G4S rejects £3bn takeover bid

The world’s largest privately owned security services company has fired the starting gun on a potential £3bn hostile bid for G4S.

GardaWorld said it had made three approaches to G4S management over the past three months that had been “summarily dismissed or ignored”.

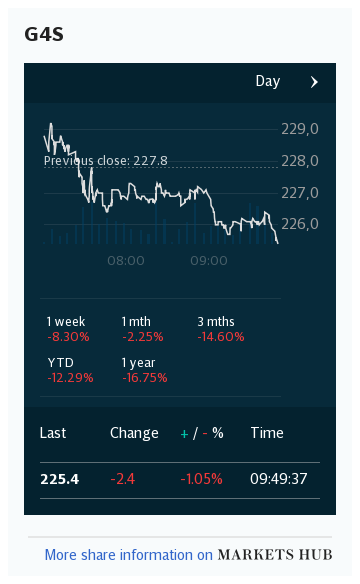

The Canadian company has now gone public with its most recent, a 190p a share all-cash offer, valuing the FTSE 250 business at £3bn in an attempt to force the company to engage with it.

This represents a 30pc premium to the G4S closing price on Friday and 86pc higher than the first approach made in June, according to the bidder.

Shares soared by a quarter to 182p in afternoon trading.

G4S fuelled speculation of a hostile bid, saying they "strongly advised" investors "to take absolutely no action".

The company said the latest offer, along with earlier proposals at 145p and 153p, had been unanimously dismissed by the board folowing careful consideration.

G4S added that the offer "significantly undervalues the company and its prospects", labelling the timing as "highly opportunistic, coming as it does at a time of severe turbulence in global financial markets".

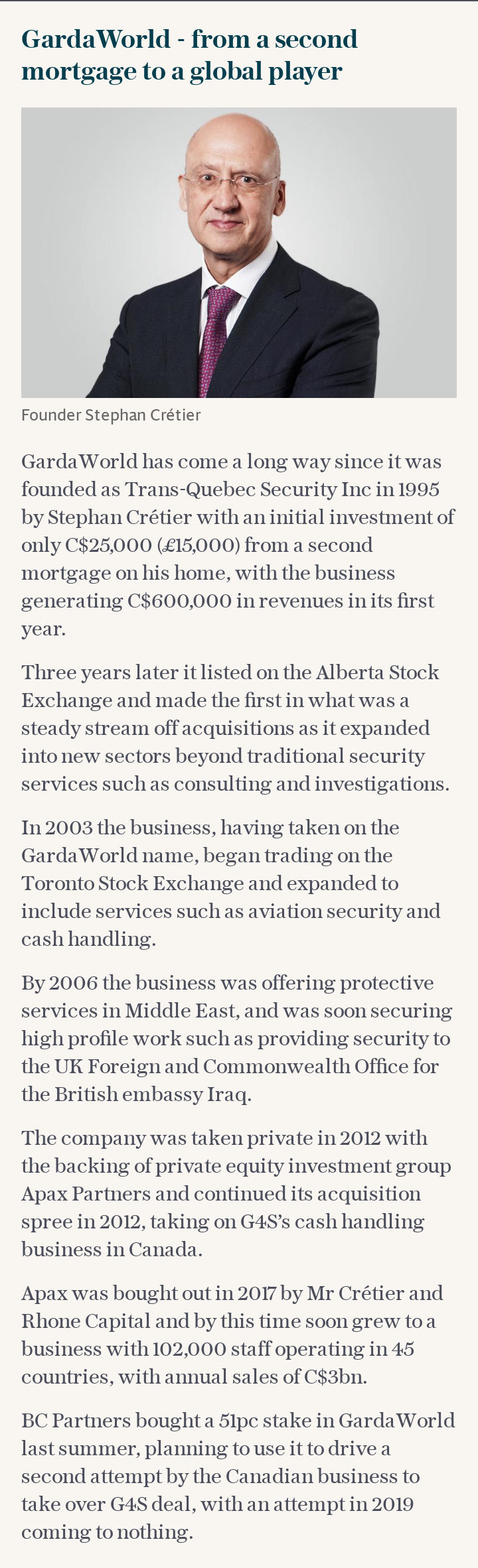

Stephan Crétier, founder and chief executive of GardaWorld, took aim at G4S management after going public with his proposal.

“G4S needs an owner, not a manager. GardaWorld has 25 years of experience in the sector and we know how to improve and repurpose this business,” he said.

“As owner-operators, we believe that the combined business’s operations will offer a better future for all those who depend on G4S. We will turn G4S around, ensuring it delivers for its customers, its people and the public.”

Mr Crétier said combining the two companies would create the world’s leading security services business and pledged a deal would come with a long-term commitment to the UK.

GardaWorld “understands G4S’s importance as a UK employer”, Mr Crétier said, as well as a “significant provider” to both public and private organisations.

G4S has about 25,000 staff in the UK, and globally employs more than 500,000 people. The company has cut 1,000 jobs in its cash handling division as coronavirus quickened a shift to electronic payments, however.

Its shares have declined from more than 300p in 2017 to about 200p when the pandemic hit in February, which has forced them under 100p.

GardaWorld’s offer provides “a certain path for G4S’s shareholders to immediately recover lost value”, Mr Crétier said, adding he “encouraged shareholders to ask G4S’s board to begin engaging with us”.

BC Partners, which holds a 51pc common equity interest in GardaWorld, and is bankrolling the bid, said the offer is “a unique opportunity for G4S's shareholders”.

GardaWorld, which approached G4S about a deal last year before pulling way with no formal offer, said further details of its latest overtures will be released “when appropriate”.

G4S is leading player in international security outsourcing with annual sales of about £3.5bn.

However the company , which has been led by Ashley Almanza since 2013, has suffered a series of problems over the past decade.

These included being unable to service its contract to provide security for the London 2012 Olympics, with the Army drafted in at the last moment to bail it out. The debacle cost chief executive Nick Buckles his job.

In July, G4S agreed a deal with the Serious Fraud Office to end an investigation into fraud offences related to the company overcharging the Government to monitor electronically “tagged” offenders.

Almost a decade ago the FTSE 100 company ran into trouble after it emerged that for years it had overcharged the taxpayer to monitor offenders, in some cases charging the taxpayer to monitor offenders who turned out to be dead, back in prison or had their tags removed. Some had even left the UK or never been tagged at all. G4S paid £50m to end the matter.

Last week the SFO announced it had charged three former executives offences relating to defrauding taxpayers over the tagging scandal.

Despite its troubles, G4S has won a string of high-profile UK contracts including a £250m deal to run a prison in Northamptonshire.

Andrew Brooke, analyst at RBC, said he was "very surprised" that G4S and dismissed GardaWorld, given the "starting price, the chequered past/management credibility, and the fact that many shareholders are long-suffering".

He added that if the Canadian business were return with a bid of between 210p and 215p, there would "be a reasonable chance of a deal, although this approach could potentially stimulate other interest to come out of the woodwork".

Yahoo News

Yahoo News