Coronavirus: UK inflation falls sharply as Eat Out to Help Out cuts average prices

Watch: New figures show the Eat Out To Help Out scheme pushed inflation down to 0.2%

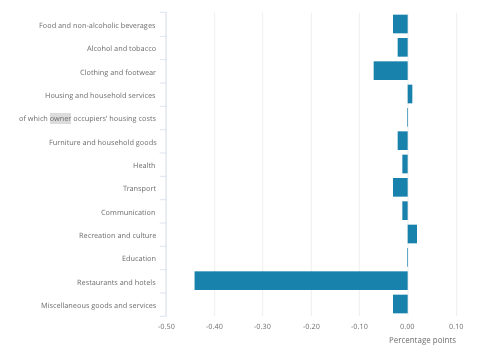

Average prices rose only 0.2% in August as the Eat Out to Help Out scheme sharply dragged down inflation.

The consumer price index (CPI) inflation reading marked a significant slowdown on the figure for July, when the rate had increased to 1%.

The CPI is a closely followed measure of the annual change in the price of a ‘basket’ of common goods and services, published by the UK’s Office for National Statistics (ONS). Prices fell 0.4% month-on-month, and when average mortgage costs are included the annual rate hit a five-year low.

Analysts had expected prices to come in flat or decline 0.1% year-on-year, with the ONS highlighting the impact of the UK government’s subsidised meal scheme.

Consumers were able to buy eat-in meals half-price up to a discount of £10 in many restaurants, cafes and pubs between Monday and Wednesday in August. Firms are able to claim a taxpayer refund to cover the discount, as part of an initiative by chancellor Rishi Sunak to revive the ailing hospitality sector.

Last month’s figures had seen inflation rising, largely because of increased fuel prices and clothing costs, as more firms re-opened and “attempted to recoup lost income,” according to CMC Markets analyst Michael Hewson.

He noted rising unemployment was likely to see households “curtail their spending” in months to come, putting more downward pressure on prices.

“We’ve already started to see the early signs of the unemployment rate starting to edge higher, and with the furlough coming to an end next month and already being tapered, this deflationary wave is likely to get worse in the short term,” said Hewson.

Thomas Pugh, UK economist at Capital Economics, said it “probably represents the low point” for inflation, however, with the Eat Out to Help Out scheme now over and a dwindling impact from lower oil prices. “But the big picture is that it will be a few years before the economy is strong enough to sustain CPI inflation at the 2% target.”

Clothing and footwear prices also fell by 0.5% between July and August this year, with struggling firms’ summer sales coming later than usual. It marks a stark contrast with previous years, when sales have typically given way to higher-priced new autumn ranges by August.

Watch: What is a V-shaped economic recovery?

“During 2020, there has been an increased amount of discounting since the beginning of lockdown,” said the ONS.

Another inflation measure including home-owner’s housing costs came in at 0.5%, the lowest figure since 2015.

Yahoo News

Yahoo News