The EU is set for impressive e-commerce growth – but Brexit challenges loom

BI Intelligence

This story was delivered to BI Intelligence "E-Commerce Briefing" subscribers. To learn more and subscribe, please click here.

The EU’s e-commerce industry is projected to be worth €602 billion ($685 billion) at the end of 2017, a new report from industry association Ecommerce Europe found. That would translate to 14% year-over-year (YoY) growth, after a 15% bump in 2016. In comparison, the US e-commerce sector is projected to advance 8-12% this year, according to the National Retail Federation.

Several factors are driving the EU’s impressive e-commerce growth:

Less mature e-commerce countries in Eastern and Central Europe are seeing rapidly increasing sales. Countries like Romania, Ukraine, and Poland have seen e-commerce growth of over 25% in the past year.

The EU’s Digital Single Market strategy is removing barriers to online trade within the EU. The EU is looking to create a digital version of its free-trade single market, which should enable more cross-border e-commerce in the region by prohibiting price discrimination against customers in different EU countries.

Young European consumers are prone to shopping online. The report found that two-thirds of those between the ages of 16 and 24 make online purchases frequently, while only one-third of those aged 55-77 do so. This bodes well for the market's future as these consumers acquire more spending power.

However, barriers remain that could keep the EU's e-commerce sector from reaching its full potential. Ecommerce Europe noted several issues that still complicate online purchasing for consumers. The top complaints cited by the report were speed of delivery (17%), technical issues (13%), and damaged goods (9%).

Additionally, Brexit could pose a new set of major challenges to e-commerce in Europe — the UK accounted for 33% of all EU online sales in 2016, and potential trade restrictions following the UK’s eventual separation from the bloc may complicate cross-border e-commerce between the EU and UK. As discussed in BI Intelligence’s new cross-border e-commerce report, a “soft Brexit” would see the UK join the European Free Trade Agreement (EFTA), keeping the UK within the European single market. Meanwhile, a “hard Brexit” would involve the UK and EU negotiating a new agreement that could include tariffs and surcharges on cross-border shipments. Multinational bank Société Générale projects the likelihood of a hard Brexit at 70%, and a soft Brexit at just 15%.

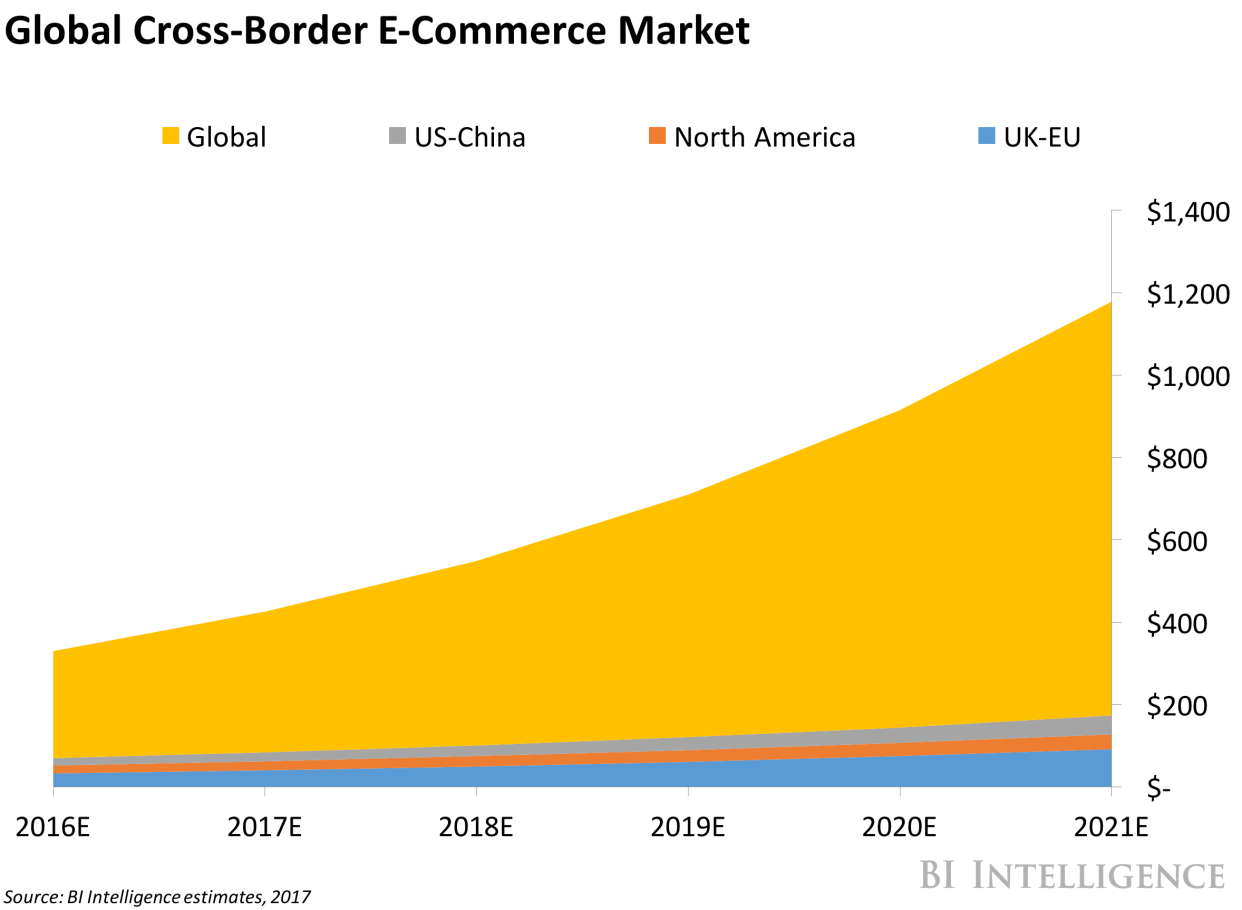

BI Intelligence estimates that, with current policies in place, global cross-border e-commerce will generate more than $1 trillion in sales for retailers by 2021.

However, over the past year, two key global events — the presidential election in the US and the Brexit vote in the UK — have cast uncertainty over the cross-border e-commerce market in the form of protectionist trade policies that could restrict the flow of goods between different countries. Growing economic nationalism in Western democracies — a phenomenon brought on by negative perceptions of the trade liberalization and globalization that these countries have experienced since the end of the Cold War — fueled both of these political upheavals.

Jonathan Camhi, research analyst for BI Intelligence, Business Insider's premium research service, has compiled a detailed report on Trump, Brexit, and cross-border e-commerce that:

Forecasts the growth of cross-border e-commerce globally, as well as growth in the specific corridors that could be impacted by Brexit, NAFTA renegotiations, and US-China trade relations.

Examines trends and challenges in cross-border e-commerce between the UK and EU, as well as between the US and Canada, Mexico, and China.

Analyzes the impact that different scenarios — including a "hard" vs. "soft" Brexit, or targeted tariffs imposed on US-China trade — could have on cross-border e-commerce between the countries involved.

Provides insight into the likelihood of these scenarios, helping online retailers adjust their plans for international expansion and sales.

To get the full report, subscribe to an ALL-ACCESS Membership with BI Intelligence and gain immediate access to this report AND more than 250 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> Learn More Now

You can also purchase and download the report from our research store.

See Also:

Yahoo News

Yahoo News