Drones enter race for next content frontier

BII

This story was delivered to BI Intelligence "Digital Media Briefing" subscribers. To learn more and subscribe, please click here.

The collision of emerging technologies like virtual reality, artificial intelligence, and holographic special effects with an accelerating scramble for novel content is driving digital media innovation.

One fresh example of yesterday's sci-fi plotline vying to become tomorrow's viral hit: Drone racing. Drone TV, a recently launched channel on the freemium side of over-the-top TV platform FilmOn.com, is trying to bring the nascent sport to the mainstream.

The platform's broad audience of 75 million monthly unique visitors (half of whom are in the US) could provide a path to reaching this goal by helping to attract sponsors and advertisers. This year saw the biggest drone-racing event ever — the World Drone Prix held in Dubai, which carried a total prize of $1 million.

Drone racing has a few key things going for it as tries to get off the ground:

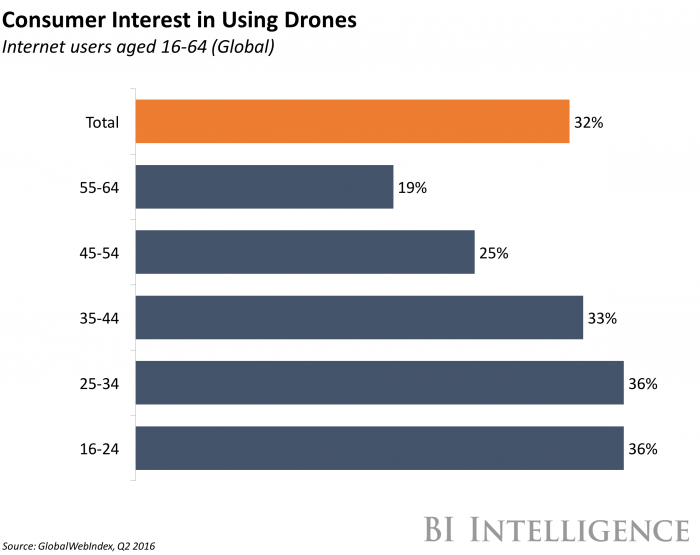

Consumer interest in drones is global and accelerating. The number of consumer – or “hobby” – drones in the US will reach 1.9 million at the end of 2016, and will more than double to 4.3 million by 2020, according to Federal Aviation Administration (FAA) forecast cited by The Daily Mail. Globally, consumer drone shipments will top 7.3 million this year and reach 29 million by 2021, according to BI Intelligence estimates.

An abundance of distribution channels to meet audiences. The ability to reach audiences across a wide range of digital platforms minimizes the distribution challenge that drone racing would face in reaching new audiences. Aside from FilmOn.com, drone racing could feed into the hunger for streaming video on social platforms like Facebook, YouTube, Twitch to build and target online communities.

Precedents for niche programming going mainstream. The growing audience for eSports illustrates how niche programming can find a broader audience at a time when potential distribution channels are multiplying. Esports grew from relative obscurity into an market with global revenues of roughly $500 million, according to Deloitte. The parallels between eSports and drone racing are significant: Each is grounded in competition using gamepads, keyboards, or controllers, and each offers a first-person point of view — from the perspective of the game character in eSports, and the drone in motion in drone racing — for both the players and spectators of the sport.

But there are certain issues that could impede the growth of drone racing:

Translating interest for owning drones into watching drones. Consumer interest in buying drones does not guarantee interest in watching drones race on TV. Nevertheless, believing that drone racing will appeal to TV audiences is not an unreasonable assumption. Consumers are already attracted to similar types of programming, like air races, car racing, and eSports.

Regulatory obstacles to overcome. The US government is still in the process of establishing regulations for the drone industry. To reach a more varied viewership and maximize the audience potential for drone-related programming, producers might have to go beyond just drone racing. However, producers will likely need to jump through more regulatory hoops with both the FAA and the Federal Communications Commission (FCC) to do so.

Drones turned the corner in 2015 to become a popular consumer device, while a framework for regulation that legitimizes drones in the US began to take shape. Technological and regulatory barriers still exist to further drone adoption.

Drone manufacturers and software providers are quickly developing technologies like geo-fencing and collision avoidance that will make flying drones safer. The accelerating pace of drone adoption is also pushing governments to create new regulations that balance safety and innovation.

Safer technology and better regulation will open up new applications for drones in the commercial sector, including drone delivery programs like Amazon’s Prime Air and Google’s Project Wing initiatives.

Jonathan Camhi, research analyst for BI Intelligence, Business Insider's premium research service, has compiled a detailed drones report that forecasts sales revenues for consumer, enterprise, and military drones. It also projects the growth of drone shipments for consumers and enterprises.

The report details several of world’s major drone suppliers and examines trends in drone adoption among several leading industries. Finally, it examines the regulatory landscape in several markets and explains how technologies like obstacle avoidance and drone-to-drone communications will impact drone adoption.

Here are some of the key takeaways from the report:

We project revenues from drones sales to top $12 billion in 2021, up from just over $8 billion last year.

Shipments of consumer drones will more than quadruple over the next five years, fueled by increasing price competition and new technologies that make flying drones easier for beginners.

Growth in the enterprise sector will outpace the consumer sector in both shipments and revenues as regulations open up new use cases in the US and EU, the two biggest potential markets for enterprise drones.

Technologies like geo-fencing and collision avoidance will make flying drones safer and make regulators feel more comfortable with larger numbers of drones taking to the skies.

Right now FAA regulations have limited commercial drones to a select few industries and applications like aerial surveying in the agriculture, mining, and oil and gas sectors.

The military sector will continue to lead all other sectors in drone spending during our forecast period thanks to the high cost of military drones and the growing number of countries seeking to acquire them.

In full, the report:

Compares drone adoption across the consumer, enterprise, and government sectors.

Breaks down drone regulations across several key markets and explains how they’ve impacted adoption.

Discusses popular use cases for drones in the enterprise sector, as well as nascent use case that are on the rise.

Analyzes how different drone manufacturers are trying to differentiate their offerings with better hardware and software components.

Explains how drone manufacturers are quickly enabling autonomous flight in their products that will be a major boon for drone adoption.

To get your copy of this invaluable guide, choose one of these options:

Subscribe to an ALL-ACCESS Membership with BI Intelligence and gain immediate access to this report AND over 100 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> START A MEMBERSHIP

Purchase the report and download it immediately from our research store. >> BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of the world of drones.

See Also:

Yahoo News

Yahoo News