China could be on the verge of stoking its financial fire even further

REUTERS/China Daily

Recent Chinese economic data has undershot expectations, leading to speculation that China’s central bank may take steps to support activity levels.

RBC Capital Markets thinks the bank is likely to cut a critical ratio for Chinese lenders, which would be a loosening of monetary policy.

In a working paper released on Tuesday, the People's Bank of China said the reserve requirement ratio should be cut to “ease burdens on financial institutions and smooth the interest rate transmission mechanism”, fuelling speculation that it could arrive imminently.

While financial markets have been focused on mounting trade tensions between the United States and China over the past week, thinks there may be a more pressing issue.

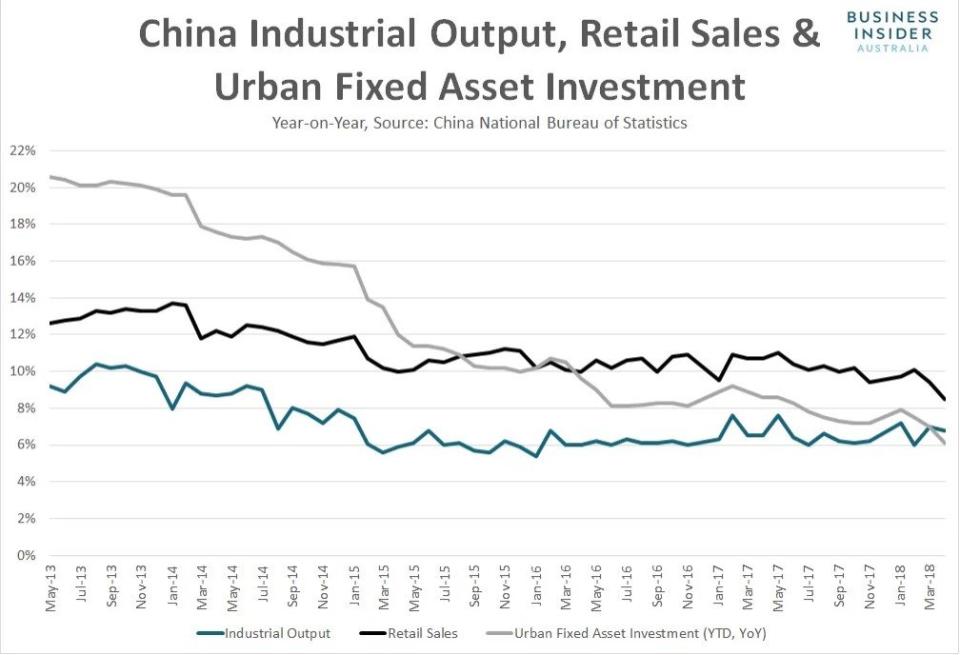

Lost in the trade war headlines, China’s latest batch of economic activity indicators were pretty weak in May.

Industrial output, retail sales and urban fixed asset investment growth all undershot market expectations by some margin, especially the latter two, which recorded the weakest annual growth in well over a decade.

China National Bureau of Statistics

After beating frequently in 2017 and in the early parts of this year, the spluttering performance has cast doubt over the outlook for the Chinese economy in the second half of the year.

Adding to concerns, in the same week that the US Federal Reserve lifted short-term borrowing costs, the People’s Bank of China (PBoC) didn’t follow suit by hiking its key reverse repo rate (RRR), breaking with tradition following Fed policy tightening in the past.

To Su-Lin Ong, Chief Economist and Head of Australian Research at RBC Capital Markets, these developments are important.

“Downside risk to the stated 6.5% growth target for this year is emerging,” she said in note to clients.

“High frequency data in China have disappointed in recent months consistent with a loss of momentum evident in the easing in the PMI data, weaker activity proxies including retail sales and industrial production, and, abstracting from some volatility, static CPI.”

Given the recent substandard data, at least compared to China’s usual lofty standards, along with the reluctance from the PBoC to follow the Fed’s lead last week, Ong says it suggests that monetary conditions and credit are already tight, potentially signalling that Chinese policymakers may need to deliver additional monetary policy easing in an attempt to shore up economic growth.

“Our FX strategists note that the Chinese government has already been pulling on both monetary and fiscal levers to ease conditions in recent months [such as a] targeted reserve requirement ratio (RRR) cut to small businesses, an expansion of collateral products for borrowing, tax exemptions and accelerated fiscal expenditure under the directive of the Ministry of Finance,” she says.

“Accordingly, they expect a general RRR cut of at least 100 basis points sooner rather than later with the likelihood of several moves in the second half of the year.”

The RRR simply sets the minimum amount of customer deposits, expressed as a percentage, that each commercial bank must hold in reserves. By cutting the RRR for lenders, it releases money into China’s financial system.

Based on recent commentary from the PBoC, RBC’s FX strategists may well be right.

In a working paper released by the PBoC on Tuesday, it said the RRR should be cut to “ease burdens on financial institutions and smooth the interest rate transmission mechanism”.

“While financial market risks have been effectively released, banks’ capital adequacy and reserves face obvious constraints,” the paper said.

Should the recommendation from the bank be followed up by an actual cut to the RRR for lenders, Ong says it will likely help to support near-term growth to the detriment of longer-term financial stability concerns.

“We view further and more broad-based policy action in response to the moderation in Chinese activity and tighter conditions as likely to be positive for near-term growth although, consistent with past action of recent years, likely adds to the imbalances and medium risks around financial and macro stability,” she says.

“The trade-off between growth and reform has, almost always, firmly flavored growth in recent years with policy action taken to shore up activity, incomes and overall living standards.

“Accordingly, the leverage and debt continues to rise building greater macro and financial risks medium term.”

Trade tensions notwithstanding, the closer integration of China’s financial system with those of advanced economies, and the depth of the trade links between China and the rest of the world, has made Beijing’s maintenance of financial stability a top concern for policy-makers around the world.

In a speech last month, Reserve Bank of Australia (RBA) Governor Philip Lowe described the challenge facing Chinese policymakers as a “very significant task.”

“It is too early to tell whether the authorities will be successful in managing the transition from a growth model heavily dependent upon the accumulation of debt to one where credit is less central,” Lowe said.

“China’s challenge is made more complicated by the dual nature of the task to bring down debt levels while also reconfiguring the financial system so as to better meet the needs of the people. There are pressing needs to make financing more widely available to small and medium enterprises, to strengthen the pension system to bolster retirement incomes, to increase transparency and reduce implicit guarantees associated with local government and SOE borrowing.

“So there is still a lot to be done.”

Suggesting that speculation of RRR cut is gathering steam, Chinese stocks staged a dramatic turnaround on Wednesday, reversing losses of more than 1% in the second half of the session.

There’s likely to be plenty of eyes on the PBoC in the days ahead.

NOW WATCH: Why American actors suck at British accents

See Also:

Yahoo News

Yahoo News