CONSOL Takes Steps to Preserve Liquidity, Withdraws Guidance

CONSOL Energy CEIX announced that it has taken certain actions to preserve liquidity, reduced outstanding indebtedness and created supplement access to capital amid the unprecedented economic distress created by the outbreak of novel coronavirus.

The company has retired more than $50 million in principal, with no material change in liquidity, from year-end 2019. It has enhanced liquidity by closing a sale-leaseback transaction on a set of longwall shields, which provided the company with net cash proceeds of $16.3 million. CONSOL has also amended the Accounts Receivable securitization program, extending the maturity to March 2023 from August 2021, while keeping the size of the facility at $100 million.

COVID-19 has a growing impact on the global economy. While the economic impact of the novel coronavirus is yet to be fully ascertained, one thing is certain that it will take time to bring businesses back to pre-pandemic levels. In view of this, CONSOL decided to withdraw its previously announced operational and financial guidance for 2020.

Thousands of coal miners across the United States are risking their safety to produce coal, which is utilized by utilities to produce electricity. Despite utmost care, risks of coronavirus infection remain among workers, which could result in forced shutdown of coal mining operation. Recently, CONSOL idled the thermal coal mine in Pennsylvania after two workers tested positive for coronavirus.

Coal Countering COVID-19 Impact

One of the ways to fight against the virus is to follow the social distancing guidelines and stay indoors. As a consequence, demand for electricity is declining in both the commercial and industrial sectors. Utility operators are adjusting their production capacity by lowering production from fossil fuel units, especially coal-fired generation units.

Given the above scenario, the U.S. Energy Information Administration (“EIA”) forecast that U.S. coal production will total 537 million short tons (MMst) in 2020, indicating a decline of 153 MMst (22%) from 2019. The decline in production is due to lower domestic demand and U.S. exports of coal. EIA also forecast that total coal consumption will decrease 19% in 2020, primarily due to drop in electric power sector demand by 107 MMst or 20% from 2019 levels.

The importance of coal as a fuel source is declining, with rising usage of natural gas and renewable sources of energy. Coal producers are fighting a battle with other cleaner sources of energy and trying to find ways to remain viable. COVID-19-induced demand decline is an additional headwind for the already troubled coal companies.

Coal companies like Alliance Resource Partners, L.P. ARLP are temporarily ceasing coal production from Illinois Basin mines through Apr 15, 2020 and have decided to withdraw their operational and financial guidance for 2020. Blackhawk Mining LLC and Rhino Resource Partners LP, among others, have already idled few of its mines in response of the declining demand caused by COVID-19.

Since it is quite evident that decline in coal demand and prices will adversely impact the top line and result in liquidity crunch, coal companies like Contura Energy Inc. CTRA and Peabody Energy BTU have borrowed funds from their respective credit facilities to ensure ample financial flexibility in this COVID-19-induced crisis period.

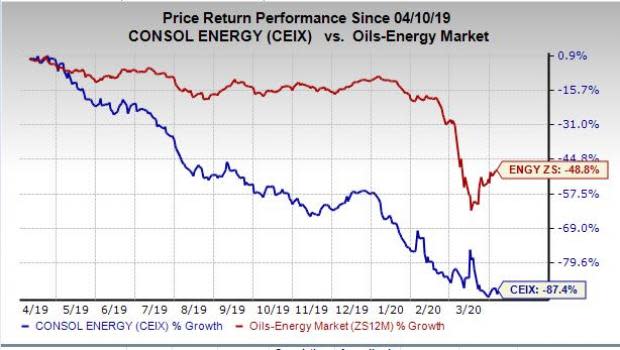

Price Performance

Shares of CONSOL have underperformed the industry in the past 12 months.

Zacks Rank

CONSOL currently has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Peabody Energy Corporation (BTU) : Free Stock Analysis Report

Alliance Resource Partners, L.P. (ARLP) : Free Stock Analysis Report

Consol Energy Inc. (CEIX) : Free Stock Analysis Report

CONTURA ENERGY (CTRA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News