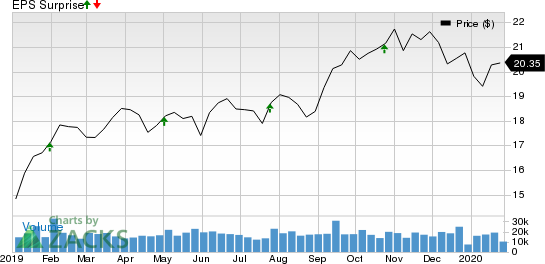

D.R. Horton (DHI) Q1 Earnings Top, Sales View Up, Shares Rise

D.R. Horton, Inc. DHI reported better-than-expected results in first-quarter fiscal 2020, thanks to its industry-leading market share, broad geographic footprint and affordable product offerings across multiple brands. Notably, shares of the company gained almost 3% following the earnings release.

The homebuilder foresees demand to remain strong in the remainder of fiscal 2020. Solid demand, a limited supply of homes at affordable prices across the markets served, favorable economic fundamentals and financing availability, as well as 30,200 homes in inventory (at the end of December) make D.R. Horton well positioned for the spring selling season.

Earnings & Revenue Discussion

Adjusted earnings came in at 99 cents per share in the quarter, surpassing the Zacks Consensus Estimate of 92 cents by 7.6%. The reported figure also increased from the year-ago profit of 76 cents per share.

The quarterly results were adjusted for a tax benefit of $32.9 million related to federal energy efficient homes tax credits that were retroactively reinstated during the quarter.

Total revenues (Homebuilding, Forestar and Financial Services) came in at $4.02 billion, up 14.3% year over year. The reported figure also topped the consensus mark of $3.78 billion.

Home Closings and Orders

Homebuilding revenues of $3.88 billion increased 13.6% from the prior-year quarter. Home sales also increased 13.3% year over year to $3.86 billion, aided by higher home deliveries. Also, land/lot sales and other revenues were $19.7 million, increasing from $6.7 million a year ago.

Home closings increased 13% from the prior-year quarter to 12,959 homes and 13% in value to $3.9 billion. It recorded growth across regions comprising East, Midwest, Southeast, West and South Central, and Southwest.

Net sales orders increased 19% year over year to 13,126 homes, with improvement witnessed in East, Midwest, Southeast, South Central and West and Southwest. Value of net orders also improved 22% year over year to $3.9 billion. The cancellation rate was 20%, lower than 24% in the prior-year quarter.

Revenues from the Financial Services segment increased 20.6% from the year-ago level to $102.9 million. Forestar contributed $247.2 million to its quarterly revenues, reflecting a notable improvement from $38.5 million a year ago.

Margins

The company’s consolidated pre-tax margin expanded 230 basis points to 13% in the quarter.

Balance Sheet

D.R. Horton’s cash, cash equivalents and restricted cash totaled $1.58 billion as of Dec 31, 2019 compared with $1.49 billion in the corresponding period of 2018.

It repurchased 3 million shares of common stock for $163.1 million during first-quarter fiscal 2020. The company has $732.6 million remaining under the stock repurchase authorization (as of Dec 31, 2019), which has no expiration date.

Guidance Revised Upward

The company expects revenues between $18.5 billion and $19.1 billion versus $18.5-$19 billion expected earlier, and homes closing within 60,000-61,500 compared with prior projection of 60,000-61,000. Effective tax rate is expected between 23% and 24% for the second, third and fourth quarters of fiscal 2020.

Homebuilding cash flow from operations is projected in excess of $1 billion. It intends to reduce share count by 2% in fiscal 2020.

Zacks Rank

Currently, D.R. Horton — which shares space with PulteGroup, Inc. PHM in the Zacks Building Products - Home Builders industry — currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Peer Releases

KB Home KBH ended fiscal 2019 on an impressive note, with fourth-quarter fiscal 2019 earnings beating analysts’ expectation. Quarterly earnings of $1.31 per share outpaced the Zacks Consensus Estimate of 1.29 cents by 1.6% and increased 36% from a year ago. Total revenues of $1,558.7 million missed the consensus mark of $1,599 million by 2.9%. That said, the top line grew by a notable 15.6% year over year, mainly due to higher home deliveries, partly offset by lower average selling price (ASP) of homes delivered.

Lennar Corporation LEN reported fourth-quarter fiscal 2019 (ended Nov 30, 2019) earnings of $2.13 per share, surpassing the Zacks Consensus Estimate of $1.90 by 12.1%. Also, the reported figure jumped 15.8% from $1.84 reported in the year-ago quarter (excluding one-time gain of 58 cents per share from the sale of Rialto and non-recurring expenses). Revenues of $6.97 billion topped the consensus estimate of $6.7 billion by 4.9%. The reported figure also increased 7.9% year over year.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained an impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Click to get this free report KB Home (KBH) : Free Stock Analysis Report Lennar Corporation (LEN) : Free Stock Analysis Report D.R. Horton, Inc. (DHI) : Free Stock Analysis Report PulteGroup, Inc. (PHM) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo News

Yahoo News