Fears in Papua New Guinea over reports of China Mobile buying major phone carrier Digicel

Speculation that mobile phone operator Digicel is considering selling the Papua New Guinea business that is considered the jewel in the financially troubled empire’s crown has sparked concern within the country over Beijing’s growing influence in PNG.

The Digicel conglomerate, which is controlled by Irish businessman Denis O’Brien, surprised many of its users in PNG by filing bankruptcy proceedings earlier this month in Bermuda and the US, where it owes billions of dollars.

But, for the 3.8 million Digicel users in Papua New Guinea there could be vast changes in the near future if the speculation that China Mobile will bid to buy Digicel Pacific’s assets is correct.

Related: Politics and Porgera: why Papua New Guinea cancelled the lease on one of its biggest mines

While unknown in Australia, Digicel is a household name in the Caribbean and the South Pacific, where it offers affordable mobile phone services. Papua New Guinea is one of Digicel’s biggest success stories. Since its arrival in 2007 it has dominated the market and invested heavily in infrastructure across the country.

In mid-May the Australian Financial Review said Australian security services were concerned that China Mobile, a state-owned telecommunications company, was planning to buy the PNG business – a report immediately and categorically denied by Digicel.

If China Mobile were to buy Digicel PNG, it would inherit a large network connecting much of rural PNG, where the Chinese government is also funding the construction of strategic transport infrastructure.

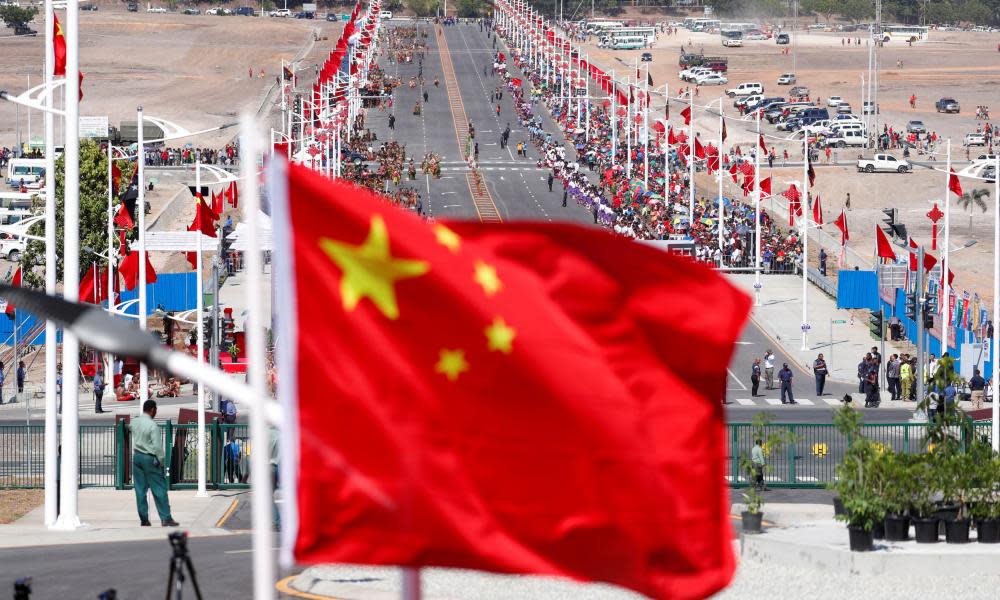

In 2018 the country’s former prime minister Peter O’Neill signed on to China’s Belt and Road Initiative, an ambitious program in which the Chinese government is bankrolling development of much-needed infrastructure across Asia and the Pacific, but there are concerns from within PNG’s ruling coalition government about the growing influence of China in the country.

“The Chinese have serious credibility issues here in PNG and any more association with Chinese companies will not be a step in the right direction for PNG,” Allan Bird, the governor of East Sepik, one of the country’s largest provinces, told the Guardian.

“Having said that, if Digicel is sold to a Chinese company, it will work in [local company] Telikom’s favour because Papua New Guinean customers are more discerning and we could see an exodus of customers to the local telco.”

A senior journalist in Papua New Guinea who covers geopolitics in the country, and who spoke on the condition of anonymity, said that if a Chinese state-controlled telecommunications company takes over the monopoly enjoyed by Digicel, it would allow China to have access to information about the people.

“People are scattered across the vastly isolated, but populated rural areas of PNG. There are over 100 Digicel towers across the country connecting people. The power to control information and the potential to collect data is a security risk, if these towers were to fall into the wrong hands.”

“China has always been sniffing for an opportunity, this just happens to be a potential one,” said Ali Kasokason, a political commentator who lives in Port Moresby.

“Digicel or not, China is quite aggressive in entering the communications sector in the Pacific.”

Documents filed with the court show accounting firm KPMG valued Digicel Pacific – the company through which the group offers its services to PNG and other Pacific nations – at up to US$615m, making it the group’s single biggest asset. However, KPMG warned it would take up to a year to sell Digicel Pacific.

“In Digicel’s case PNG has become the jewel in its crown,” said PNG Institute of National Affairs Executive Director Paul Barker.

But Digicel, which is incorporated in tax haven Bermuda, is crippled by a US$7.4bn debt mountain – some of which attracts interest rates north of 9%. Despite making a profit of US$480m off revenue of US$2.3bn last year the debts are “unsustainable” due to soaring interest bills, Digicel has told a US court. It said it was in negotiations with debtholders to reduce the load.

Yahoo News

Yahoo News