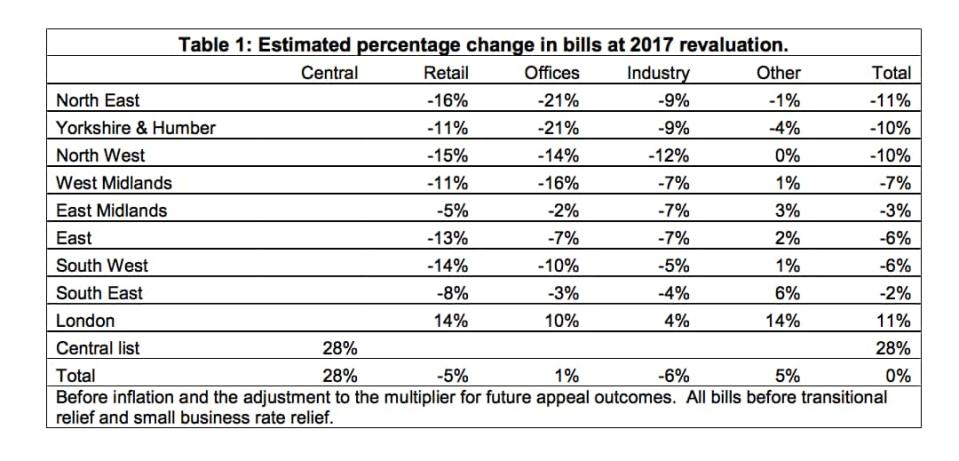

This year’s revaluation threatens to raise rates for London overall while cutting them everywhere else. It would be a revenue neutral change, but loss aversion means the businesses that will lose out are protesting much more loudly than the ones that stand to gain.

But economists, left and right, tend to think of business rates as a very good tax. Even though it’s businesses that write the cheque, they say, it’s landlords who actually pay business rates. When rates go up, rents go down by the same amount, and vice versa.

That sounds improbable to most people. But there’s actually quite a lot of evidence that it’s true.

When business rates were introduced in their current form in 1990, replacing a myriad of local property taxes, rents gradually adjusted to price in the new rates. Places that saw their rates burden rise fell in value, and places that saw their burdens fall rose in value. There is other evidence that this is the case, and the IFS argues that the incidence is mostly on landowners in the long run.

Why might this be? For most goods, the price is set by the supply and demand for that good. But when the supply is fixed the price is entirely determined by demand – the highest amount someone is willing to pay for it.

There are 1,885 Picasso paintings in the world, and we’re not getting any more of them, so the price of one is entirely determined by what someone is willing to pay for it.

The supply of land really is fixed, and the supply of commercial real estate is so tightly held back by restrictive planning laws that we’d expect something similar to hold when business rents are being set: the rental value of a property is whatever the highest bidder is willing to pay.

And since rates are a part of the cost of renting somewhere, businesses will factor that in to their calculation of how much they’re willing to spend on that location.

The total cost of occupying the building or shop space is what matters, and how much of that is made up by rent and how much by rates isn’t relevant to them. When the amount they have to spend on rates rises, the amount they are willing to spend on rents falls. When rates fall, the amount they can spend on rents rises. Well, in the long-run, anyway: it takes some time for rents to adjust in this way.

According to research by the British Property Federation, based on evidence from five revaluations between 1990 and 2010, it takes about three years for 75% of the rental adjustment to take place. Three years can be a long time for a firm to cope.

There are a few ways we could deal with this problem. One is to have transitional reliefs, giving direct support to businesses caught with a higher bill for the transitional years. This is what we do at the moment, although the system is quite oddly run on the basis of property sizes instead of property values.

A better approach might be to announce the rise a few years in advance, so rents could adjust in time for the introduction. This would give businesses more warning so they could adjust the amount they were willing to pay in rents before the rates rise actually kicked in. The problem with this is that, as we’ve seen, governments are easily bullied out of actually implementing revaluations.

There are other problems with rates. They’re a tax on property values, not on land values alone. That means that landlords or businesses are punished for investing in their properties. If there are ways to estimate the value of the land alone, and levy rates on that, we will stop discouraging improvements to buildings.

We also discourage landowners from using their land for business instead of housing, because council tax (which also falls on rental values) is so much lower than rates.

And let’s be realistic about the politics. Most people will never accept the economic case that business rates fall on landlords, not businesses. As long as businesses are writing the cheques, most people will think the tax falls on business. If we replace rates with a ‘landlord tax’ the economic change would be cosmetic but the politics of revaluations could become a lot easier.

One thing that isn’t a flaw in rates is that they apply indiscriminately to successful and unsuccessful businesses alike. Ideally, we want taxes to be as blind as possible to firms’ success, just as electricity and rental bills are. Taxing well-off businesses more than struggling ones keeps unviable firms around for longer and discourages investment by lowering the rewards for success.

Remember that under the government’s plans London is the only region that would see a rise in rates overall – everywhere else would see a fall. Even though most of the benefits would pass to landowners, the changes would encourage greater property investment in the country outside of London. If the revaluation doesn’t go ahead, then next time the adjustments might be even bigger, making changes even more difficult.

Unless we’re content to freeze rates across the country forever, benefiting London and hurting the rest of the UK, we should hope the government has the will to ignore the special interests and push ahead with this revaluation – or replace rates altogether with something politically easier to manage sensibly.

Business rates changes - postcode

Sam Bowman is executive director of the Adam Smith Institute

Yahoo News

Yahoo News