GoDaddy (GDDY) to Report Q2 Earnings: What's in the Offing?

GoDaddy Inc. GDDY is scheduled to report second-quarter 2020 results on Aug 5.

The company expects second-quarter revenues of $790 million, indicating year-over-year growth of 7%. The Zacks Consensus Estimate for sales is pegged at $793.7 million, suggesting growth of 7.7% from the year-ago quarter.

Further, the Zacks Consensus Estimate for earnings stands at 17 cents per share, indicating a decline of 30.8% from the year-ago quarter.

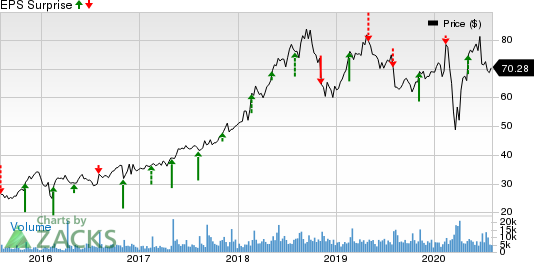

The company beat estimates in two of the trailing four quarters, while missing the same twice. It has a trailing four-quarter earnings surprise of 21.4%, on average.

GoDaddy Inc. Price and EPS Surprise

GoDaddy Inc. price-eps-surprise | GoDaddy Inc. Quote

Factors to Note

Strength across the core business is likely to have benefited GoDaddy’s second-quarter performance. Accelerating renewal rates might have contributed to growth in this particular business inthe to-be-reported quarter.

Further, the company’s growing efforts toward enhancing product offerings remain positives. The company’s freemium model for websites and marketing, which is integrated with GoFundMe capabilities with PayPal and gift card functionality, may have driven customer momentum during the quarter under review.

Additionally, the launch of messaging capability is likely to have enhanced the company’s customer feedback process in the second quarter.

Robust managed WordPress offerings are anticipated to have contributed significantly to the Hosting and Presence segment’s second-quarter performance.

Moreover, growing momentum with OpenWeStand is likely to get reflected in the to-be-reported results. Companies like Adobe, Cisco, LinkedIn, Mastercard, Microsoft and Uber joined OpenWeStand in the second quarter.

Solid customer demand for building websites across verticals like professional services, beauty, fashion and health, is also expected to have benefited the performance in the quarter to be reported.

Furthermore, GoDaddy’s robust personalized products and services and technology platform might get reflected in the second-quarter revenues.

Growing adoption of its domain products and rising subscriptions to Websites and Marketing are likely to have driven the to-be-reported quarter’s performance.

However, the company’s heavy debt burden and rising expenses may have weighed on the second-quarter performance.

Further, increasing work-from-home trend amid the ongoing coronavirus pandemic situation is likely to have impacted the company’s Care Guides sales in the quarter to be reported.

What Our Model Says

Our proven model does not conclusively predicts an earnings beat for GoDaddy this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

GoDaddy has an Earnings ESP of -42.86% and a Zacks Rank #3.

Stocks to Consider

Here are some stocks you may consider, as our proven model shows that these have the right combination of elements to post an earnings beat this quarter.

Cogent Communications Holdings CCOI has an Earnings ESP of +11.66% and carries a Zacks Rank of 2, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Synaptics SYNA has an Earnings ESP of +10.6 % and currently carries a Zacks Rank of 2.

Benefitfocus BNFT has an Earnings ESP of +6.25% and carries a Zacks Rank of 2, currently.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synaptics Incorporated (SYNA) : Free Stock Analysis Report

GoDaddy Inc. (GDDY) : Free Stock Analysis Report

Cogent Communications Holdings, Inc. (CCOI) : Free Stock Analysis Report

Benefitfocus, Inc. (BNFT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News