FMC Corp's (FMC) Q2 Earnings Top, Revenues Lag Estimates

FMC Corporation FMC recorded earnings (as reported) of $1.41 per share in second-quarter 2020, up around 7% from $1.32 reported a year ago.

Barring one-time items, adjusted earnings per share came in at $1.72, topping the Zacks Consensus Estimate of $1.65.

Revenues were $1,155.3 million for the quarter, down around 4% from the year-ago quarter. It lagged the Zacks Consensus Estimate of $1,197 million.

Revenues were affected by a 7% unfavorable impact of currencies, partly offset by a 2% contribution from volume and a 1% contribution from pricing. The company saw lower sales across North America and EMEA (Europe, Middle East, and Africa). Sales rose in Latin America and Asia in the reported quarter.

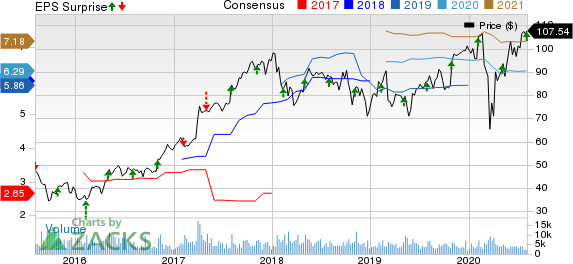

FMC Corporation Price, Consensus and EPS Surprise

FMC Corporation price-consensus-eps-surprise-chart | FMC Corporation Quote

Regional Sales Performance

Sales in Latin America rose 2% year over year in the reported quarter driven by volume gains and favorable pricing that offset currency headwinds.

Sales fell 6% year over year in North America, impacted by the company’s actions to reduce channel inventories of pre-emergent herbicides.

In EMEA, sales dropped 13% year over year. Sales were, in part, impacted by poor weather conditions in Northern and Eastern Europe and product rationalizations.

Revenues rose 2% year over year in Asia as currency headwinds were offset by pricing and volume growth across India, Pakistan and Australia.

Financials

The company had cash and cash equivalents of $342.7 million at the end of the quarter, a roughly four-fold year-over-year increase. Long-term debt was $3,027.5 million at the end of the quarter, up around 41% year over year.

Guidance

For 2020, FMC sees revenues to be between $4.68 billion and $4.82 billion, indicating a rise of 3% at the midpoint versus 2019.

The company now expects adjusted earnings per share for 2020 in the range of $6.28-$6.62, compared with its prior view of $6.05-$6.70. The revised guidance reflects an increase of 6% at the midpoint compared with 2019.

Moreover, FMC now envisions adjusted EBITDA of $1.265-$1.325 billion for 2020, compared with $1.23-$1.34 billion expected earlier. The guidance indicates a 6% rise at the midpoint versus 2019.

For third-quarter 2020, revenues are projected in the band of $1.045-$1.105 billion, reflecting an increase of 6% at the midpoint compared with third-quarter 2019. Adjusted earnings are forecast in the range of $1.03-$1.17 per share, indicating a 17% rise at the midpoint versus third-quarter 2019.

Price Performance

FMC’s shares are up 7.7% year to date against the industry’s 13% decline.

Zacks Rank & Key Picks

FMC currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the basic materials space include Barrick Gold Corporation GOLD, Equinox Gold Corp. EQX and Eldorado Gold Corporation EGO.

Barrick Gold has a projected earnings growth rate of 72.6% for the current year. The company’s shares have gained around 69% in a year. It currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Equinox Gold has a projected earnings growth rate of 255.2% for the current year. The company’s shares have rallied roughly 106% in a year. It currently carries a Zacks Rank #2.

Eldorado Gold has an expected earnings growth rate of 2,025% for the current year. The company’s shares have shot up around 48% in the past year. It presently carries a Zacks Rank #2.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FMC Corporation (FMC) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Eldorado Gold Corporation (EGO) : Free Stock Analysis Report

Equinox Gold Corp. (EQX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News