EPAM Systems (EPAM) Q4 Earnings & Revenues Surpass Estimates

EPAM Systems’ EPAM fourth-quarter 2019 non-GAAP earnings per share improved 18.9% year over year to $1.51 and also beat the Zacks Consensus Estimate by 4.1%.

Additionally, revenues in the reported quarter came in at $633 million, reflecting a year-over-year rise of 25.3%. The top line also surpassed the Zacks Consensus Estimate of $618 million. On a constant currency (cc) basis, revenues were up 24.8%.

Increase in demand in the second half of the quarter coupled with stronger performance from a few of its acquired companies drove results. The company also incurred foreign exchange benefit of 0.5% due to the strengthening of Russian ruble.

The company is benefiting from growth across all industry verticals and geographies. Digital transformation, focus on customer engagement and product development are key catalysts.

Top-Line Details

EPAM Systems’ largest vertical Financial Services exhibited 21.8% growth on a year-over-year basis. Travel & Consumer improved 15.9%.

Software & Hi-Tech was up nearly 24.5%. Business Information & Media rose 38%.

Life Science & Healthcare rose 20.3%. Exceptionally strong performance in the year-ago quarter resulted in tough year-over-year comparison.

Emerging Verticals improved 36.3%, driven primarily by clients in energy and telecommunications sectors.

Geographically, EPAM Systems generated 60.1% of total revenues from North America, up 20.2% year over year.

Revenues from Europe, contributing 32.7% to total revenues, were up 31.4% (31.7% at cc).

CIS or Commonwealth of Independent States, representing 4.9% of revenues, jumped 39.7% (27.7% at cc).

APAC rose 5.4%, accounting for 2.3% of revenues.

The company’s top 20 clients climbed 22.1% year over year in the quarter under review while the rest improved 27.7%.

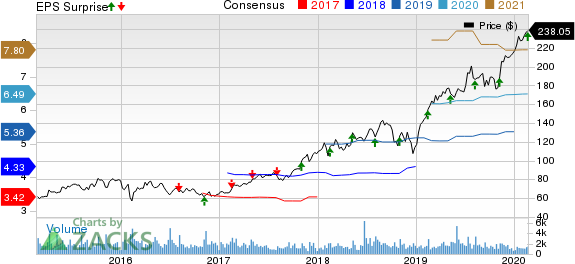

EPAM Systems, Inc. Price, Consensus and EPS Surprise

EPAM Systems, Inc. price-consensus-eps-surprise-chart | EPAM Systems, Inc. Quote

Margins

EPAM Systems’ non-GAAP gross margin contracted 100 basis points (bps) to 36.7%.

The company’s non-GAAP operating income improved 15.6% year over year to $107.6 million while operating margin contracted 140 bps to 17%.

Balance Sheet and Cash Flow

EPAM Systems exited the fourth quarter with cash and cash equivalents of $936.6 million, up from $853.2 million at the end of the third quarter.

As of Dec 31, 2019, long-term debt was $25 million, flat sequentially.

Cash generated from operating activities was $124.6 million in the quarter compared with $119 million reported in the previous quarter.

Free cash flow came in at $77.6 million, compared with $91.8 million sequentially.

2019 Highlights

EPAM generated total revenues of $2.29 billion in 2019, up 25.8% year over year.

The company generated 22% of revenues from Financial Services, 19% revenues each from Travel and Consumer, and Software & Hi-Tech and 18% from Business Information & Media. Life Sciences & Healthcare and Emerging Verticals each contributed 10% to revenues.

The company generated 61% of its revenues from North America, 33% from Europe, 4% from CIS and 2% from APAC.

Guidance

For 2020, EPAM Systems expects revenue growth to be at least 22% year over year. The company anticipates foreign currency fluctuations to have no impact on revenues. Inorganic contribution for the full year is expected to be around 1%.

Non-GAAP operating margin is projected in the band of 16-17%. The company anticipates non-GAAP earnings to be $6.3.

For the fourth quarter, the company forecasts revenues of minimum $642 million, up 23% (as reported and at cc) year over year.

Non-GAAP earnings per share are expected to be at least at $1.36. Meanwhile non-GAAP operating margin is predicted between 15% and 16%.

Zacks Rank and Other Stocks to Consider

EPAM currently carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader technology sector are Cirrus Logic CRUS, SYNNEX SNX and Silicon Motion Technology Corporation SIMO, all sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Cirrus, SYNNEX and Silicon Motion is currently pegged at 15.3%, 10.37% and 7%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SYNNEX Corporation (SNX) : Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS) : Free Stock Analysis Report

EPAM Systems, Inc. (EPAM) : Free Stock Analysis Report

Silicon Motion Technology Corporation (SIMO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News