Conagra (CAG) Tops Q1 Earnings Estimates, Hikes Dividend

Conagra Brands, Inc. CAG posted robust first-quarter fiscal 2021 results, with the top and the bottom line surging year over year and beating the Zacks Consensus Estimate. Results were backed by increased organic sales, which in turn benefited from higher at-home consumption driving Conagra’s retail business. This also helped the company offset softness in the Foodservice segment, wherein sales fell due to COVID-19.

Quarter in Detail

Conagra’s quarterly adjusted earnings came in at 70 cents, which surpassed the Zacks Consensus Estimate of 57 cents. Moreover, the figure jumped 62.8% from the year-ago quarter. The year-over-year growth can be attributed to increased adjusted net income, higher gross profit as well as reduced SG&A expenses. Adjusted EPS was somewhat affected by greater average shares outstanding.

Conagra generated net sales of $2,678.9 million, which advanced 12.1% year over year and beat the Zacks Consensus Estimate of $2,604.5 million. The year-over-year sales growth was backed by higher organic sales partly offset by the divestiture of Sold Businesses and adverse currency movements.

Organic sales increased 15% on higher volumes and favorable price/mix. Volumes were aided by elevated at-home consumption amid the coronavirus pandemic, which in turn boosted Conagra’s retail business but hurt the Foodservice segment. Also, price/mix was favorable in the quarter.

Adjusted gross profit jumped 21.7% to $823 million, while adjusted gross margin expanded 244 basis points to 30.7%. This can be attributed to higher sales, productivity related to supply chain, favorable margin mix, fixed cost leverage and cost synergies from Pinnacle Foods’ buyout. These were somewhat countered by costs associated with COVID-19, adverse impacts of unfavorable currency rates as well as profit that was lost from Sold Businesses.

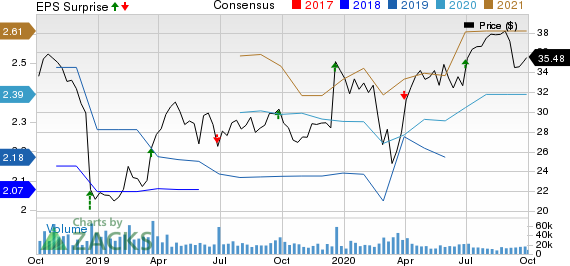

Conagra Brands Inc. Price, Consensus and EPS Surprise

Conagra Brands Inc. price-consensus-eps-surprise-chart | Conagra Brands Inc. Quote

Segmental Details

Grocery & Snacks: Quarterly sales in the segment came in at $1,134.2 million, which increased 16% year over year owing to higher organic sales, partially hurt by divestiture of Sold Businesses. Organic sales increased 20.7% with volumes and price/mix up 17.2% and 3.5%, respectively. Volumes rose owing to consumers’ higher at-home consumption and customer inventory replenishment.

Refrigerated & Frozen: Net sales advanced 17.9% to $1,130.6 million due to the same factor that drove the Grocery & Snacks segment’s sales. Organic sales rose 19%, with volumes up 12.8% and price/mix growth of 6.2%. Higher consumption at home and replenishment of customer inventory boosted volumes.

International: Net sales rose 7.2% to $219 million on account of higher organic sales, offset by unfavorable currency movements. On an organic basis, net sales rose 13.1%, as volumes increased 10.5% and price/mix was up 2.6%. This was backed by higher demand amid the pandemic. All the regions in which the company operates witnessed considerable growth.

Foodservice: Quarterly sales in the segment declined 21.8% year over year to $195.1 million due to Sold Businesses and lower organic sales. Organic sales fell 20.3%, with volumes down 24.2% but price/mix up 3.9%. Volumes were hurt by reduced restaurant traffic amid the pandemic.

Other Updates

Conagra exited the quarter with cash and cash equivalents of $438.2 million, senior long-term debt (excluding current portion) of $8,897.6 million and total stockholders’ equity of $8,199 million. During 13-weeks ended Aug 30, the company generated net cash of $284.5 million from operating activities.

During the quarter, Conagra paid out a quarterly dividend of 21.25 cents per share. The company is on track with its de-leveraging goals and has lowered its total gross debt by more than $1.9 billion since it concluded Pinnacle Foods’ buyout through the end of the first quarter. As of the end of the first quarter of fiscal 2021, the company’s net debt to last twelve month’s adjusted EBITDA ratio was 3.7x. Management expects to achieve its 3.5x-3.6x target by the end of the third quarter of fiscal 2021.

In a separate press release, Conagra announced a dividend hike. It will now pay out a quarterly dividend of 27.50 cents per share, up 29% from the prior rate. The hiked dividend will be paid out on Dec 2, 2020 to shareholders of record as of Nov 2. Notably, the new rate takes the company’s annualized dividend to $1.10 per share.

On Sep 28, 2020, the Company entered into a definitive agreement to offload its H.K. Anderson business to Utz Quality Foods, LLC. The deal is expected to be closed by the second quarter of fiscal 2021.

Guidance

Management is uncertain about the impact of coronavirus on Conagra’s fiscal 2021 performance. Keeping this in mind, management did not offer any guidance for fiscal 2021.

Nonetheless, the company continued to see a considerable increase in demand in the retail business in the second quarter of fiscal 2021, to date. However, demand for foodservice products continues to be lower than the pre-pandemic level. Additionally, costs associated with the pandemic have been impacting Conagra’s business.

Considering these factors and assuming a smooth supply chain, management expects organic sales growth of 6-8% in the second quarter of fiscal 2021. Adjusted operating margin is likely to be 18-18.5%, while adjusted earnings per share (EPS)are envisioned between 70 cents and 74 cents.

Apart from this, management reiterated its targets for fiscal 2022. Organic net sales are anticipated to grow 1-2% (three-year CAGR ending fiscal 2022). Adjusted operating margin is expected in a range of 18-19% and adjusted EPS for fiscal 2022 is likely to be between $2.66 and $2.76.

Shares of this Zacks Rank #3 (Hold) company have gained 4.3% so far this year against the industry’s decline of 6.2%.

Solid Food Stocks

Flowers Foods FLO, with a Zacks Rank #2 (Buy), has a trailing four-quarter earnings surprise of 8.2%, on average.You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

TreeHouse Foods THS, with a Zacks Rank #2, has a long-term earnings growth rate of 7.7%.

General Mills GIS, with a Zacks Rank #2, has a long-term earnings growth rate of 7.5%.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, SherazMian hand-picks one to have the most explosive upside of all.

With users in 180 countries and soaring revenues, it’s set to thrive on remote working long after the pandemic ends. No wonder it recently offered a stunning $600 million stock buy-back plan.

The sky’s the limit for this emerging tech giant. And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Conagra Brands Inc. (CAG) : Free Stock Analysis Report

General Mills, Inc. (GIS) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News