General Mills (GIS) Q1 Earnings & Sales Top Estimates, Up Y/Y

General Mills, Inc. GIS released robust first-quarter fiscal 2021 results, wherein both top and bottom lines surged year over year and beat the Zacks Consensus Estimate. Results benefited from broad-based market share gains from rising demand due to increased at-home consumption amid the coronavirus pandemic. Concurrently, management announced a 4% dividend hike. Shares of the company were up about 2.8% in the pre-market trading session on Sep 23.

Given the current situation and uncertainty surrounding the pandemic, the company is not offering fiscal 2021 guidance. However, the company expects at-home demand to remain elevated in the second quarter and remains on track with its core priorities for fiscal 2021.

Q1 Highlights

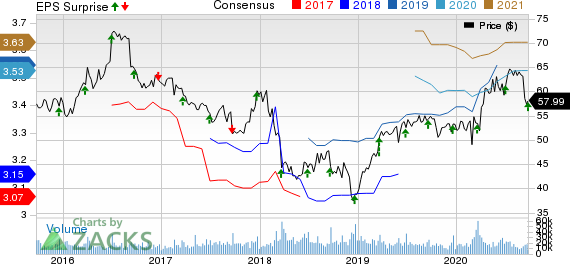

The company’s adjusted earnings per share of $1.00 increased 27% year over year on a constant-currency (cc) basis. Moreover, the bottom line beat the Zacks Consensus Estimate of 87 cents. The uptick can be attributed to improved adjusted operating profit and higher after-tax earnings from joint ventures. This was somewhat countered by elevated adjusted effective tax rate and a rise in the number of shares outstanding.

Net sales of $4,364 million advanced 9% year over year and surpassed the Zacks Consensus Estimate of $4,176 million. Also, organic sales increased 10% on the back of higher pound volumes stemming from increased at-home demand amid the pandemic, favorable net price realization and mix.

Adjusted gross margin expanded 100 basis points (bps) to 36.2% owing to gains from fixed cost leverage in the supply-chain network. This was partly countered by coronavirus-related costs like health, safety and costs associated with additional capacity. Adjusted operating profit increased 22% at cc on the back of higher net sales and adjusted gross margin, partly negated by a rise in SG&A expenses. Adjusted operating margin expanded 210 bps to 19.1%.

Segmental Performance

North America Retail: Revenues in the segment came in at $2,707 million, up 14% year over year, courtesy of solid demand from higher at-home consumption amid the pandemic. Organic sales also rose 14%.

Convenience Stores & Foodservice: Revenues dropped 12% to $391.6 million due to a significant reduction in demand for away-from-home food amid the coronavirus outbreak. Though results improved from the previous quarter, traffic remained below the year-ago period levels in core channels such as restaurants, convenience stores and lodging.

Europe & Australia: The segment’s revenues rose 8% to $491 million, including favorable currency impacts of 3 points. Also, sales were backed by elevated demand due to increased at-home consumption amid the pandemic. Further, sales increased 7% year over year on an organic basis.

Asia & Latin America: Revenues rose 6% from the year-ago quarter’s figure to $382.7 million on higher volumes, partly countered by currency woes, adverse net price realization and mix.

Pet Segment: Revenues came in at $391.7 million, up 6% year over year on the back of solid volume growth, somewhat offset by adverse net price realization and mix.

Other Financial Aspects

The company ended the quarter with cash and cash equivalents of $1,796.7 million, long-term debt of $10,832.9 million and total shareholders’ equity of $8,444.6 million.

General Mills generated $584 million as net cash from operating activities in the first quarter. During the same time frame, the company made capital investments worth $117 million and paid out dividends of $303 million.

Concurrently, the company raised its quarterly dividend by 4%, taking it from 49 cents per share to 51 cents, which is payable on Nov 2, 2020, to shareholders of record as on Oct 9. Management informed that a major rise in General Mills’ earnings as well as a reduction in net debt since Blue Buffalo’s buyout in April 2018 encouraged it to announce the dividend hike.

Other Developments & Outlook

Constant-currency sales from joint ventures of Cereal Partners Worldwide increased 9% in the quarter on elevated pandemic-led demand. In Haagen-Dazs Japan, sales declined 1% at cc from the prior-year quarter’s figure.

The company continues to expect pandemic-related trends to be the main factor driving its fiscal 2021 performance. To this end, it expects increased at-home consumption and declines in away-from-home food demand, together with other pandemic-led macroeconomic hurdles, to impact fiscal 2021 results. The company stated that at-home demand remained higher than pre-pandemic levels through the first quarter, though the trend has moderated sequentially owing to the gradual easing of restrictions and elevated restaurant reopening. Nonetheless, second-quarter at-home food demand is expected to remain high compared with pre-pandemic levels. This includes expectations of high-single-digit total retail sales growth in the North America Retail categories.

Core Priorities for Fiscal 2021

General Mills is on track with its three core priorities for fiscal 2021, which include competing efficiently, boosting efficiency to fuel investments and reducing leverage. With regard to the first priority, the company expects fiscal 2021 sales growth to be backed by elevated demand and the company’s solid execution. However, sales comparisons are likely to reflect adverse impacts from an additional week and an extra month of Pet segment results in fiscal 2020.

As part of boosting efficiency, management expects adjusted operating profit margin in fiscal 2021 to be roughly in-line with fiscal 2020. It expects full-year margins to benefit from Holistic Margin Management savings as well as volume leverage. However, higher input costs, costs associated with catering to the rising demand, health and safety-related costs and elevated brand investments are likely to act as deterrents. In fact, adjusted operating profit margin is expected to decline in the second quarter. Finally, management expects to reduce its net-debt-to-adjusted-EBITDA ratio to less than 3.2x by the end of fiscal 2021.

This Zacks Rank #3 (Hold) stock has gained 8.2% year to date against the industry’s decline of 6.6%.

3 Food Stocks You Must Relish

Medifast MED, which currently carries a Zacks Rank #1 (Strong Buy), has a trailing four-quarter earnings surprise of 15.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

B&G Foods BGS, with a Zacks Rank #2 (Buy), has a trailing four-quarter earnings surprise of 6.9%, on average.

Flowers Foods FLO, also with a Zacks Rank #2, has a trailing four-quarter earnings surprise of 8.2%, on average.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Click to get this free report General Mills, Inc. (GIS) : Free Stock Analysis Report BG Foods, Inc. (BGS) : Free Stock Analysis Report Flowers Foods, Inc. (FLO) : Free Stock Analysis Report MEDIFAST INC (MED) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo News

Yahoo News