Eastman Chemical (EMN) Q4 Earnings, Revenues Top Estimates

Eastman Chemical Company EMN saw its profits soar in the fourth quarter of 2017, aided by strong growth of high-margin products in its specialty businesses. The chemical maker recorded profit of $581 million or $4.01 per share, a five-fold rise from the year-ago figure of $116 million or 79 cents.

Barring one-time items, earnings were $1.62 per share for the quarter, up from $1.51 in the year ago-quarter. Earnings trounced the Zacks Consensus Estimate of $1.06.

Revenues rose around 8% year over year to $2,362 million in the quarter, also coming ahead of the Zacks Consensus Estimate of $2,289.5 million.

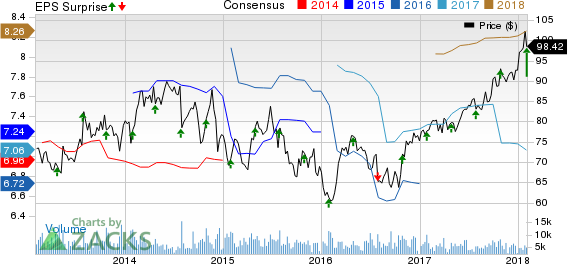

Eastman Chemical Company Price, Consensus and EPS Surprise

Eastman Chemical Company price-consensus-eps-surprise-chart | Eastman Chemical Company Quote

FY17 Results

For 2017, the company logged a profit of $1,474 million or $10.09 per share, a nearly two-fold increase from $854 million $5.75 per share recorded in 2016.

Revenues rose 6% year over year to $9,549 million in 2017.

Segment Review

Revenues from the Additives and Functional Products division went up 19% year over year to $854 million in the reported quarter. The increase was attributable to higher sales volumes for most product lines, favorable currency swings and increased selling prices.

Revenues from the Advanced Materials unit rose 9% year over year to $635 million on increased sales volume and better product mix of premium products.

Chemical Intermediates sales rose 2% to $659 million on the back of higher selling prices and improved market conditions.

Fibers segment sales fell 13% to $200 million due to lower selling prices and volumes, in particular, for acetate tow.

Financials

Eastman Chemical ended 2017 with cash and cash equivalents of $191 million, up roughly 6% year over year. Net debt at the end of the year was $6,240 million, down around 3% year over year.

Eastman Chemical generated operating cash flows of $646 million during the quarter. The company returned $646 million to shareholders through share repurchases during 2017 and repaid $350 million of debt.

Outlook

Moving ahead, the company expects to drive growth in 2018 on the back of growth investments, innovation and high margin products. It also sees modestly lower tax rate to support earnings growth in 2018. The company expects raw material and energy prices, especially for olefins, to be volatile through this year. Eastman Chemical expects adjusted earnings per share growth in 2018 to be 8-12% year over year.

Price Performance

Eastman Chemical’s shares have rallied 26.3% over the past year, outperforming the 25.3% gain of the industry it belongs to.

Zacks Rank & Stocks to Consider

Eastman Chemical currently carries a Zacks Rank #2 (Buy).

Other companies worth considering in the basic materials space include Steel Dynamics, Inc. STLD, ArcelorMittal MT and Air Products and Chemicals, Inc. APD, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics has an expected long-term earnings growth rate of 12%. Its shares have soared around 35% in a year’s time.

ArcelorMittal has an expected long-term earnings growth rate of 13.4%. Its shares have rallied 52% over a year.

Air Products has an expected long-term earnings growth rate of 14.1%. Its shares rallied 19% over a year.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley, Goldman Sachs and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks’ has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks. >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eastman Chemical Company (EMN) : Free Stock Analysis Report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

ArcelorMittal (MT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News