China's industrial growth slumps to weakest rate in over 17 years

Growth in China’s industrial production slumped last month to its weakest rate in more than 17 years as US import tariffs and softening domestic demand took their toll on factory owners.

Measures of retail sales and investment also reinforced concerns that the world’s second largest economy would need to make further cuts to interest rates to boost growth after moves last week by its central bank to ease lending restrictions were criticised by some analysts as “too little, too late”.

Industrial output growth slowed to 4.4% in August compared with the same month a year earlier, down from 4.8% in July, to register the slowest pace of expansion since February 2002.

Premier Li Keqiang is understood to be concerned that a strategy of bringing down carbon emissions to meet climate targets is hurting factory output just as domestic and global demand is slowing.

The situation has worsened in the last year as Donald Trump expanded the number of goods caught by US import tariffs on Chinese products

Related: If China's economy crashes Australia will be hit hard, report says

Chinese companies have responded by cutting production and repatriating investments in the US, while seeking outlets in other markets for their goods.

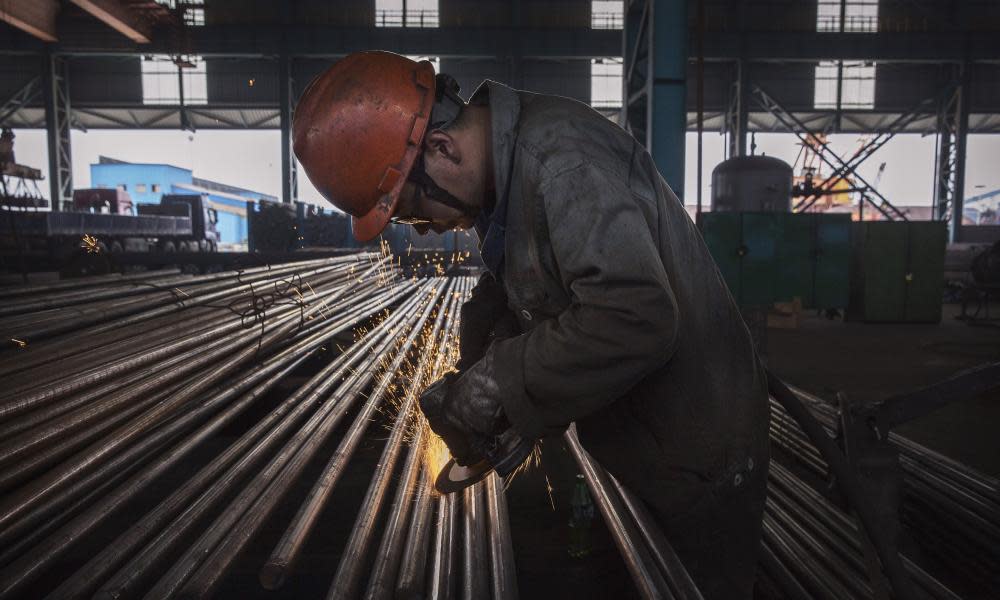

“The whole manufacturing sector is affected by the trade war. Production and sales of vehicles and home appliances have been plunging,” said Richard Lu, an analyst with CRU in Beijing. He said steel firms had also underperformed due to rising raw material costs.

Li said it was very difficult for the economy to grow at 6% or more and that it faced downward pressure.

Retail sales missed expectations, with growth easing to 7.5%, from 7.6% in July. Car sales continued a year-long slide, dragging down the overall sales figures.

Capital investment was another weak spot, dropping to 5.5% growth over the first eight months of the year from the same period in 2018, down from the 5.7% of the period between January and July.

Analysts Wei Yao and Michelle Lam at Société Générale said the lowering of the reserve requirement ratio (RRR) by the central bank – the People’s Bank of China (PBoC) – allowed banks to lower their reserves, freeing up more funds for lending.

But the move is likely to be followed by more straightforward interest rate cuts. “Given the latest data, the rate cut last week now just seems a case of ‘too little, too late’,” they said.

“Before the data came out we thought that one interest rate cut and one RRR cut in one month might be seen as too desperate. But now, we think that even a [small] rate cut tomorrow could look timid. A clear signal that the PBoC wants lower interest rates is all but necessary now,” they added.

Several analysts said in recent weeks that China’s economic growth was already testing the lower end of Beijing’s full-year target of about 6%-6.5%, which is likely to spur more policy easing. Second-quarter growth cooled to 6.2%, the weakest in nearly 30 years.

Louis Kuijs, head of Asia economics at Oxford Economics, said: “The key downside risk is the authorities not stepping up policy support sufficiently.”

There is the prospect that Beijing will be forced to increase spending to supplement cuts in interest rates after figures showed that China’s monthly crude steel output appeared to artificially boost overall production in August.

Steel mills boosted output ahead of production cuts expected to kick in by October as part of Beijing’s anti-pollution drive.

Total crude steel production was 87.25m tonnes last month, data from the National Bureau of Statistics showed, up 2.4% from 85.22m tonnes in July and up 9.3% from a year earlier.

Yahoo News

Yahoo News