Who Has Been Buying SalMar ASA (OB:SALM) Shares?

We often see insiders buying up shares in companies that perform well over the long term. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So shareholders might well want to know whether insiders have been buying or selling shares in SalMar ASA (OB:SALM).

What Is Insider Selling?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, most countries require that the company discloses such transactions to the market.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But equally, we would consider it foolish to ignore insider transactions altogether. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.

See our latest analysis for SalMar

The Last 12 Months Of Insider Transactions At SalMar

Over the last year, we can see that the biggest insider purchase was by Chief Operating Officer of Farming Roger Bekken for kr2.4m worth of shares, at about kr397 per share. So it's clear an insider wanted to buy, even at a higher price than the current share price (being kr332). It's very possible they regret the purchase, but it's more likely they are bullish about the company. In our view, the price an insider pays for shares is very important. As a general rule, we feel more positive about a stock if insiders have bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price.

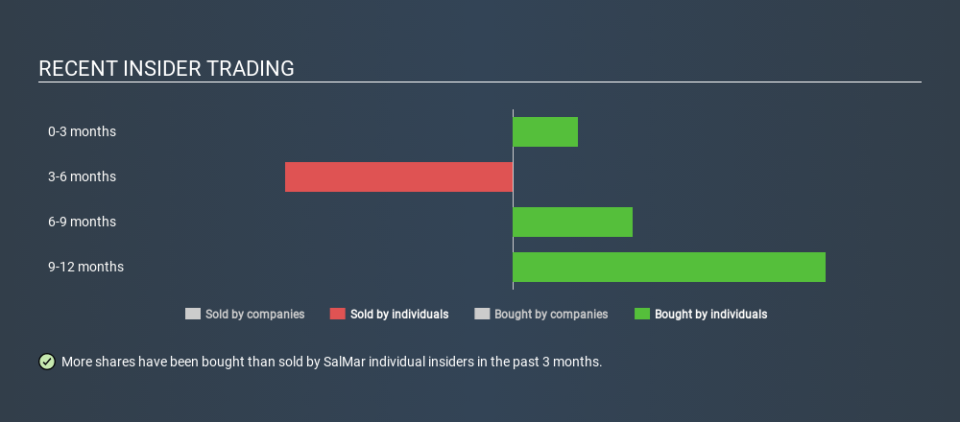

Happily, we note that in the last year insiders paid kr3.9m for 9.55k shares. On the other hand they divested 4370 shares, for kr1.8m. In the last twelve months there was more buying than selling by SalMar insiders. You can see the insider transactions (by individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

SalMar is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insiders at SalMar Have Bought Stock Recently

We saw some SalMar insider buying shares in the last three months. COO & CFO Trine Romuld bought kr496k worth of shares in that time. It's great to see that insiders are only buying, not selling. But in this case the amount purchased means the recent transaction may not be very meaningful on its own.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. We usually like to see fairly high levels of insider ownership. Our data suggests SalMar insiders own 0.04% of the company, worth about kr16m. We prefer to see high levels of insider ownership.

So What Do The SalMar Insider Transactions Indicate?

It's certainly positive to see the recent insider purchase. And the longer term insider transactions also give us confidence. Given that insiders also own a fair bit of SalMar we think they are probably pretty confident of a bright future. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Case in point: We've spotted 2 warning signs for SalMar you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News