Endo (ENDP) Surpasses Earnings, Revenue Estimates in Q4

Endo International plc ENDP reported fourth-quarter 2017 results wherein both earnings and revenues surpassed estimates but declined significantly year-over-year. Earnings from continuing operations were 77 cents which beat the Zacks Consensus Estimate of 62 cents. However, earnings declined significantly from $1.77 recorded in the year-ago quarter.

Revenues came in at $769 million in the quarter, surpassing the Zacks Consensus Estimate of $764.81 million. However, the top line was down 38% year over year, primarily due to the loss of marketing exclusivity in the first half of 2017 for the first-to-file products, the generic version of Zetia (ezetimibe tablets) and the generic version of Seroquel XR (quetiapine extended-release (ER) tablets) both of which were launched in fourth-quarter 2016.

Moreover, the product discontinuances in the generic pharmaceuticals segment, pricing pressure from increased competition primarily impacting the generics base business, the divestitures of Litha and Somar, as well as the cessation of Opana ER shipments to customers by Sep 1, 2017 accounted for the decline.

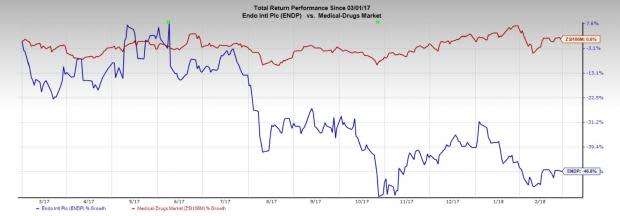

As a result of the aforementioned factors, Endo had a choppy ride in 2017. Endo’s stock has tumbled 50.1% over the last 12 months as against the industry’s 2.7% gain.

Endo International PLC Price and Consensus

Endo International PLC Price and Consensus | Endo International PLC Quote

Quarterly Highlights

Endo reports results through three segments — Branded Pharmaceuticals (U.S.), Generic Pharmaceuticals (U.S.) and International Pharmaceuticals.

U.S. Branded Pharmaceuticals sales were down 21% to $228 million, as generic competition is impacting the company’s established products portfolio and cessation of product shipments of Opana ER. However, Xiaflex sales increased 10% year over year reflecting strong volume growth of the product.

In December 2016, Endo terminated its worldwide license and development agreement with BioDelivery Sciences International, Inc. BDSI for Belbuca and returned the product.

U.S. Generic Pharmaceuticals recorded sales of $499 million in the quarter, down 43% due to the loss of marketing exclusivity for the first-to-file products ezetimibe tablets and quetiapine ER tablets in the first half of 2017. Product discontinuances and pricing pressure from increased competition impacted the generic base business. Nevertheless, sterile Injectables revenue increased 16% driven primarily by Adrenalin.

The International Pharmaceuticals division garnered sales of $41 million, down from $70 million in the year-ago quarter due to recent divestitures. Endo sold Mexican subsidiary, Somar, to Advent International in October 2017. Endo also sold its South African subsidiary, Litha Healthcare Group in July 2017.

2017 Results

Revenues came in at $3.47 billion, down 14% from 2016 and in line with the Zacks Consensus Estimate. Earnings per share of $3.84 were down from $4.73 in 2016 but surpassed the Zacks Consensus Estimate of $3.67.

2018 Outlook

Endo expects revenues between $2.6 billion and $2.8 billion in 2018, below the Zacks Consensus Estimate of $3.06 billion. The company anticipates earnings from continuing operations in the range of $2.15-$2.55 per share, much below the Zacks Consensus Estimate of $2.86.

Our Take

While the fourth-quarter results beat estimates, the guidance for 2018 was way below expectations. The generics business is under tremendous pressure due to the loss of marketing exclusivity in the first half of 2017 for the first-to-file products ezetimibe tablets and quetiapine ER tablets. The branded pharmaceuticals business was impacted by continued generic competition for established products, product divestitures and ceasing shipments of Opana ER and this is expected to continue further.

We expect challenging business conditions for the company in 2018.

Zacks Rank & Stocks to Consider

Endo currently carries a Zacks Rank #5 (Strong Sell).

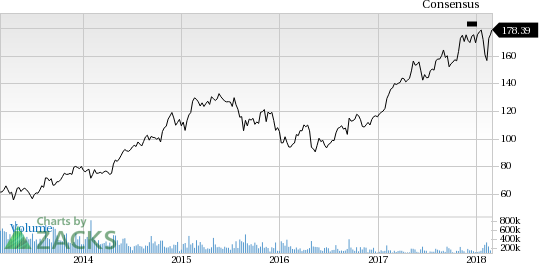

A couple of better-ranked stocks in the health care sector are Regeneron Pharmaceuticals, Inc. REGN and Enanta Pharmaceuticals, Inc. ENTA. While Regeneron sports a Zacks Rank #1 (Strong Buy), Enanta carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here..

Regeneron’s earnings per share estimates have moved up from $17.13 to $18.65 and from $20.38 to $21.56 for 2018 and 2019, respectively, in the last 30 days. The company pulled off a positive earnings surprise in three of the last four quarters with an average beat of 9.15%.

Enanta Pharma came up with a positive surprise in three of the last four quarters with an average beat of 373.1%.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

BioDelivery Sciences International, Inc. (BDSI) : Free Stock Analysis Report

Endo International PLC (ENDP) : Free Stock Analysis Report

Enanta Pharmaceuticals, Inc. (ENTA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News