Gold Price Futures (GC) Technical Analysis – Ripe for Pressure-Relieving Reversal Top, but Buying Too Strong

Gold futures jumped to a new contract high on Thursday, driven by expectations of more fiscal stimulus from the U.S. government in response to surging coronavirus cases in the country that threaten to derail the slowing economic recovery.

The early session rally stalled, however, as some investors moved to the sidelines ahead of Friday’s U.S. Non-Farm Payrolls report. Meanwhile, buyers held their ground despite data that showed U.S. jobless claims fell last week. Nonetheless, a staggering 31.3 million people were receiving unemployment checks in mid-July, as new infections battered the economy.

At 17:39 GMT, December Comex gold futures are trading $2072.20, up $22.90 or +1.12%.

Gold traders are also awaiting further policy response as U.S. Democratic leaders and White House officials continued their talks to try to hash out a next wave of relief to help the economy.

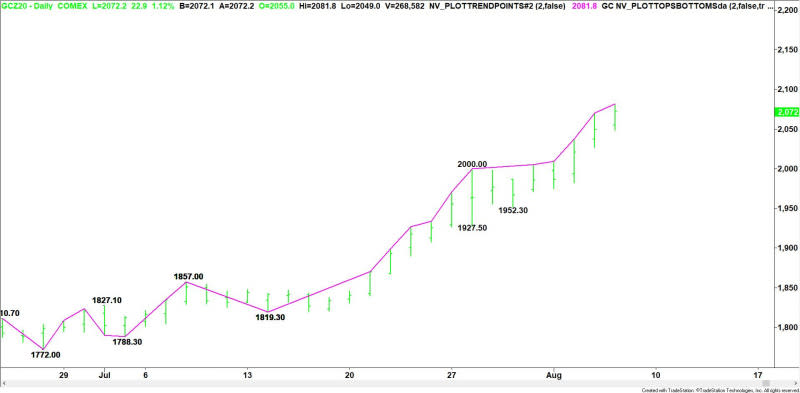

Daily Swing Chart Technical Analysis

The main trend is up according to the daily swing chart. The uptrend was reaffirmed when buyers took out yesterday’s high. The market is in no position to change the main trend to down, but it is ripe for a potentially bearish closing price reversal top.

This chart pattern won’t change the trend to down, but it could alleviate some of the upside pressure with a 2 to 3 day correction.

The minor trend is also up. A trade through $1952.30 will change the minor trend to down. This will also shift momentum to the downside.

Daily Swing Chart Technical Forecast

The current price action suggests the direction of the December Comex gold futures contract into the close on Thursday will be determined by $2049.30.

Bullish Scenario

A sustained move over $2049.30 will signal the presence of buyers. This could lead to another breakout over $2081.80.

Bearish Scenario

A close under $2049.30 will form a closing price reversal top. If confirmed, this could trigger the start of a 2 to 3 day correction. It will also shift momentum to the downside.

This article was originally posted on FX Empire

Yahoo News

Yahoo News