If You Had Bought Eldorado Gold (TSE:ELD) Stock A Year Ago, You Could Pocket A 53% Gain Today

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. To wit, the Eldorado Gold Corporation (TSE:ELD) share price is 53% higher than it was a year ago, much better than the market decline of around 8.2% (not including dividends) in the same period. So that should have shareholders smiling. On the other hand, longer term shareholders have had a tougher run, with the stock falling 3.1% in three years.

See our latest analysis for Eldorado Gold

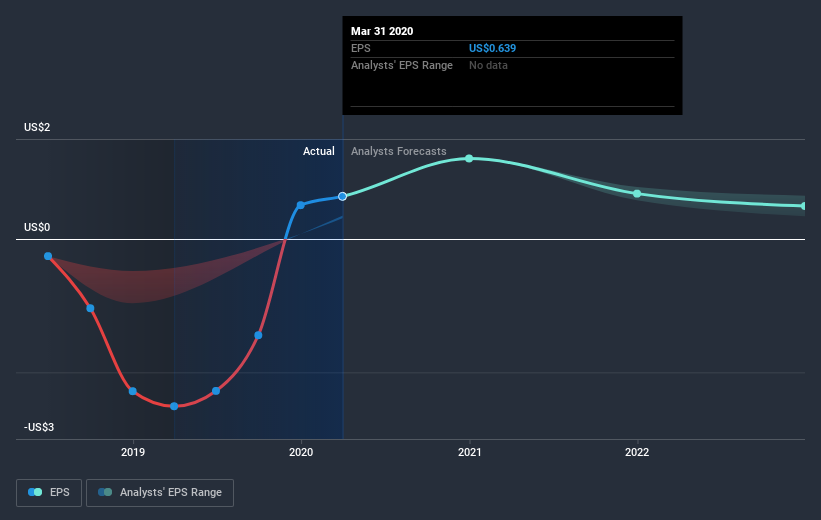

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Eldorado Gold grew its earnings per share, moving from a loss to a profit.

We think the growth looks very prospective, so we're not surprised the market liked it too. Inflection points like this can be a great time to take a closer look at a company.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Eldorado Gold's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Eldorado Gold shareholders have received a total shareholder return of 53% over one year. Notably the five-year annualised TSR loss of 5.1% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Eldorado Gold better, we need to consider many other factors. For instance, we've identified 5 warning signs for Eldorado Gold (1 is concerning) that you should be aware of.

Eldorado Gold is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News