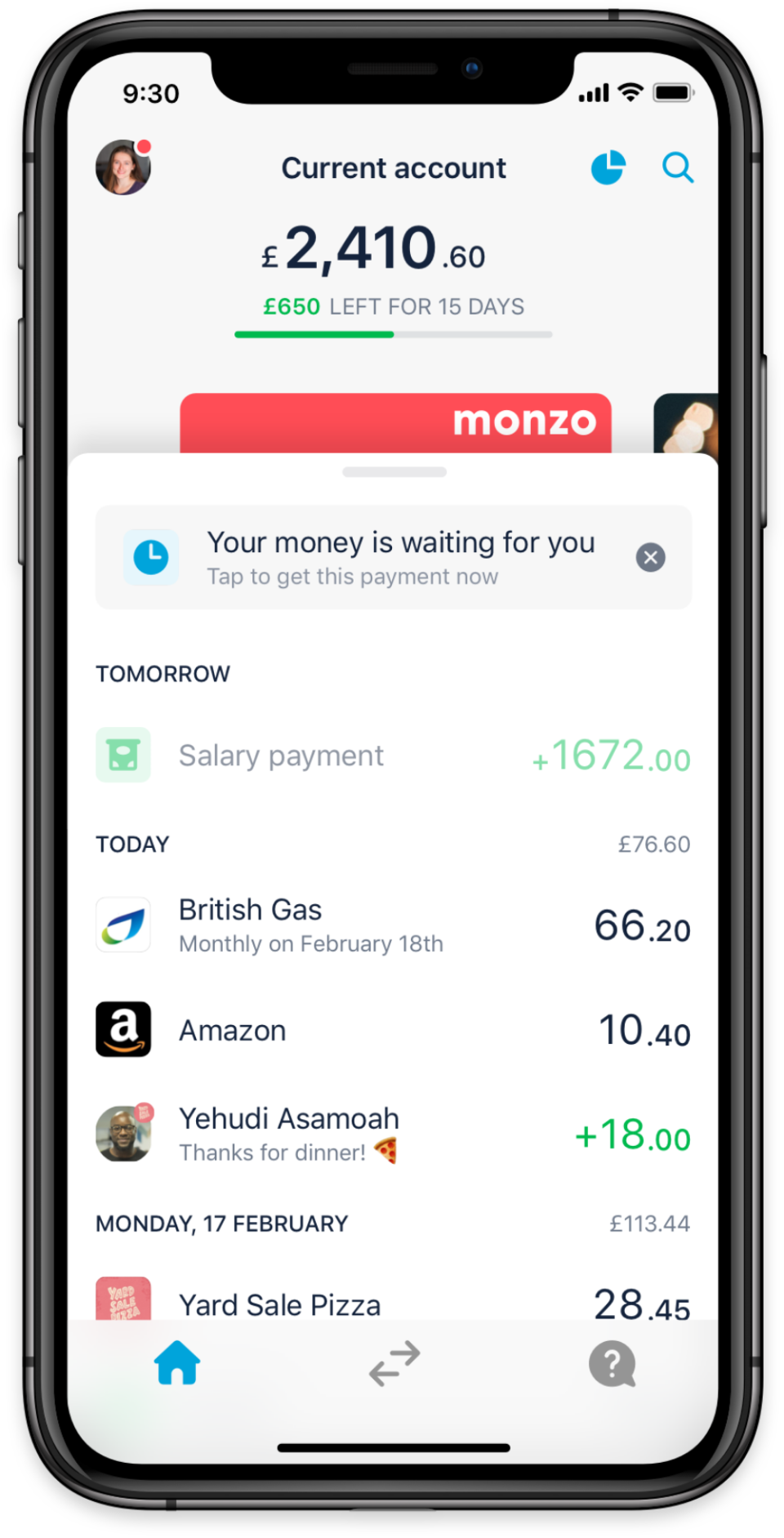

Cash flow problem? Monzo’s new feature will pay your salary a day early

Challenger bank Monzo’s two million+ customers will be delighted to hear about the bank’s new feature, ‘Get Paid Early’.

Using the new feature, if you receive a salary payment via BACS credit (which 90 per cent of the UK population do), the payment will come into a customer’s account at 4pm the day before they get paid, instead of at midnight. Monzo is able to offer it because it can be confident the money will actually arrive into your account because it can see the money coming into the system.

All banks have access to this information so could technically advance the money at this point as well, however, they choose not to.

The new feature is rolling out today and is opt-in so you don’t have to take advantage of it if you don’t want to. But with many Brits relying on credit cards and overdrafts to get through the month, it’s at least a way to help people breathe easier a day earlier.

Read more

The challenger bank working to give bank accounts to UK's homeless

It’s also a savvy move by Monzo to encourage more customers to use its current account as their sole bank account by getting their salary paid in. As the bank launched its signature hot coral cards as prepaid Mastercards, many people came to Monzo by using it as a secondary account. The challenger officially shut down its prepaid programme last April, moving everyone over to a current account.

Monzo isn’t the only fintech trying to tackle the problem of pre-payday financial difficulties. London-based start-up Wagestream, which was recently named as one of WIRED’s hottest European startups, allows employees to receive a proportion of their earned salary part way through the month, in order to prevent staff being pushed by unexpected bills and expenses towards payday lenders.

Read more

London gets another fintech unicorn as Monzo reaches £1 billion

Wagestream charges the employer £1.75 per transaction and charges employers who use the service a fee of between £1 or £2 per employer, depending on the workforce. Around 50 per cent of Wagestream’s users access the service in order to pay bills, whilst the majority of customers don’t use it monthly - instead, they view it as a security blanket to use “as needed”.

Wagestream’s CEO and co-founder Peter Briffett thinks Monzo’s feature is a nice idea but it can be too late for most people, as the majority of payday loans are taken between four to eight days before payday, not the day before. “What employees really need is the ability to ‘income stream’ or access accrued earnings any day of the month. Income streaming is the next big revolution in pay and there’s one simple reason for that — people are fed up of having little control over money they have already earned,” he told the Standard.

Read more

Read more The challenger bank working to give bank accounts to UK's homeless

Yahoo News

Yahoo News