Did You Participate In Any Of Caribbean Investment Holdings' (LON:CIHL) Incredible 853% Return?

Caribbean Investment Holdings Limited (LON:CIHL) shareholders might understandably be very concerned that the share price has dropped 40% in the last quarter. But over five years returns have been remarkably great. In that time, the share price has soared some 700% higher! So it might be that some shareholders are taking profits after good performance. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

It really delights us to see such great share price performance for investors.

View our latest analysis for Caribbean Investment Holdings

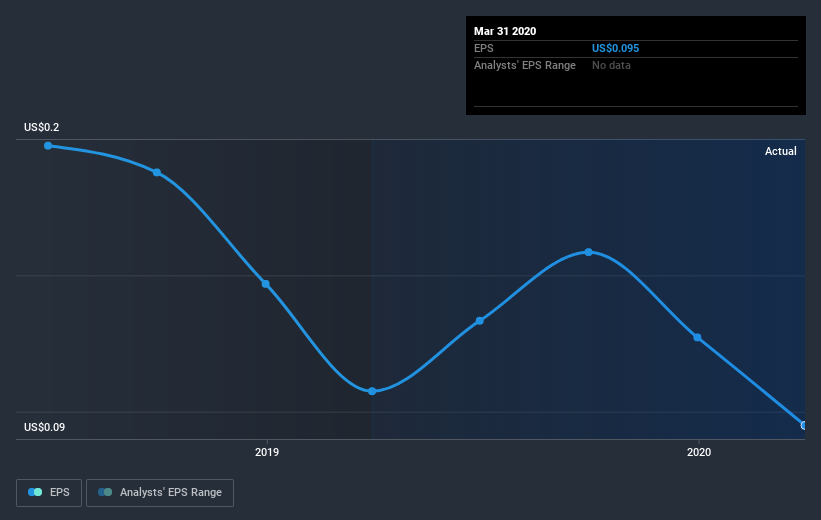

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, Caribbean Investment Holdings moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Caribbean Investment Holdings' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Caribbean Investment Holdings' TSR of 853% over the last 5 years is better than the share price return.

A Different Perspective

We're pleased to report that Caribbean Investment Holdings shareholders have received a total shareholder return of 160% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 57% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Caribbean Investment Holdings better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Caribbean Investment Holdings you should be aware of.

But note: Caribbean Investment Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News