Diaceutics (LON:DXRX) Shareholders Have Enjoyed A 99% Share Price Gain

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more than that. To wit, the Diaceutics PLC (LON:DXRX) share price is 99% higher than it was a year ago, much better than the market decline of around 15% (not including dividends) in the same period. So that should have shareholders smiling. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

View our latest analysis for Diaceutics

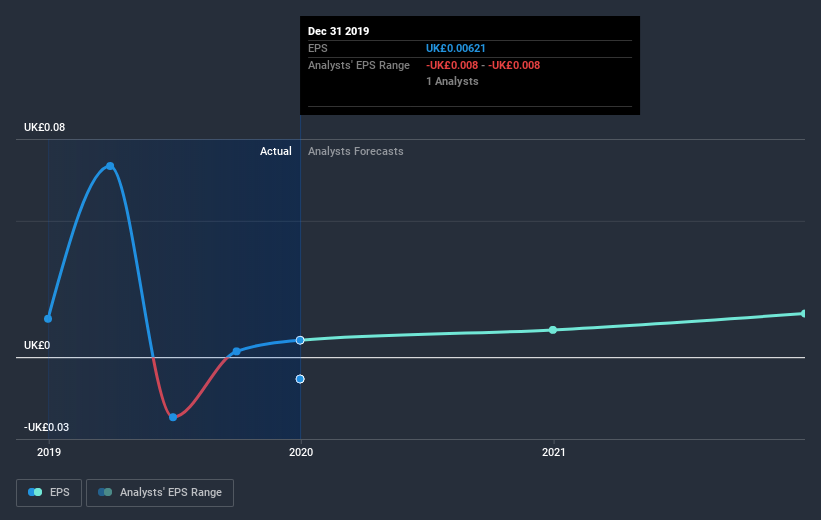

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Diaceutics grew its earnings per share, moving from a loss to a profit.

While it's good to see positive EPS of UK£0.0062 this year, the loss wasn't too bad last year. We'd argue the positive share price reflects the move to profitability. Inflection points like this can be a great time to take a closer look at a company.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on Diaceutics's earnings, revenue and cash flow.

A Different Perspective

Diaceutics shareholders should be happy with the total gain of 99% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 23% in that time. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Diaceutics has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News