Did You Miss ATS Automation Tooling Systems' (TSE:ATA) 39% Share Price Gain?

Stock pickers are generally looking for stocks that will outperform the broader market. And in our experience, buying the right stocks can give your wealth a significant boost. For example, long term ATS Automation Tooling Systems Inc. (TSE:ATA) shareholders have enjoyed a 39% share price rise over the last half decade, well in excess of the market return of around 22% (not including dividends).

See our latest analysis for ATS Automation Tooling Systems

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

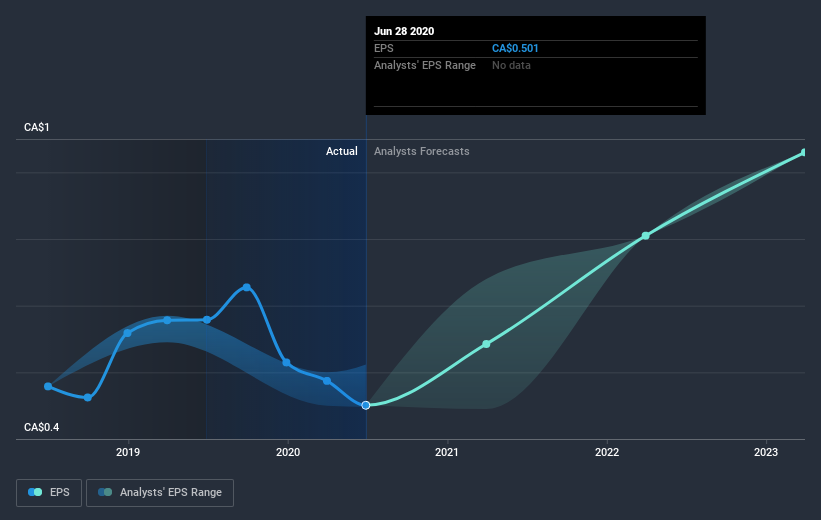

During five years of share price growth, ATS Automation Tooling Systems achieved compound earnings per share (EPS) growth of 2.9% per year. This EPS growth is lower than the 6.8% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on ATS Automation Tooling Systems' earnings, revenue and cash flow.

A Different Perspective

While it's certainly disappointing to see that ATS Automation Tooling Systems shares lost 3.8% throughout the year, that wasn't as bad as the market loss of 4.4%. Longer term investors wouldn't be so upset, since they would have made 6.8%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for ATS Automation Tooling Systems (1 can't be ignored) that you should be aware of.

But note: ATS Automation Tooling Systems may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News