Is Citigroup’s Stock a Buy for Value Investors?

Over the past year, shares of Citigroup (NYSE: C) have climbed 47%. That's more than double the return on the S&P 500, and it comfortably exceeds other big banks as well, with the KBW Bank Index returning 38% since this time last year.

Given this performance, it's reasonable for investors to ask: Is Citigroup's stock still a buy for value investors?

The top of the Citigroup building in London's Canary Wharf. Image source: Getty Images.

Citigroup's price-to-book value ratio

The conventional way to measure a bank stock's valuation is to use the price-to-book value ratio. You calculate this by dividing a bank's price per share by its book value per share. This tells you how much investors think a bank is worth relative to how much the bank says its worth on its balance sheet.

If a bank has a price-to-book value ratio higher than 1.0, it's said to trade for a premium to book value. The implication is that investors think the bank will create value beyond its current net worth.

Conversely, a bank priced below its book value per share is said to trade at a discount to book value. This suggests that investors expect the bank's value to erode -- as a consequence of loan losses, for instance.

Data source: YCharts.com. Chart by author.

In Citigroup's case, its stock trades for 0.93 times its book value per share. That equates to a 7% discount to book value.

Citigroup comes across as reasonably priced based on this. The average bank stock on the KBW Bank Index is valued at 1.41 times its book value, or well above the $1.8 trillion bank.

One could thus be excused for concluding that Citigroup's stock is still a bargain, at least compared to other bank stocks, despite the fact that it has climbed 47% in 12 months.

Citigroup's price-to-earnings ratio

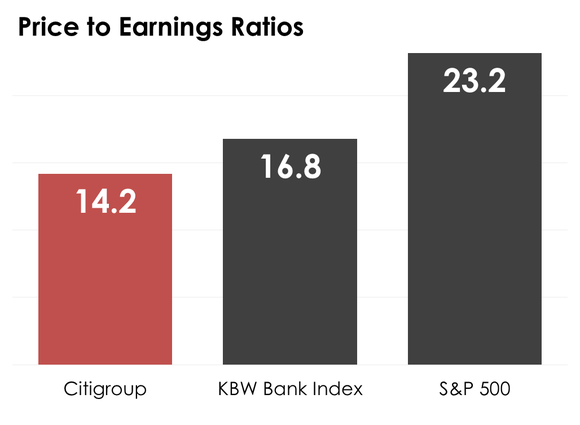

A second way to capture a bank stock's valuation is to use the price-to-earnings ratio, or P/E ratio. This is calculated by dividing a bank's share price by its earnings per share.

You can interpret the P/E ratio like this: It calculates how much it costs an investor to buy $1 worth of a company's earnings. If the P/E ratio is 35, then it costs $35. If the ratio is eight, it costs $8.

There is no set threshold for what constitutes a good P/E ratio for a bank stock. That said, you can compare a bank's P/E ratio to other stocks, both within the bank industry and outside of it. This is a key benefit of the P/E ratio over the price-to-book value ratio.

*The median was used for the KBW Bank Index and the S&P 500. Data source: YCharts.com, The Wall Street Journal. Chart by author.

In Citigroup's case, its stock trades for 14.2 times its earnings. That compares to a median P/E ratio on the KBW Bank Index of 16.8 and a median ratio on the S&P 500 of 23.2.

By both measures, then, Citigroup's stock seems reasonably priced, at least on a relative basis.

An important caveat

It's important to appreciate that just because Citigroup's stock trades at a lower valuation than the typical bank stock in terms of the price-to-book value and price-to-earnings ratios doesn't mean that its share price won't fall in the future, even by a large margin, because it can.

This is especially true right now, given the multiyear bull market in equities since the financial crisis. But holding all else equal, if you're going to buy a bank stock in this environment, it wouldn't hurt to buy one that's selling at a discount to others, as Citigroup's is.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

NVIDIA Scores 2 Drone Wins -- Including the AI for an E-Commerce Giant's Delivery Drones

John Maxfield has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo News

Yahoo News