Get used to fewer employees for the next three months: Statistics Canada

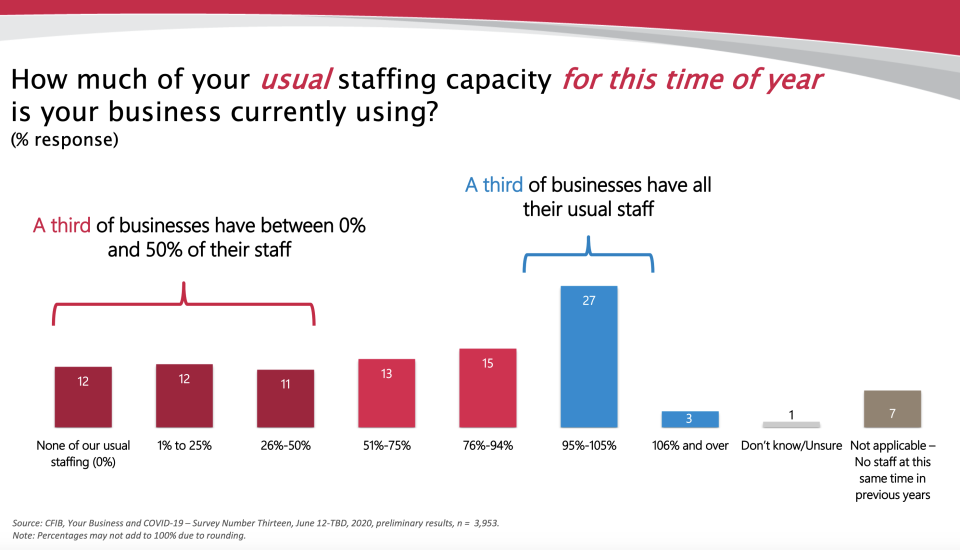

When it comes to staffing levels during the COVID-19 recovery, most Canadian businesses don’t have all hands on deck. A Canadian Federation of Independent Business (CFIB) survey found that only one third of businesses had re-hired their pre-pandemic staff capacity. It’s likely going to stay that way for some time: In a separate survey on Canadian business conditions, newly released from Statistics Canada, almost two-thirds of businesses expect their number of employees to remain the same over the next three months.

Dan Kelly, the president of the CFIB, told Yahoo Finance Canada that the numbers don’t surprise him. The businesses he works with are more likely to delay bringing back a full staff if revenue doesn’t justify a full payroll expense. “The biggest driver as to whether you're going to bring back the workers, of course, is whether your customers are expected to return to the business in short order - and that's a big question mark for many.”

It’s not just costs, it’s also a challenge to lure back workers who were relying on the Canadian Emergency Relief Benefit (CERB).

Kelly explained that many Canadians have health concerns or other challenges about their return to work, but he also pointed out a few comments on CFIB’s most recent survey. “From the employee’s perspective, it was ‘When else am I going to have the opportunity to take a paid Summer off? So check back with me in September,’” he laughed, “That scares the heck out of me.”

As the national economy shifts into recovery mode, there have been growing calls to wean Canadians off of CERB, like yesterday’s call from Manitoba premier Brian Pallister, who recommended a phased reduction in the benefit as Canadians return to work. Business advocates like Kelly aren’t calling for a swift elimination of CERB, but for legislative amendments that would push recipients back into the workplace if they were offered a job. “If you've got a job to go back to, then unless you have a pressing reason why you cannot, that CERB benefits would end.”

Government Supports for Businesses

Another challenge for businesses is the lack of details surrounding government supports for businesses. Kelly explained that there is confusion in particular with the Canadian Emergency Wage Subsidy (CEWS), which the federal government extended until December in an announcement on Monday. “That has been one of the big struggles to employers rehiring their team is a lack of understanding of how the wage subsidy is going to work for the balance of this year.”

When the program was introduced in March, Canadian businesses with revenue down 30 per cent related to the pandemic could qualify for CEWS and receive a 75 per cent subsidy for up to 24 weeks. In a May 15 release announcing the details of the CEWS extension, the federal government stated that there would be regulatory changes for certain types of organizations and made further promises to change eligibility requirements. “It's now mid July, and we still don't know what those eligibility requirements are...” Kelly said, “Employers still do not know whether or not they qualify!”

The Statistics Canada report also showed that two-thirds of Canadian businesses were approved for funding from government programs or credit from external providers. CFIB’s survey showed that 98 per cent of businesses found these supports to be very helpful, but they work only if the eligibility is clearly defined.

“This is a big chicken and egg problem. An employer can't necessarily make money until they get their staff back - but they don't have the money to hire the staff back just yet. So, if the feds could actually give them the assurance that they've suggested that they will, I feel like we will have much better track record as a nation of getting workers back on the payrolls of small and medium-sized companies across the country.”

These supports would also go a long way in providing personal protective equipment that businesses will need as they gradually re-open. Statistics Canada reported that just over 80 per cent either need or expect to need protective gear as physical distancing measures relax - particularly among those in the healthcare, accommodation and food services sectors. 22 per cent of businesses report that they are struggling or anticipate a challenge in procuring these supplies.

“We certainly have heard from the kind of the private healthcare sector - people like chiropractors, dentists - that their cost of PPE and the related cleaning procedures are just going through the roof,” said Kelly. Providing masks for customers who arrive empty-handed is an additional cost that businesses are taking on.

This is why, Kelly explains, the CFIB is pushing for an expansion of the Canada Emergency Business Account (CEBA) program. “We’re pushing for that to be raised basically for $40,000 to $60,000 and to raise the forgivable portion from 25 per cent to 50 per cent,” explained Kelly. The current eligibility requirements for this loan mean that businesses must have between $20,000 and $1.5 million in income paid in 2019 (with separate requirements for businesses paying out less than that amount). Kelly expects that more access to funding will keep more businesses afloat.

“One of the things that worries me the most right now... is that 14 per cent of businesses are actively planning bankruptcy or winding down their business. Extrapolate that to the economy as a whole, that could be 100,000 to 200,000 businesses that are no longer there at the end of pandemic,” Kelly said. “And that would be just devastating to the long-term health of Canada's economy.”

Watch Crisis Management, a livestream show on the Canadian economy that builds a crisis playbook for small and medium-sized businesses during COVID-19 times and beyond. Watch live on Yahoo Finance Canada or subscribe to the podcast on Apple and Spotify.

Yahoo News

Yahoo News