Does BeWhere Holdings (CVE:BEW) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in BeWhere Holdings (CVE:BEW). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for BeWhere Holdings

How Fast Is BeWhere Holdings Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. Which is why EPS growth is looked upon so favourably. Commendations have to be given in seeing that BeWhere Holdings grew its EPS from CA$0.0047 to CA$0.024, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

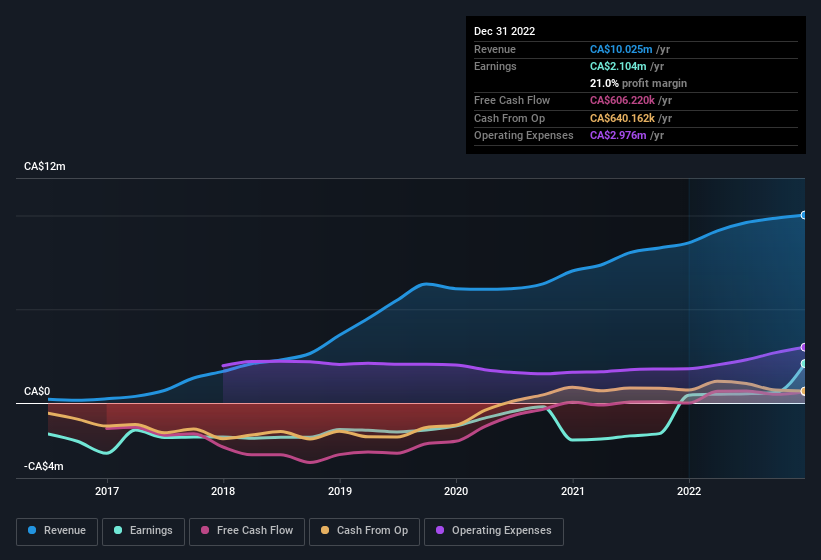

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. BeWhere Holdings maintained stable EBIT margins over the last year, all while growing revenue 17% to CA$10m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

BeWhere Holdings isn't a huge company, given its market capitalisation of CA$18m. That makes it extra important to check on its balance sheet strength.

Are BeWhere Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did BeWhere Holdings insiders refrain from selling stock during the year, but they also spent CA$69k buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. It is also worth noting that it was Independent Director Edward Kulperger who made the biggest single purchase, worth CA$49k, paying CA$0.24 per share.

Does BeWhere Holdings Deserve A Spot On Your Watchlist?

BeWhere Holdings' earnings have taken off in quite an impressive fashion. Growth-minded people will be intrigued by the incredible movement in EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put BeWhere Holdings on your watchlist. We should say that we've discovered 2 warning signs for BeWhere Holdings (1 doesn't sit too well with us!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of BeWhere Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo News

Yahoo News