Did Changing Sentiment Drive First Financial Northwest's (NASDAQ:FFNW) Share Price Down By 27%?

Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, your risk returning less than the market. We regret to report that long term First Financial Northwest, Inc. (NASDAQ:FFNW) shareholders have had that experience, with the share price dropping 27% in three years, versus a market return of about 48%. It's up 3.5% in the last seven days.

Check out our latest analysis for First Financial Northwest

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Although the share price is down over three years, First Financial Northwest actually managed to grow EPS by 12% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

We note that, in three years, revenue has actually grown at a 6.6% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching First Financial Northwest more closely, as sometimes stocks fall unfairly. This could present an opportunity.

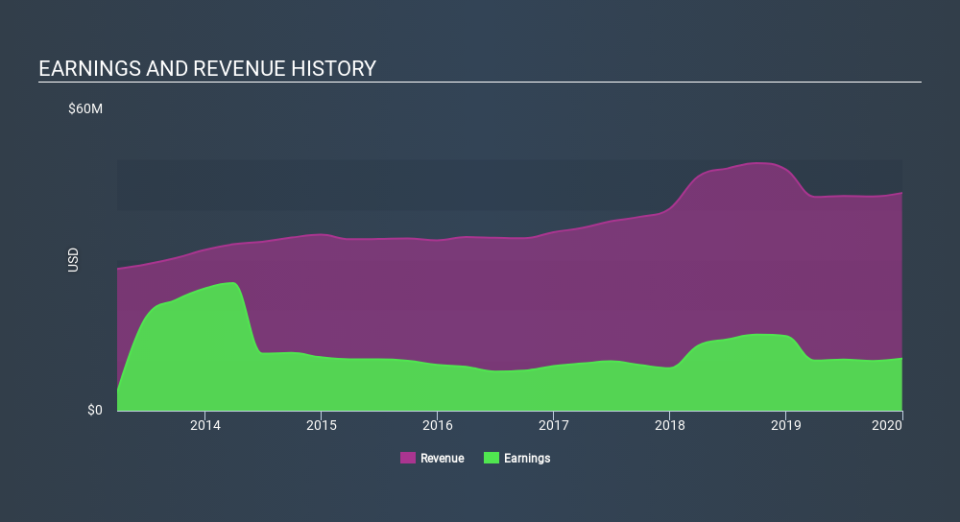

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on First Financial Northwest's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for First Financial Northwest the TSR over the last 3 years was -23%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

First Financial Northwest provided a TSR of 0.9% over the last twelve months. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 6.8% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - First Financial Northwest has 1 warning sign we think you should be aware of.

Of course First Financial Northwest may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News