A fund raised £182 million to take advantage of post-Brexit property bargains

REUTERS/Alessandro Bianchi

LONDON – A fund backed by eight institutional investors has raised £182 million to snap up post-Brexit offices and business parks across England at bargain prices.

First Property said in a statement on Monday it raised the money to "take advantage of the slowdown in the UK commercial property market since" the June referendum last year.

The recent round of financing brings the fund's total post-Brexit influx of cash to £250 million.

First Property CEO Ben Habib said: "The UK's decision to leave the EU has created opportunities on which we, as a niche fund manager, are well placed to capitalise."

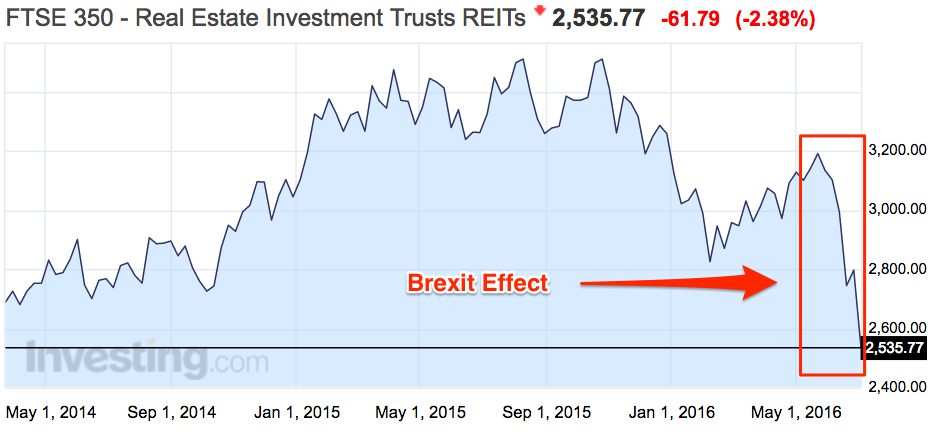

The Brexit referendum hit commercial property investments hard. At least nine investment firms suspended trading in their property funds in the aftermath of the June vote, freezing £15 billion of assets. Investors rushed to pull their money out but fund managers could not liquidate, or sell-off, the underlying property assets fast enough to meet the demand for cash.

Here's how the market looked in the weeks after the Brexit vote:

InvestingThis Brexit-driven slump presents potential opportunities for First Property: if other funds become forced sellers to meet their liquidity obligations, it drives down prices, creating bargains in the market.

The fund has a different fee structure to most of its peers, and won't charge a management fee. Instead, managers will take a share in the profits over the seven-year life of the fund, with the level determined by the annual rate of return.

"Our confidence in the fund's prospects is also demonstrated by our decision to determine our entire economic benefit from it by reference only to the profits it earns," Habib said.

First Property said it expects total assets under management to grow from £477 million to more than £750 million as part of its investing drive.

NOW WATCH: A rogue trader who lost £350 million explains why he became so addicted to risk-taking

See Also:

France is actively seeking to punish the City of London during Brexit, according to a leaked memo

Brexit could cause food disruption 'unprecedented for an advanced economy outside of wartime'

Brexit is now directly damaging business investment in Britain

DON'T MISS: An international bank is already pulling business out of the UK because of Brexit

Yahoo News

Yahoo News