El Salvador loophole gives Bitcoin traders a chance to dodge tax bills

The taxman risks missing out on millions of pounds in revenue from Bitcoin traders after El Salvador became the first country to make the cryptocurrency legal tender.

HMRC is at rise of a legal challenge from investors seeking to slash their tax bills by exploiting a loophole for foreign currencies, according to tax experts.

Profits made from moves in foreign currencies held in bank accounts are currently exempt from capital gains tax, but Bitcoin and other cryptocurrencies are not.

However, the use of Bitcoin as an everyday currency in El Salvador paves the way for it to receive more favourable tax treatment unless HMRC takes further action.

Chris Etherington, a tax partner at RSM, said: “There are some hurdles that you need to meet but this is a first and important step towards essentially Bitcoin actually being exempt in the UK, if it meets certain criteria.”

He said HMRC is likely to face test cases and eventually legal challenges from traders who want to benefit from the foreign currency exemption.

Bitcoin prices have almost doubled this year to $54,000 but is still a highly volatile asset.

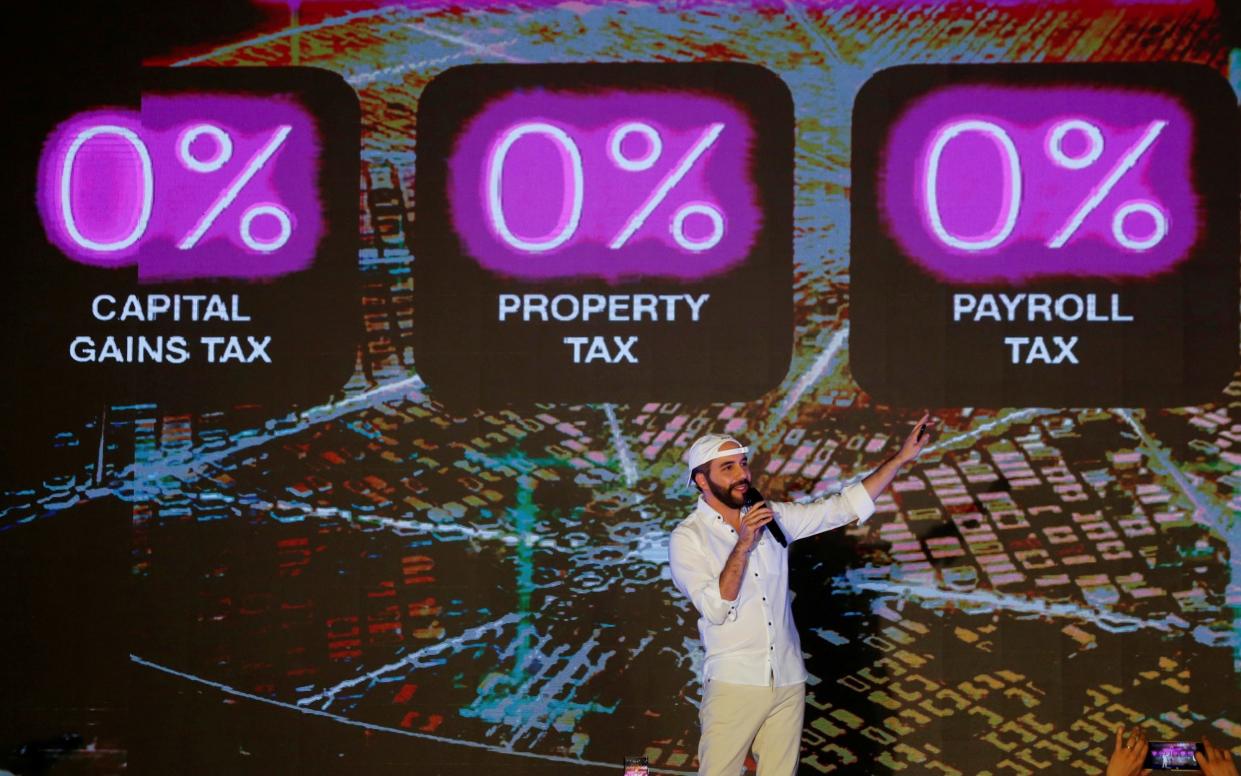

Nayib Bukele, El Salvador’s authoritarian president, is betting big on the digital money in a bid to make the Central American country a cryptocurrency hub. In addition to making it legal tender, El Salvador is launching a $1bn (£750m) “Bitcoin bond”, with half of the funds raised to be ploughed into the digital currency and the other half used to help create a “Bitcoin city” powered by a volcano.

Bitcoin would need to be considered a currency by HMRC and be held in a bank account if it were to benefit from the tax exemption - roadblocks which experts believe can now be cleared following El Salvador’s move.

The “argument becomes harder for HMRC” if more countries adopt Bitcoin as legal tender and prices become less volatile, Mr Etherington said.

He said: “That move is probably going to be the first of a few. There are other countries that are exploring this, particularly in Latin America.”

A HMRC spokesman said that it does not consider cryptoassets to be currency or money.

He added: "We want to help people get their tax affairs right and believe that taxpayers want to get it right. We have published detailed guidance to help our customers apply tax law to cryptoassets correctly.”

Yahoo News

Yahoo News